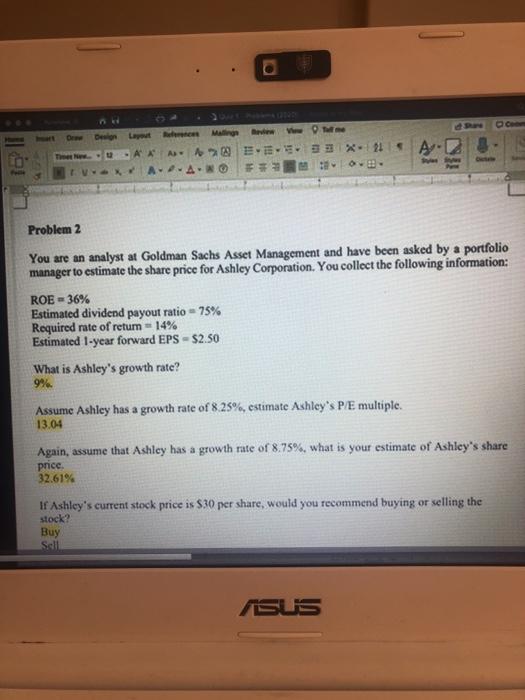

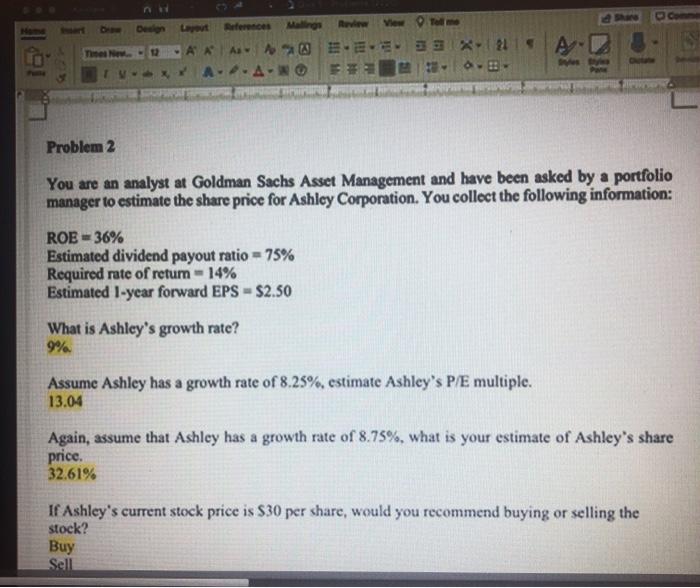

Question: Der Mai WO AA As E 93 % A A... F#M # Problem 2 You are an analyst at Goldman Sachs Asset Management and have

Der Mai WO AA As E 93 % A A... F#M # Problem 2 You are an analyst at Goldman Sachs Asset Management and have been asked by a portfolio manager to estimate the share price for Ashley Corporation. You collect the following information: ROE - 36% Estimated dividend payout ratio - 75% Required rate of retum-14% Estimated 1-year forward EPS - $2.50 What is Ashley's growth rate? 9% Assume Ashley has a growth rate of 8.25%, estimate Ashley's P/E multiple 13.04 Again, assume that Ashley has a growth rate of 8.75%, what is your estimate of Ashley's share pnice , 32.61% If Ashley's current stock price is $30 per share, would you recommend buying or selling the stock? Buy Sell ISUS n Den ereces R Tel These AAS AAN 91 . Problem 2 You are an analyst at Goldman Sachs Asset Management and have been asked by a portfolio manager to estimate the share price for Ashley Corporation. You collect the following information: ROE - 36% Estimated dividend payout ratio = 75% Required rate of retum - 14% Estimated 1-year forward EPS - $2.50 What is Ashley's growth rate? 9% Assume Ashley has a growth rate of 8.25%, estimate Ashley's P/E multiple. 13.04 Again, assume that Ashley has a growth rate of 8.75%, what is your estimate of Ashley's share price. 32.61% If Ashley's current stock price is $30 per share, would you recommend buying or selling the stock? Buy Sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts