Question: Determine the EPS indifference EBIT level for Poutine Company for the following two scenarios: A debt/equity ratio of .8, pre-tax cost of debt is 4

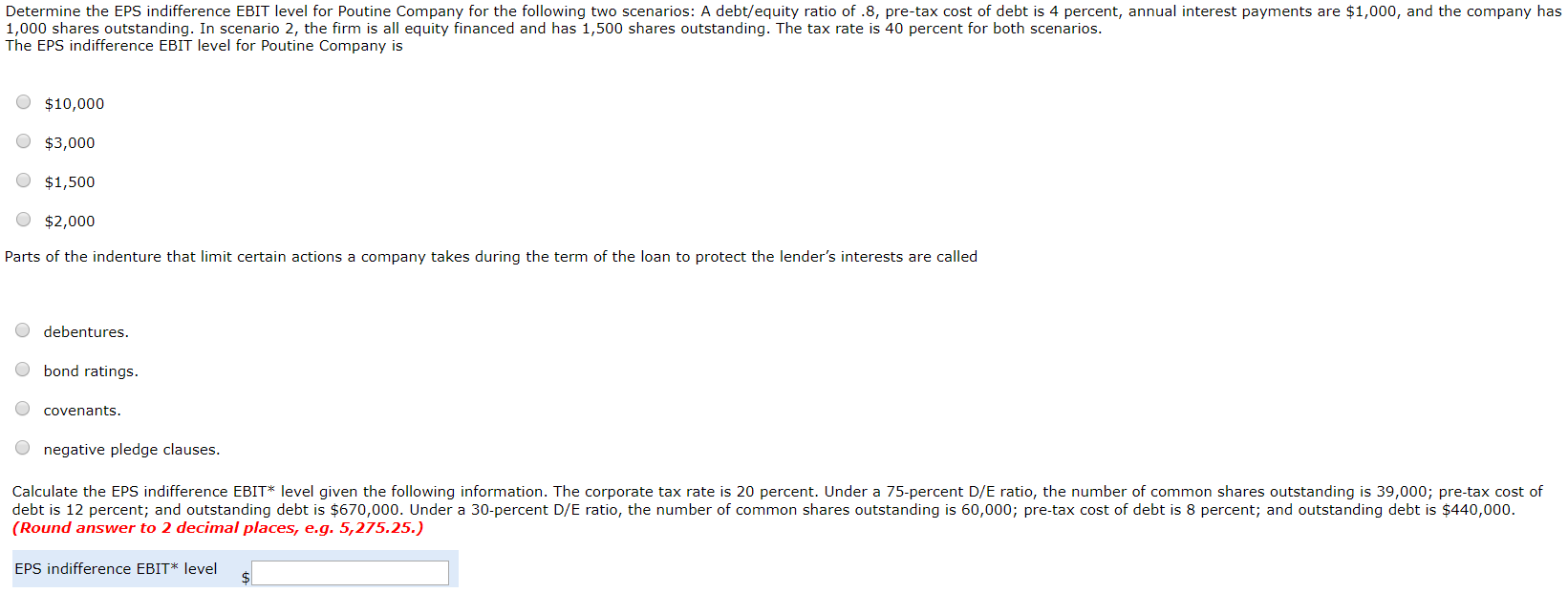

Determine the EPS indifference EBIT level for Poutine Company for the following two scenarios: A debt/equity ratio of .8, pre-tax cost of debt is 4 percent, annual interest payments are $1,000, and the company has 1,000 shares outstanding. In scenario 2, the firm is all equity financed and has 1,500 shares outstanding. The tax rate is 40 percent for both scenarios. The EPS indifference EBIT level for Poutine Company is $10,000 $3,000 o $1,500 $2,000 Parts of the indenture that limit certain actions a company takes during the term of the loan to protect the lender's interests are called O debentures. bond ratings. covenants. O negative pledge clauses. Calculate the EPS indifference EBIT* level given the following information. The corporate tax rate is 20 percent. Under a 75-percent D/E ratio, the number of common shares outstanding is 39,000; pre-tax cost of debt is 12 percent; and outstanding debt is $670,000. Under a 30-percent D/E ratio, the number of common shares outstanding is 60,000; pre-tax cost of debt is 8 percent; and outstanding debt is $440,000. (Round answer to 2 decimal places, e.g. 5,275.25.) EPS indifference EBIT* level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts