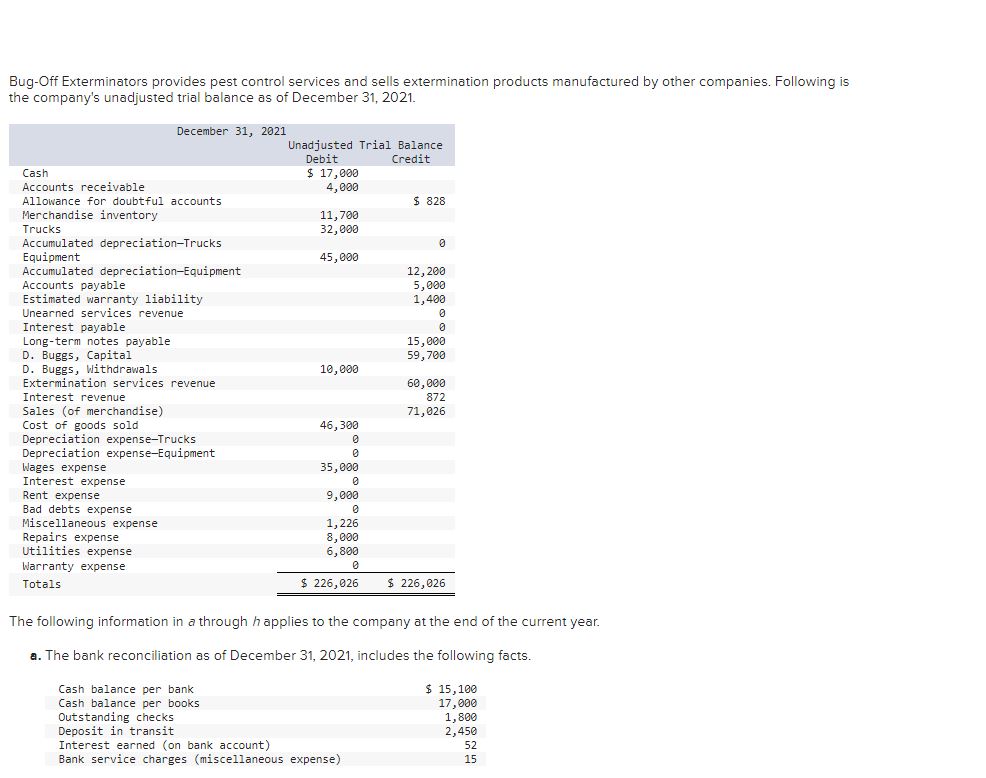

Question: Determine amounts for the following items: Correct ( reconciled ) ending balance of Cash; and the amount of the omitted check. Adjustment needed to obtain

Determine amounts for the following items:

Correct reconciled ending balance of Cash; and the amount of the omitted check.

Adjustment needed to obtain the correct ending balance of the Allowance for Doubtful Accounts.

Depreciation expense for the truck used during year

Depreciation expense for the two items of equipment used during year

The adjusted ending balances of the Extermination Services Revenue and Unearned Services Revenue accounts.

The adjusted ending balances of the Warranty Expense and the Estimated Warranty Liability accounts.

The adjusted ending balances of the Interest Expense and the Interest Payable accounts.

Use the results of part to complete the sixcolumn table by first entering the appropriate adjustments for items a through g and then completing the adjusted trial balance columns. Hint: Item b requires two adjustments.

Prepare journal entries to record the adjustments entered on the sixcolumn table. Assume BugOffs adjusted balance for Merchandise Inventory matches the yearend physical count.

a Prepare a singlestep income statement for

b Prepare the statement of owners equity cash withdrawals during were $ and owner investments were $ for

c Prepare a classified balance sheet for December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock