Question: Managerial finance- Answer e. f. g. & h. as per chegg guidelines. I already have answers to the first a b c & d. Der

Managerial finance- Answer e. f. g. & h. as per chegg guidelines. I already have answers to the first a b c & d.

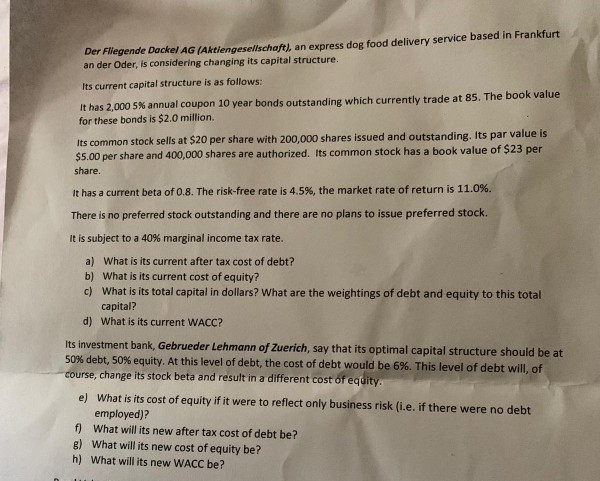

Der Fliegende Dackel AG (Aktiengesellschaft), an express dog food delivery service based in Frankfurt an der Oder, is considering changing its capital structure. Its current capital structure is as follows: It has 2,000 5% annual coupon 10 year bonds outstanding which currently trade at 85. The book value for these bonds is $2.0 million. Its common stock sells at $20 per share with 200,000 shares issued and outstanding. Its par value is $5.00 per share and 400,000 shares are authorized. Its common stock has a book value of $23 per share. It has a current beta of 0.8. The risk-free rate is 4.5%, the market rate of return is 11.0%. There is no preferred stock outstanding and there are no plans to issue preferred stock. It is subject to a 40% marginal income tax rate. a) What is its current after tax cost of debt? b) What is its current cost of equity? c) What is its total capital in dollars? What are the weightings of debt and equity to this total capital? d) What is its current WACC? its investment bank, Gebrueder Lehmann of Zuerich, say that its optimal capital structure should be at 50% debt, 50% equity. At this level of debt, the cost of debt would be 6%. This level of debt will, of course, change its stock beta and result in a different cost of equity e) What is its cost of equity if it were to reflect only business risk (i.e. if there were no debt employed)? f) What will its new after tax cost of debt be? g) What will its new cost of equity be? h) What will its new WACC be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts