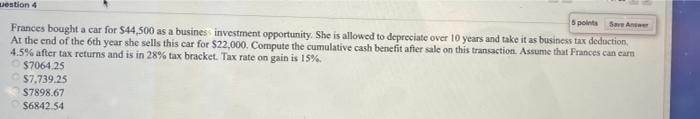

Question: Destion 4 6 points Save A Frances bought a car for $44,500 as a business investment opportunity. She is allowed to depreciate over 10 years

Destion 4 6 points Save A Frances bought a car for $44,500 as a business investment opportunity. She is allowed to depreciate over 10 years and take it as business tax deduction At the end of the 6th year she sells this car for $22,000. Compute the cumulative cash benefit after sale on this transaction. Assume that Frances can earn 4.5% after tax returns and is in 28% tax bracket. Tax rate on gain is 15%. $7064.25 $7.739.25 S7898.67 $6842 54

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock