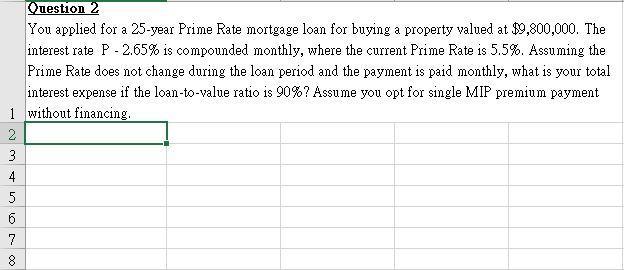

Question: Question 2 You applied for a 25-year Prime Rate mortgage loan for buying a property valued at $9,800,000. The interest rate P-2.65% is compounded

Question 2 You applied for a 25-year Prime Rate mortgage loan for buying a property valued at $9,800,000. The interest rate P-2.65% is compounded monthly, where the current Prime Rate is 5.5%. Assuming the Prime Rate does not change during the loan period and the payment is paid monthly, what is your total interest expense if the loan-to-value ratio is 90%? Assume you opt for single MIP premium payment 1 without financing. ~ 2 3 LO LO 5 6 7 8 00

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Solution The loantovalue ratio is 90 so the loan amount is 90 of the property value Loan amount 09 9... View full answer

Get step-by-step solutions from verified subject matter experts