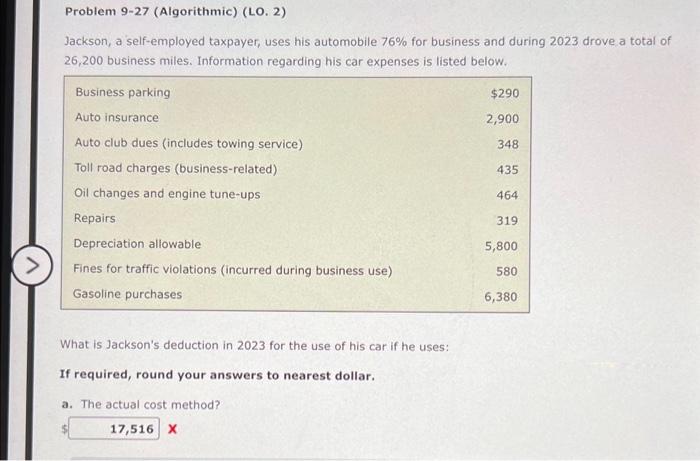

Question: determine the actual cost and automatic cost Problem 9-27 (Algorithmic) (LO. 2) Jackson, a self-employed taxpayer, uses his automobile 76% for business and during 2023

Problem 9-27 (Algorithmic) (LO. 2) Jackson, a self-employed taxpayer, uses his automobile 76% for business and during 2023 drove a total of 26,200 business miles. Information regarding his car expenses is listed below. What is Jackson's deduction in 2023 for the use of his car if he uses: If required, round your answers to nearest dollar. a. The actual cost method? $ x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts