Question: Description Term Answer A. A table or graph of a firm's potential investments ranked from Capital components the highest internal rate of return to the

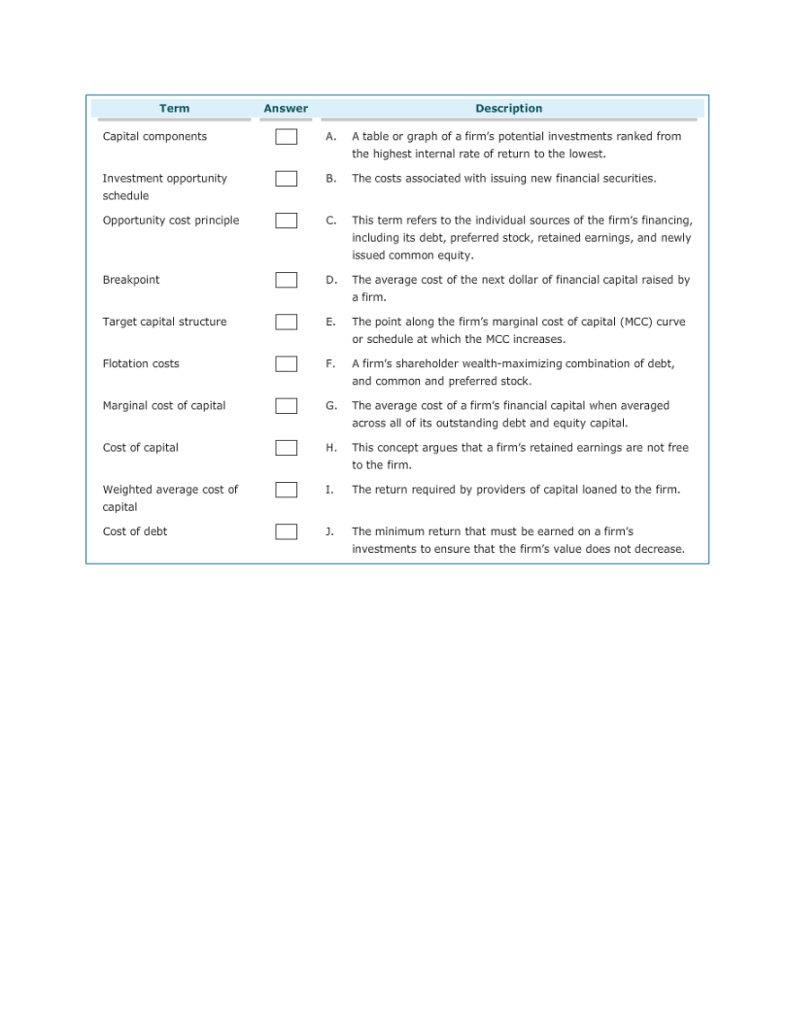

Description Term Answer A. A table or graph of a firm's potential investments ranked from Capital components the highest internal rate of return to the lowest. Investment opportunity B. The costs associated with issuing new financial securities schedule opportunity cost principle c. This term refers to the individual sources of the firm's financing including its debt, preferred stock, retained earnings, and newly issued common equity. D. The average cost of the next dollar of financial capital raised by Breakpoint a firm. Target capital structure E. The point along the firm's marginal cost of capital (MCC) curve or schedule at which the MCC increases. F. A firm's shareholder wealth-maximizing combination of debt, Flotation costs and common and preferred stock. Marginal cost of capital G. The average cost of a firm's financial capital when averaged across all of its outstanding debt and equity capital. H. This concept argues that a firm's retained earnings are not free Cost of capital to the firm. Weighted average cost of I. The return required by providers of capital loaned to the firm. capital J. The minimum return that must be earned on a firm's Cost of debt investments to ensure that the firm's value does not decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts