Question: Help Pleaseeeee!!!!! Problem 3 (Required, 25 marks) There are N risky assets (N > 3) in the market and short-selling is allowed. The expected return

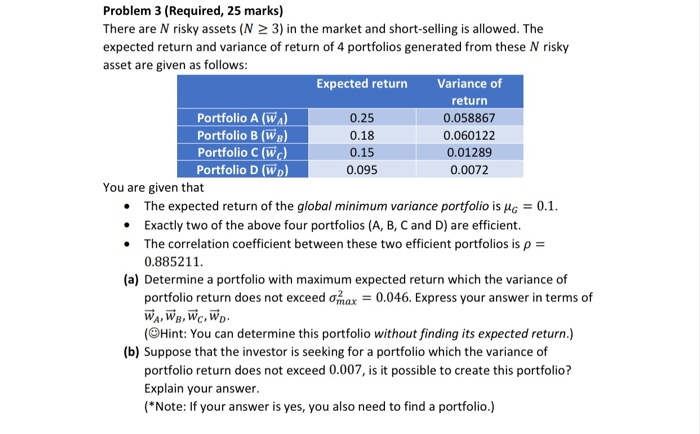

Problem 3 (Required, 25 marks) There are N risky assets (N > 3) in the market and short-selling is allowed. The expected return and variance of return of 4 portfolios generated from these N risky asset are given as follows: Expected return variance of return Portfolio A (WA) 0.25 0.058867 Portfolio B (WB) 0.18 0.060122 Portfolio C (W ) 0.15 0.01289 Portfolio D (WD) 0.095 0.0072 You are given that The expected return of the global minimum variance portfolio is Hg = 0.1. Exactly two of the above four portfolios (A, B, C and D) are efficient. The correlation coefficient between these two efficient portfolios is p = 0.885211. (a) Determine a portfolio with maximum expected return which the variance of portfolio return does not exceed omax = 0.046. Express your answer in terms of WA, WB, Wc, WD (Hint: You can determine this portfolio without finding its expected return.) (b) Suppose that the investor is seeking for a portfolio which the variance of portfolio return does not exceed 0.007, is it possible to create this portfolio? Explain your answer. (Note: If your answer is yes, you also need to find a portfolio.) Problem 3 (Required, 25 marks) There are N risky assets (N > 3) in the market and short-selling is allowed. The expected return and variance of return of 4 portfolios generated from these N risky asset are given as follows: Expected return variance of return Portfolio A (WA) 0.25 0.058867 Portfolio B (WB) 0.18 0.060122 Portfolio C (W ) 0.15 0.01289 Portfolio D (WD) 0.095 0.0072 You are given that The expected return of the global minimum variance portfolio is Hg = 0.1. Exactly two of the above four portfolios (A, B, C and D) are efficient. The correlation coefficient between these two efficient portfolios is p = 0.885211. (a) Determine a portfolio with maximum expected return which the variance of portfolio return does not exceed omax = 0.046. Express your answer in terms of WA, WB, Wc, WD (Hint: You can determine this portfolio without finding its expected return.) (b) Suppose that the investor is seeking for a portfolio which the variance of portfolio return does not exceed 0.007, is it possible to create this portfolio? Explain your answer. (Note: If your answer is yes, you also need to find a portfolio.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts