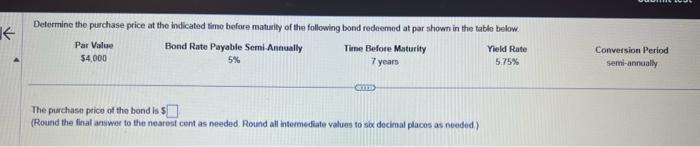

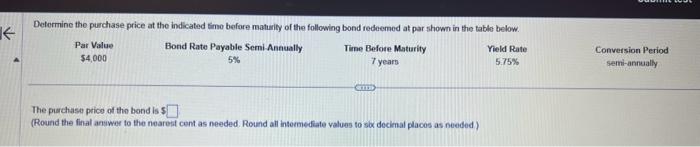

Question: Determine the purchase price at the indicated time before maturity of the following bond redeemed at par shown in the table below. Time Before

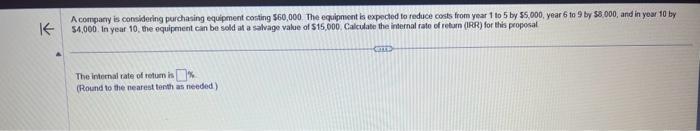

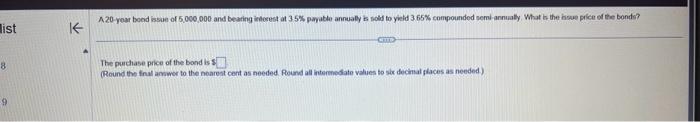

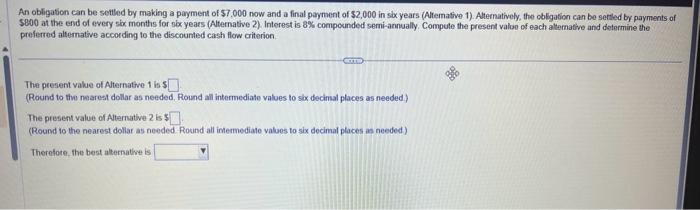

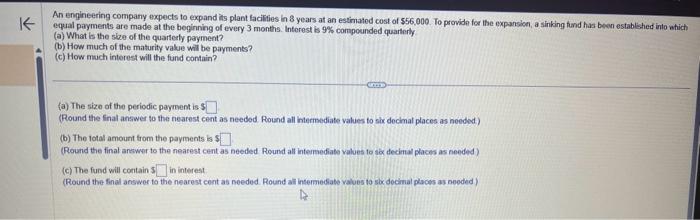

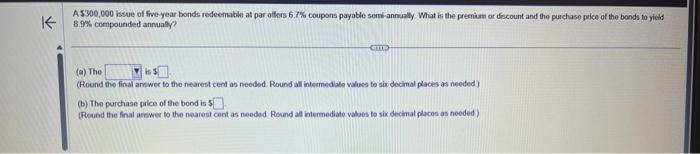

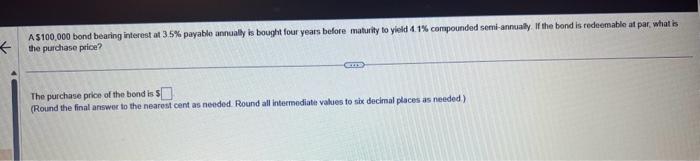

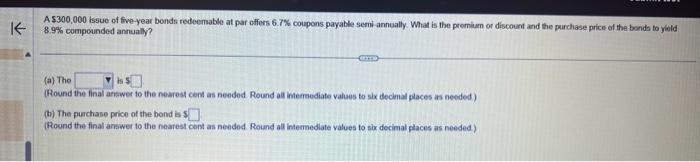

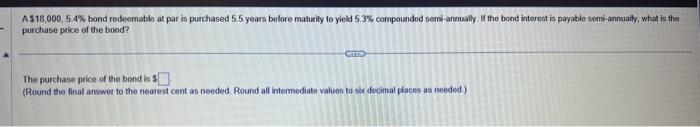

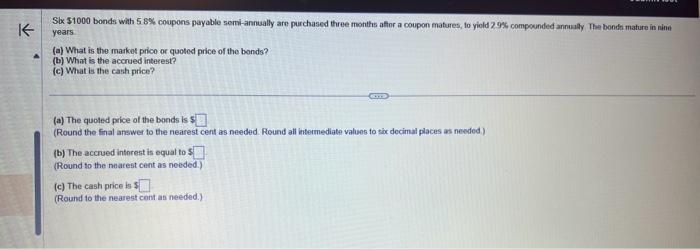

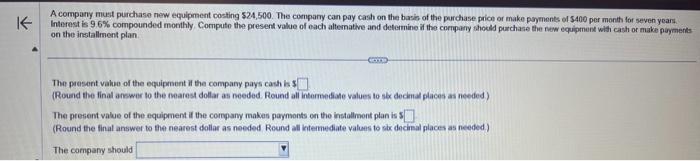

Determine the purchase price at the indicated time before maturity of the following bond redeemed at par shown in the table below. Time Before Maturity 7 years Par Value $4,000 Bond Rate Payable Semi-Annually 5% m The purchase price of the bond is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) Yield Rate 5.75% Conversion Period - semi-annually K A company is considering purchasing equipment costing $60,000. The equipment is expected to reduce costs from year 1 to 5 by $5,000, year 6 to 9 by $8,000, and in year 10 by $4,000. In year 10, the equipment can be sold at a salvage value of $15,000, Calculate the internal rate of return (IRR) for this proposal The internal rate of return is (Round to the nearest tenth as needed.) COLE list 8 9 A 20-year bond issue of 5,000,000 and bearing interest at 35% payable annually is sold to yield 3.65% compounded semi-annually. What is the issue price of the bonds? K- The purchase price of the bond is (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) An obligation can be settled by making a payment of $7,000 now and a final payment of $2,000 in six years (Alterative 1). Alternatively, the obligation can be settled by payments of $800 at the end of every six months for six years (Alternative 2). Interest is 8% compounded semi-annually. Compute the present value of each alternative and determine the preferred alternative according to the discounted cash flow criterion The present value of Alternative 1 is $ (Round to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The present value of Alternative 2 is $ (Round to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) Therefore, the best alternative is K An engineering company expects to expand its plant facilities in 8 years at an estimated cost of $56,000. To provide for the expansion, a sinking fund has been established into which equal payments are made at the beginning of every 3 months. Interest is 9% compounded quarterly (a) What is the size of the quarterly payment? (b) How much of the maturity value will be payments? (c) How much interest will the fund contain? KETE (a) The size of the periodic payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) (b) The total amount from the payments is $ (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed) (c) The fund will contain Sin interest (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) 4 K A $300,000 issue of five-year bonds redeemable at par offers 6.7% coupons payable semi-annually. What is the premium or discount and the purchase price of the bonds to yield 8.9% compounded annually? (a) The (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) (b) The purchase price of the bond is (Round the final answer to the nearest cent as needed Round all intermediate values to six decimal places as needed) A$100,000 bond bearing interest at 3.5% payable annually is bought four years before maturity to yield 4.1% compounded semi-annually. If the bond is redeemable at par, what is the purchase price? CITS) The purchase price of the bond is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) A $300,000 issue of five-year bonds redeemable at par offers 6.7% coupons payable semi-annually. What is the premium or discount and the purchase price of the bonds to yield 8.9% compounded annually? (T) (a) The (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) (b) The purchase price of the bond is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) A$18,000, 5.4% bond redeemable at par is purchased 5.5 years before maturity to yield 5.3% compounded semi-annually. If the bond interest is payable semi-annually, what is the purchase price of the bond? The purchase price of the bond is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) K Six $1000 bonds with 5.8% coupons payable semi-annually are purchased three months after a coupon matures, to yield 2.9% compounded annually. The bonds mature in nine years (a) What is the market price or quoted price of the bonds? (b) What is the accrued interest? (c) What is the cash price? (a) The quoted price of the bonds is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (b) The accrued interest is equal to $ (Round to the nearest cent as needed.) (c) The cash price is $ (Round to the nearest cent as needed.) Determine the purchase price at the indicated time before maturity of the following bond redeemed at par shown in the table below. Time Before Maturity 7 years Par Value $4,000 Bond Rate Payable Semi-Annually 5% m The purchase price of the bond is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) Yield Rate 5.75% Conversion Period - semi-annually K A company must purchase new equipment costing $24,500. The company can pay cash on the basis of the purchase price or make payments of $400 per month for seven years. Interest is 9.6% compounded monthly Compute the present value of each alternative and determine if the company should purchase the new equipment with cash or make payments on the installment plan The present value of the equipment if the company pays cash is $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed) The present value of the equipment if the company makes payments on the installment plan is (Round the final answer to the nearest dollar as needed Round all intermediate values to six decimal places as needed.) The company should

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

To determine the purchase price of the bond we need to calculate the present value of the bonds futu... View full answer

Get step-by-step solutions from verified subject matter experts