Question: derivatives securities, please provide correct answer Question 4 0.0/10.0 points (graded) Consider two European call options on the stock of XYZ. Both options mature one

derivatives securities, please provide correct answer

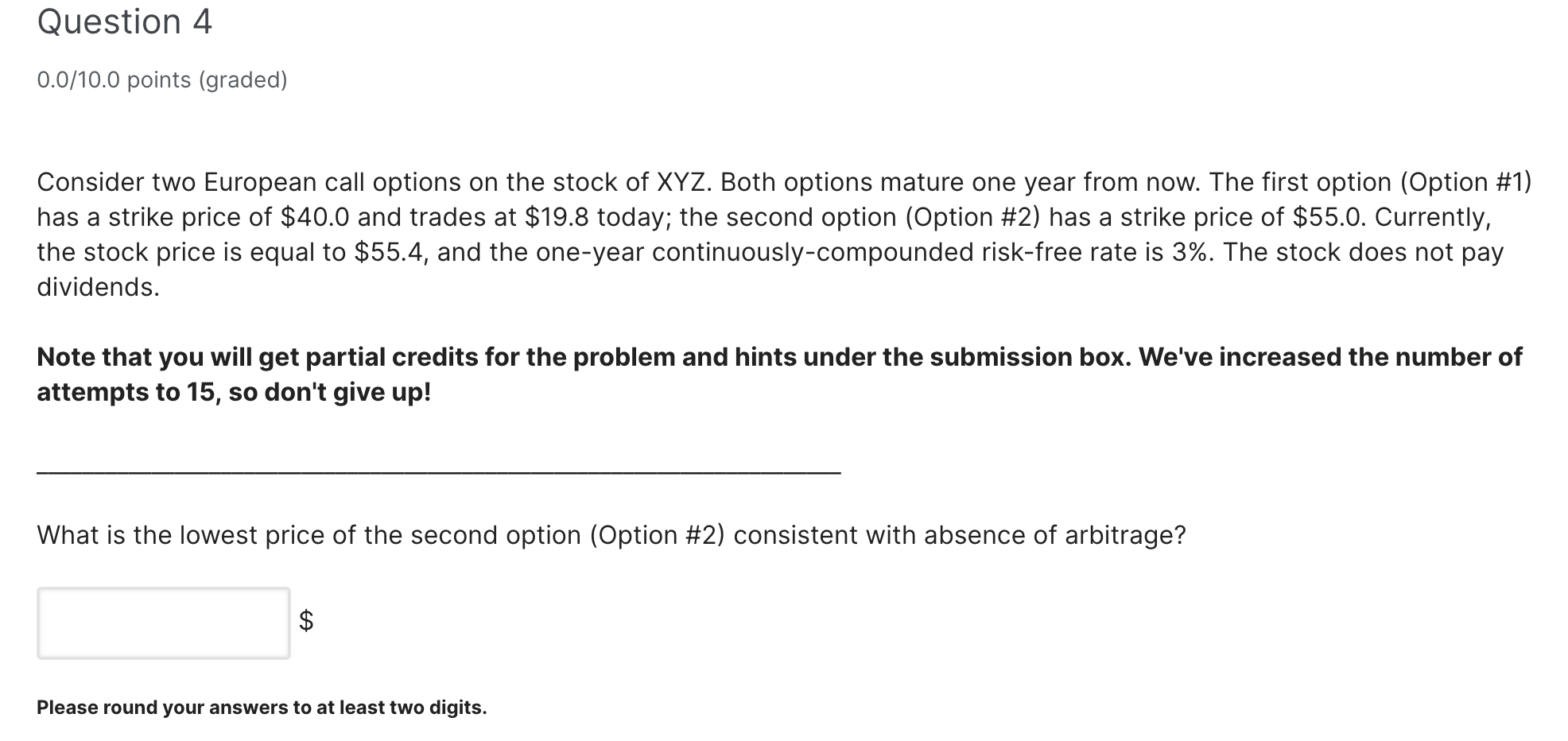

Question 4 0.0/10.0 points (graded) Consider two European call options on the stock of XYZ. Both options mature one year from now. The first option (Option #1) has a strike price of $40.0 and trades at $19.8 today; the second option (Option #2) has a strike price of $55.0. Currently, the stock price is equal to $55.4, and the one-year continuously-compounded risk-free rate is 3%. The stock does not pay dividends. Note that you will get partial credits for the problem and hints under the submission box. We've increased the number of attempts to 15, so don't give up! What is the lowest price of the second option (Option #2) consistent with absence of arbitrage? Please round your answers to at least two digits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts