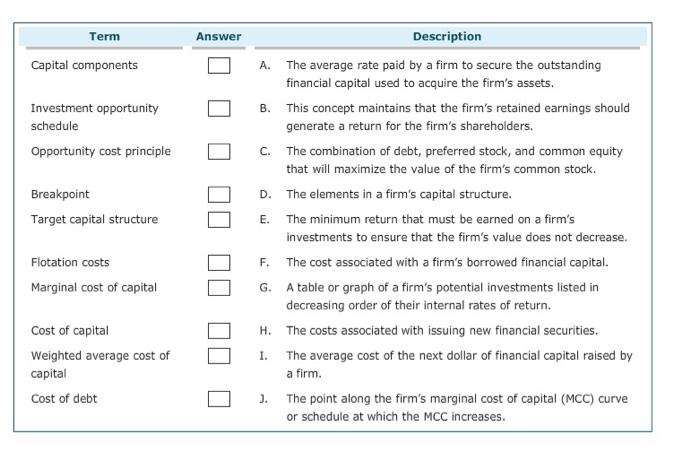

Question: Term Description Answer Capital components A. The average rate paid by a firm to secure the outstanding financial capital used to acquire the firm's assets.

Term Description Answer Capital components A. The average rate paid by a firm to secure the outstanding financial capital used to acquire the firm's assets. Investment opportunity B. This concept maintains that the firm's retained earnings should schedule generate a return for the firm's shareholders. opportunity cost principle C. The combination of debt, preferred stock, and common equity that will maximize the value of the firm's common stock. D. The elements in a firm's capital structure Breakpoint Target capital structure E. The minimum return that must be earned on a firm's investments to ensure that the firm's value does not decrease. F. The cost associated with a firm's borrowed financial capital Flotation costs Marginal cost of capital G. A table or graph of a firm's potential investments listed in decreasing order of their internal rates of return. Cost of capital H. The costs associated with issuing new financial securities. Weighted average cost of I. The average cost of the next dollar of financial capital raised by capital a firm J. The point along the firm's marginal cost of capital (MCC) curve Cost of debt or schedule at which the MCC increases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts