Question: detailed answer please Question 1 (25 marks) U-Bend Lid is a plumbing company which is growing rapidly despite its sbgan: U-Bend when you need to.

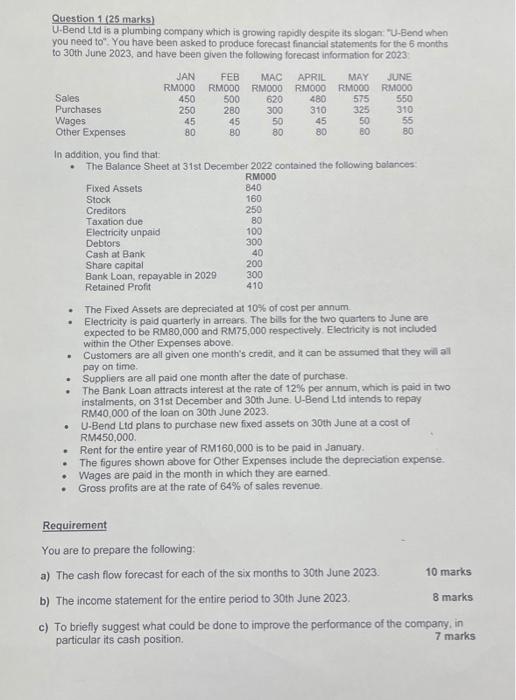

Question 1 (25 marks) U-Bend Lid is a plumbing company which is growing rapidly despite its sbgan: U-Bend when you need to". You have been asked to produce forecast financial statements for the 6 months to 30th June 2023, and have been given the following forecast information for 2023 In addition, you find that: - The Balance Sheet at 31 st December 2022 contained the following bolances: - The Fixed Assets are depreciated at 10% of cost per annum. - Electricity is paid quarterly in arrears. The bils for the two quarters to June are expected to be RM80,000 and RM75,000 respectively. Electricty is not included within the Other Expenses above. - Customers are all given one month's credit, and it can be assumed that they will al pay on time. - Suppliers are all paid one month atter the date of purchase. - The Bank Loan attracts interest at the rate of 12% per annum, which is paid in two instalments, on 31st December and 30th June. U-Bend Ltd intends to repay RM40,000 of the loan on 30 th June 2023 - U-Bend Lid plans to purchase new fixed assets on 30th June at a cost of RM450,000. - Rent for the entire year of RM160,000 is to be paid in January. - The figures shown above for Other Expenses include the depreciation expense. - Wages are paid in the month in which they are earned - Gross profits are at the rate of 64% of sales revenue. Requirement You are to prepare the following: a) The cash flow forecast for each of the six months to 30 th June 2023. 10 marks b) The income statement for the entire period to 30th June 2023 . 8 marks c) To briefly suggest what could be done to improve the performance of the company, in particular its cash position. 7 marks Question 1 (25 marks) U-Bend Lid is a plumbing company which is growing rapidly despite its sbgan: U-Bend when you need to". You have been asked to produce forecast financial statements for the 6 months to 30th June 2023, and have been given the following forecast information for 2023 In addition, you find that: - The Balance Sheet at 31 st December 2022 contained the following bolances: - The Fixed Assets are depreciated at 10% of cost per annum. - Electricity is paid quarterly in arrears. The bils for the two quarters to June are expected to be RM80,000 and RM75,000 respectively. Electricty is not included within the Other Expenses above. - Customers are all given one month's credit, and it can be assumed that they will al pay on time. - Suppliers are all paid one month atter the date of purchase. - The Bank Loan attracts interest at the rate of 12% per annum, which is paid in two instalments, on 31st December and 30th June. U-Bend Ltd intends to repay RM40,000 of the loan on 30 th June 2023 - U-Bend Lid plans to purchase new fixed assets on 30th June at a cost of RM450,000. - Rent for the entire year of RM160,000 is to be paid in January. - The figures shown above for Other Expenses include the depreciation expense. - Wages are paid in the month in which they are earned - Gross profits are at the rate of 64% of sales revenue. Requirement You are to prepare the following: a) The cash flow forecast for each of the six months to 30 th June 2023. 10 marks b) The income statement for the entire period to 30th June 2023 . 8 marks c) To briefly suggest what could be done to improve the performance of the company, in particular its cash position. 7 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts