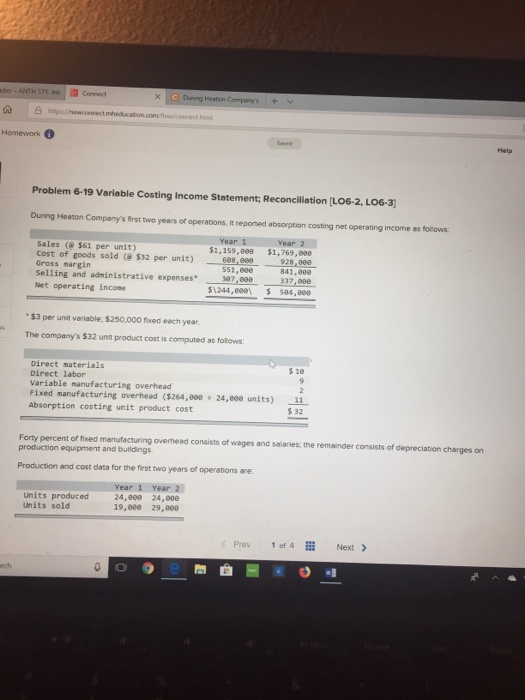

Question: des- ANTH 171 Comect htm Homework 6 Help Problem 6-19 Variable Costing Income Statement; Reconciliation [LO6-2, LO6-3) During Heaton Company's first two years of operations,

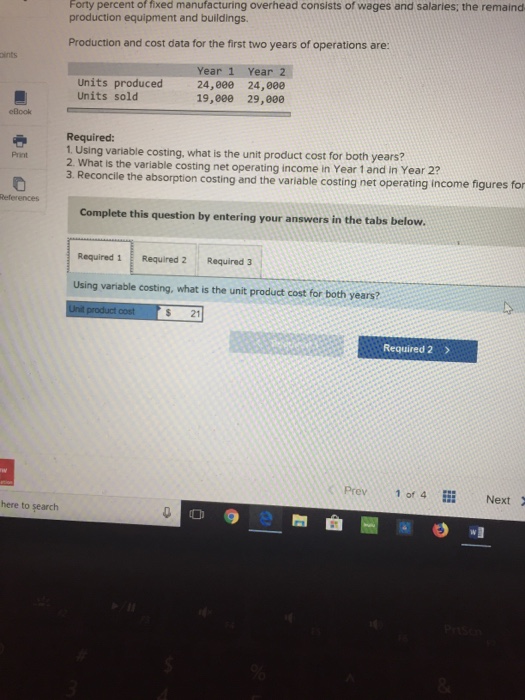

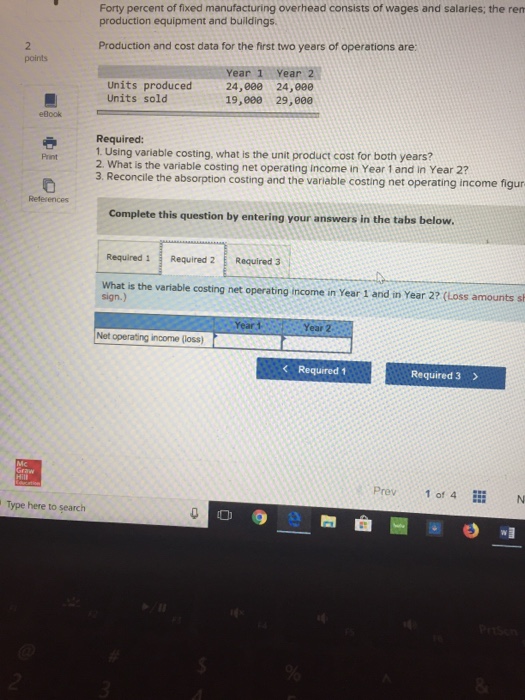

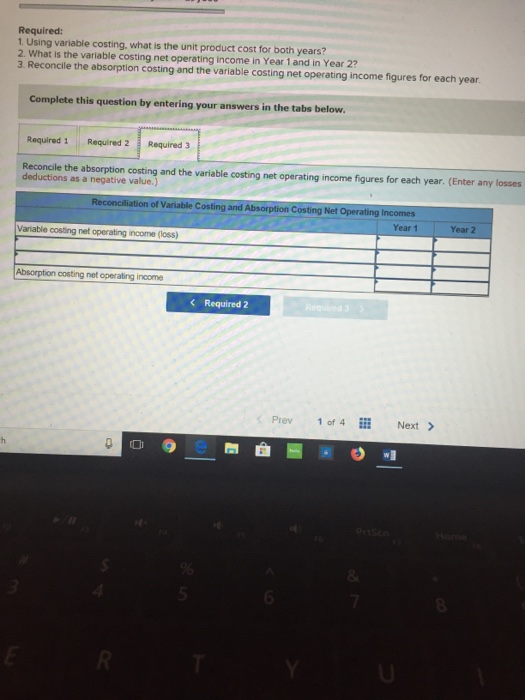

des- ANTH 171 Comect htm Homework 6 Help Problem 6-19 Variable Costing Income Statement; Reconciliation [LO6-2, LO6-3) During Heaton Company's first two years of operations, it repoted absorption costing net operating income as follows Sales ( $61 per unit) Cost of goods sold ( 532 per unit) Gross margin Selling and administrative expenses37,80 ,080 Net operating income $1,159,008 $1,769,89e 928,80e 841,000 688,888 551,000 $1244,8e8$584,e00 $3 per unit variable: $250.000 fixed each year The company's $32 unit product cost is computed as folows Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($264,eee 24,ea0 units) 11 Absorption costing unit product cost 1e 32 Forty percent of fixed manufacturing overheed consists of wages and sailaries; the remainder consists of depreciation charges on production equipment and buildings Production and cost data for the first two years of operations are: Units produced Units sold Year 24,800 24,900 19,80 29,000 Prev 1of4 Next > o 9 rch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts