Question: Dev and Mia form the CM Partnership, each receiving a 50% capital interest. Dev contributed property worth $581,500 (adjusted basis of $668,725), while Mia contributed

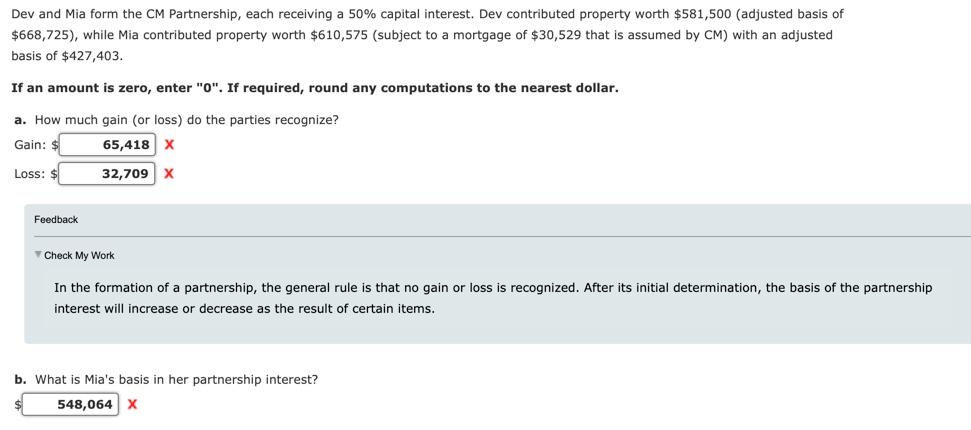

Dev and Mia form the CM Partnership, each receiving a 50% capital interest. Dev contributed property worth $581,500 (adjusted basis of $668,725), while Mia contributed property worth $610,575 (subject to a mortgage of $30,529 that is assumed by CM) with an adjusted basis of $427,403. If an amount is zero, enter "O". If required, round any computations to the nearest dollar. a. How much gain (or loss) do the parties recognize? Gain: $ 65,418 x Loss: $ 32,709x Feedback Check My Work In the formation of a partnership, the general rule is that no gain or loss is recognized. After its initial determination, the basis of the partnership interest will increase or decrease as the result of certain items. b. What is Mia's basis in her partnership interest? 548,064 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts