Question: Use the same information for this problem as you did for Exercise 12-41, except that the investment is subject to taxes and that the pre-tax

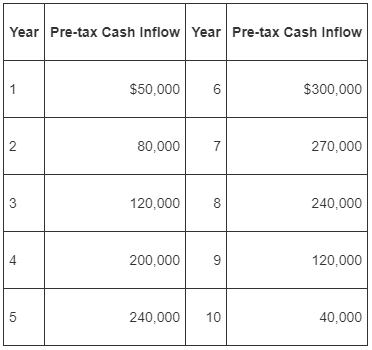

Use the same information for this problem as you did for Exercise 12-41, except that the investment is subject to taxes and that the pre-tax operating cash inflows are as follows:

Irv Nelson has been paying 30 percent for combined federal, state, and local income taxes, a rate that is not expected to change during the period of this investment. The firm uses straight-line depreciation. Assume, for simplicity, that MACRS depreciation rules do not apply.

Required

Using Excel, compute for the proposed investment the:

1. Payback period for the proposed investment under the assumption that the cash inflows occur evenly throughout the year.

2. Book rate of return based on

(a) Initial investment

(b) Average investment.

3. Net present value (NPV).

4. Present value payback period of the proposed investment under the assumption that the cash inflows occur evenly throughout the year.

5. Internal rate of return (IRR).

6. Modified internal rate of return(MIRR).

Year Pre-tax Cash Inflow Year Pre-tax Cash Inflow $300,000 $50,000 80,000 270,000 120,000 240,000 4 200,000 120,000 10 240,000 40,000 2. 3.

Step by Step Solution

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Savings or Net Net Cumulative 1 Net Expense Aftertax Aftertax Net Aftertax Cash Depreciation Taxable on Income Income Cash Cash Year Inflow Expense In... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

249-B-M-L-P (570).xlsx

300 KBs Excel File