Question: Describe the various steps involved in structuring a 5-year inverse floating rate note. (25 marks) b. How does the risk of an inverse floater

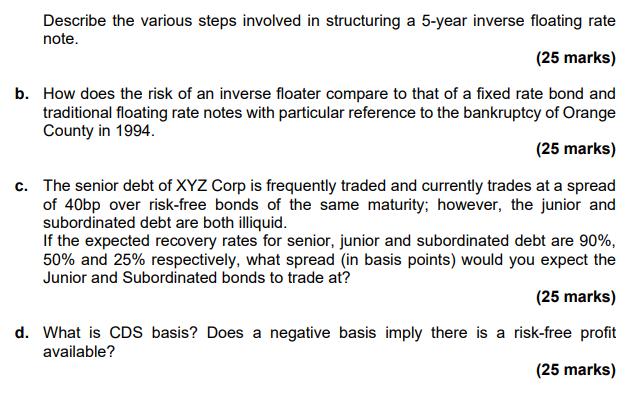

Describe the various steps involved in structuring a 5-year inverse floating rate note. (25 marks) b. How does the risk of an inverse floater compare to that of a fixed rate bond and traditional floating rate notes with particular reference to the bankruptcy of Orange County in 1994. (25 marks) c. The senior debt of XYZ Corp is frequently traded and currently trades at a spread of 40bp over risk-free bonds of the same maturity; however, the junior and subordinated debt are both illiquid. If the expected recovery rates for senior, junior and subordinated debt are 90%, 50% and 25% respectively, what spread (in basis points) would you expect the Junior and Subordinated bonds to trade at? (25 marks) d. What is CDS basis? Does a negative basis imply there is a risk-free profit available? (25 marks)

Step by Step Solution

3.23 Rating (150 Votes )

There are 3 Steps involved in it

a Structuring a 5year inverse floating rate note typically involves several steps including Determining the underlying reference rate The first step is to determine the reference rate that the inverse ... View full answer

Get step-by-step solutions from verified subject matter experts