Question: Derivative Finance HW Question; Please solve using Excel The Eurodollar futures contract specifications are: Contract Size $2,500*Quote or $25 per basis point 100-R where R

Derivative Finance HW Question; Please solve using Excel

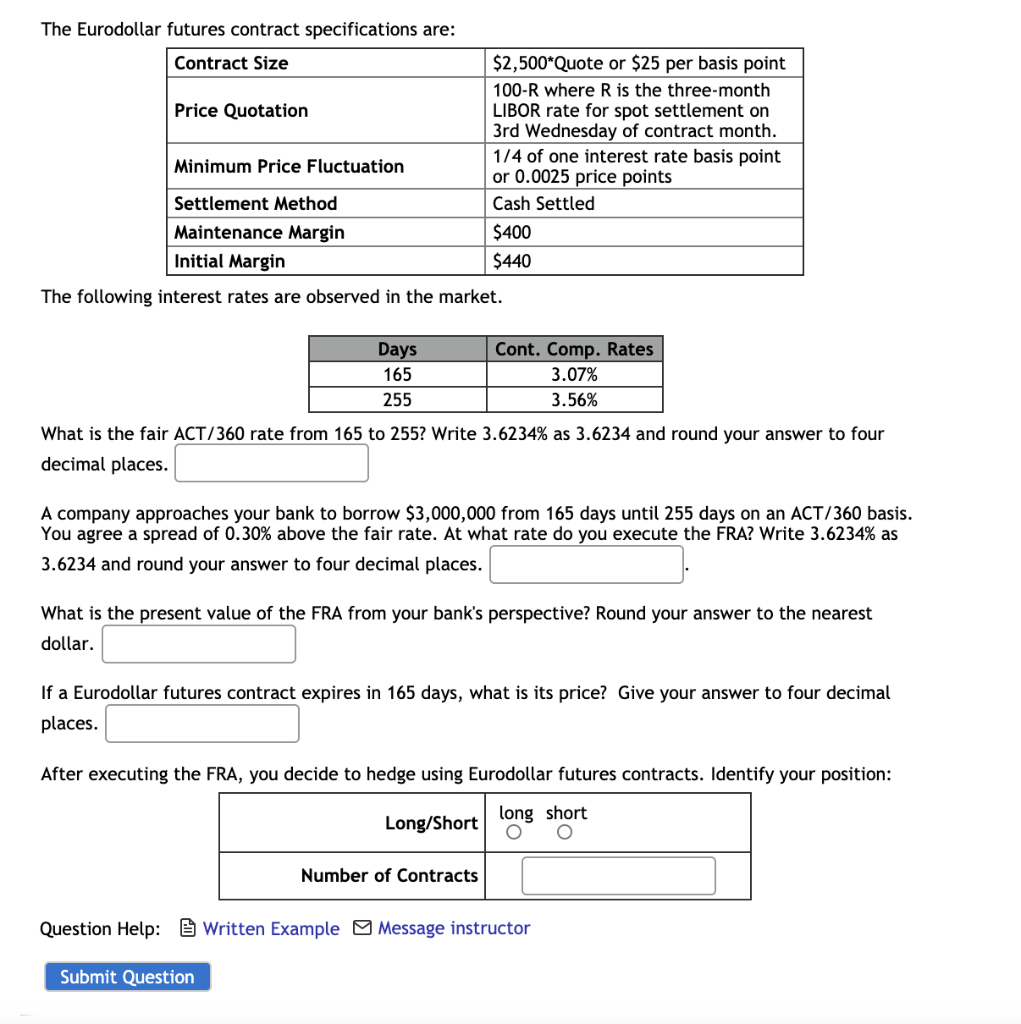

The Eurodollar futures contract specifications are: Contract Size $2,500*Quote or $25 per basis point 100-R where R is the three-month Price Quotation LIBOR rate for spot settlement on 3rd Wednesday of contract month. Minimum Price Fluctuation 1/4 of one interest rate basis point or 0.0025 price points Settlement Method Cash Settled Maintenance Margin $400 Initial Margin $440 The following interest rates are observed in the market. Days Cont. Comp. Rates 165 3.07% 255 3.56% What is the fair ACT/360 rate from 165 to 255? Write 3.6234% as 3.6234 and round your answer to four decimal places. A company approaches your bank to borrow $3,000,000 from 165 days until 255 days on an ACT/360 basis. You agree a spread of 0.30% above the fair rate. At what rate do you execute the FRA? Write 3.6234% as 3.6234 and round your answer to four decimal places. What is the present value of the FRA from your bank's perspective? Round your answer to the nearest dollar. If a Eurodollar futures contract expires in 165 days, what is its price? Give your answer to four decimal places. After executing the FRA, you decide to hedge using Eurodollar futures contracts. Identify your position: Long/Short long short Number of Contracts Question Help: Written Example Message instructor Submit Question The Eurodollar futures contract specifications are: Contract Size $2,500*Quote or $25 per basis point 100-R where R is the three-month Price Quotation LIBOR rate for spot settlement on 3rd Wednesday of contract month. Minimum Price Fluctuation 1/4 of one interest rate basis point or 0.0025 price points Settlement Method Cash Settled Maintenance Margin $400 Initial Margin $440 The following interest rates are observed in the market. Days Cont. Comp. Rates 165 3.07% 255 3.56% What is the fair ACT/360 rate from 165 to 255? Write 3.6234% as 3.6234 and round your answer to four decimal places. A company approaches your bank to borrow $3,000,000 from 165 days until 255 days on an ACT/360 basis. You agree a spread of 0.30% above the fair rate. At what rate do you execute the FRA? Write 3.6234% as 3.6234 and round your answer to four decimal places. What is the present value of the FRA from your bank's perspective? Round your answer to the nearest dollar. If a Eurodollar futures contract expires in 165 days, what is its price? Give your answer to four decimal places. After executing the FRA, you decide to hedge using Eurodollar futures contracts. Identify your position: Long/Short long short Number of Contracts Question Help: Written Example Message instructor Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts