Question: Determine which portfolio is most likely immunize client's future liability and justify why the othet two portfolios are not suitable? John Paul is a fixed

Determine which portfolio is most likely immunize client's future liability and justify why the othet two portfolios are not suitable?

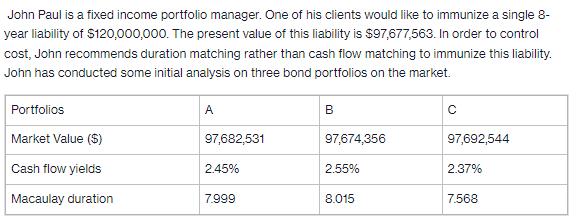

John Paul is a fixed income portfolio manager. One of his clients would like to immunize a single 8- year liability of $120,000,000. The present value of this liability is $97,677,563. In order to control cost, John recommends duration matching rather than cash flow matching to immunize this liability. John has conducted some initial analysis on three bond portfolios on the market. Portfolios Market Value ($) Cash flow yields Macaulay duration A 97,682,531 2.45% 7.999 B 97,674,356 2.55% 8.015 97,692,544 2.37% 7.568

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

To determine which portfolio is most likely to immunize the clients future liability we need to find ... View full answer

Get step-by-step solutions from verified subject matter experts