Question: Describe systematic and specific risks and returns. (ii) Explain how the risks of a portfolio can be reduced by diversification, without impacting on expected return.

Describe systematic and specific risks and returns.

(ii) Explain how the risks of a portfolio can be reduced by diversification,

without impacting on expected return.

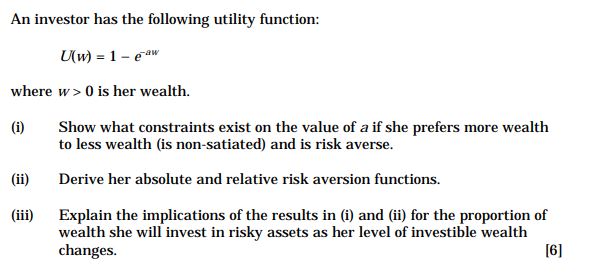

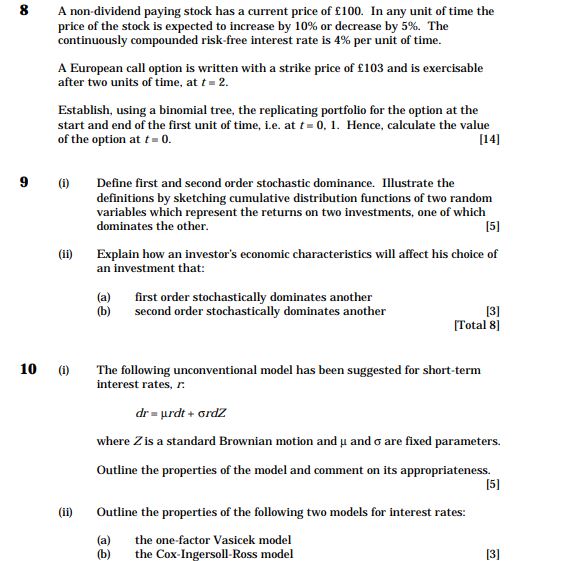

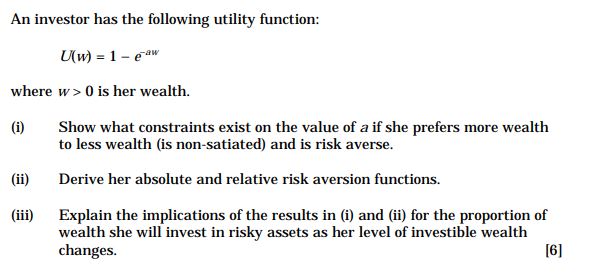

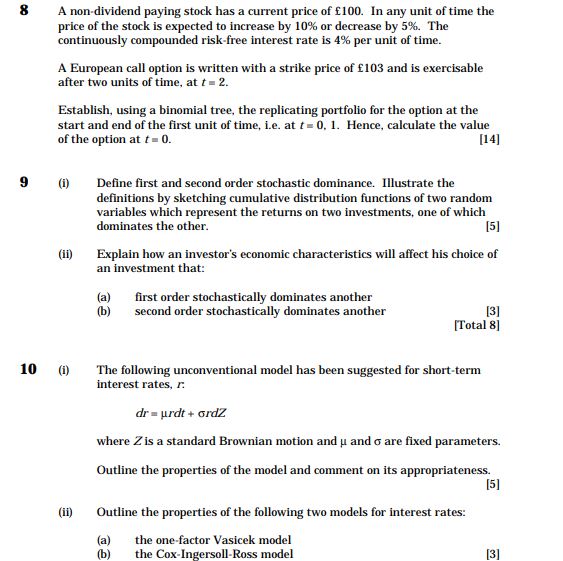

An investor has the following utility function: U(w) = 1-paw where w > 0 is her wealth. (i) Show what constraints exist on the value of a if she prefers more wealth to less wealth (is non-satiated) and is risk averse. (ii) Derive her absolute and relative risk aversion functions. (iii) Explain the implications of the results in (i) and (ii) for the proportion of wealth she will invest in risky assets as her level of investible wealth changes. [6]8 A non-dividend paying stock has a current price of $100. In any unit of time the price of the stock is expected to increase by 10% or decrease by 5%. The continuously compounded risk-free interest rate is 4% per unit of time. A European call option is written with a strike price of $103 and is exercisable after two units of time, at t = 2. Establish, using a binomial tree, the replicating portfolio for the option at the start and end of the first unit of time, i.e. at f = 0, 1. Hence, calculate the value of the option at f = 0. [14] 9 (1) Define first and second order stochastic dominance. Illustrate the definitions by sketching cumulative distribution functions of two random variables which represent the returns on two investments, one of which dominates the other. [5] (1i) Explain how an investor's economic characteristics will affect his choice of an investment that: (a) first order stochastically dominates another (b) second order stochastically dominates another [3] [Total 8] 10 The following unconventional model has been suggested for short-term interest rates, n dr = urdt + ordz where Z is a standard Brownian motion and u and o are fixed parameters. Outline the properties of the model and comment on its appropriateness. [5] (ii) Outline the properties of the following two models for interest rates: (a) the one-factor Vasicek model (b) the Cox-Ingersoll-Ross model (3]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts