Question: Frances bought a car for ( $ 44,500 ) as a business investment opportunity. She is allowed to depreciate over 10 years and take it

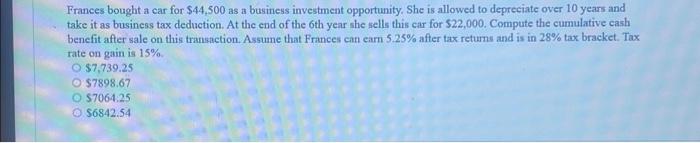

Frances bought a car for \\( \\$ 44,500 \\) as a business investment opportunity. She is allowed to depreciate over 10 years and take it as business tax deduction. At the end of the 6 th year she sells this car for \\( \\$ 22,000 \\). Compute the cumulative cash benefit after sale on this transaction. Assume that Frances can earn \5.25 after tax returns and is in \28 tax bracket. Tax rate on gain is \15. \\[ \\begin{array}{r} \\$ 7,739.25 \\\\ \\$ 7898.67 \\\\ \\$ 7064.25 \\\\ \\$ 6842.54 \\end{array} \\]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock