Question: Derek's Bows (an obscure and dated reference), sells high-end archery equipment. They plan to have net income of $3 million in the first quarter of

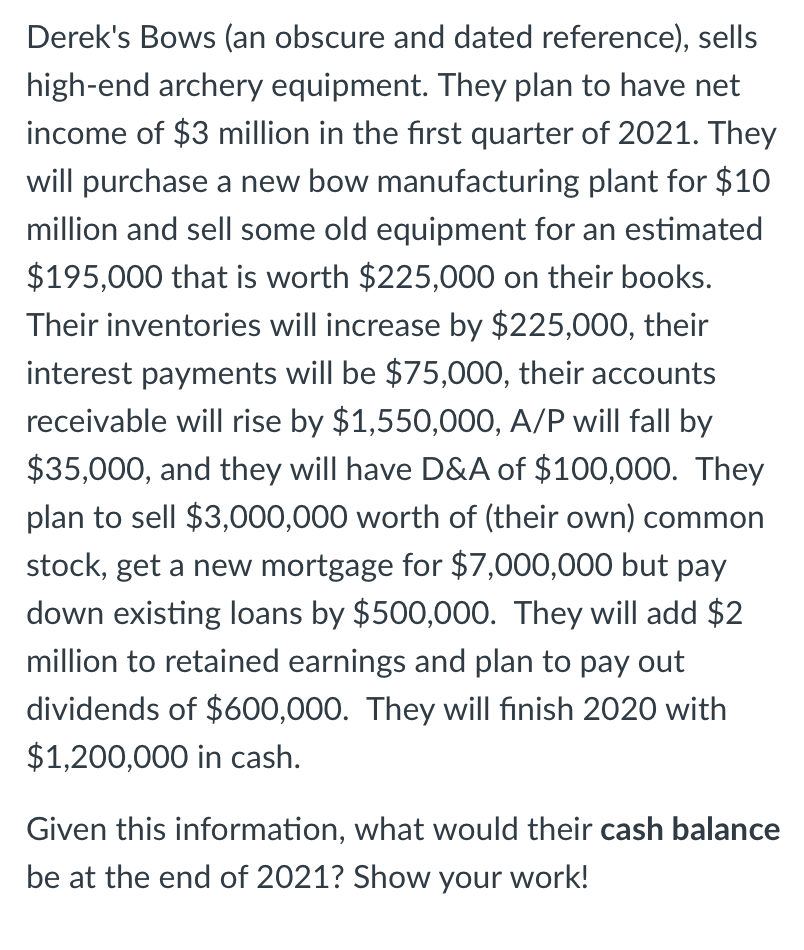

Derek's Bows (an obscure and dated reference), sells high-end archery equipment. They plan to have net income of $3 million in the first quarter of 2021. They will purchase a new bow manufacturing plant for $10 million and sell some old equipment for an estimated $195,000 that is worth $225,000 on their books. Their inventories will increase by $225,000, their interest payments will be $75,000, their accounts receivable will rise by $1,550,000, A/P will fall by $35,000, and they will have D&A of $100,000. They plan to sell $3,000,000 worth of (their own) common stock, get a new mortgage for $7,000,000 but pay down existing loans by $500,000. They will add $2 million to retained earnings and plan to pay out dividends of $600,000. They will finish 2020 with $1,200,000 in cash. Given this information, what would their cash balance be at the end of 2021? Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts