Question: develop a five forces model analysis develop a swot analysis based off the information provided Cracker Barrel Old Country Store Inc.-2018 www.crackerbarrel.com (CBRL) Hended a

develop a five forces model analysis

develop a swot analysis

based off the information provided

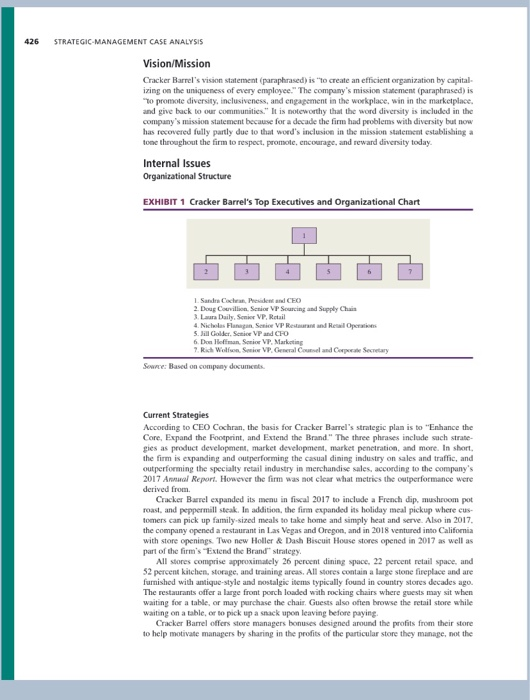

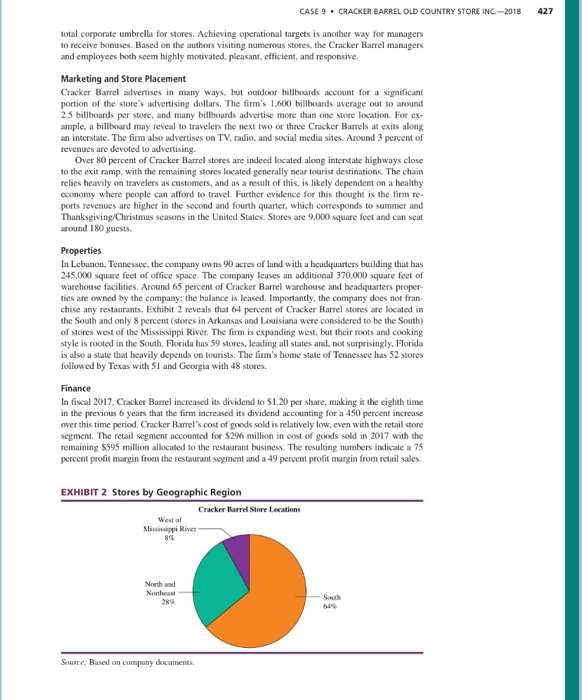

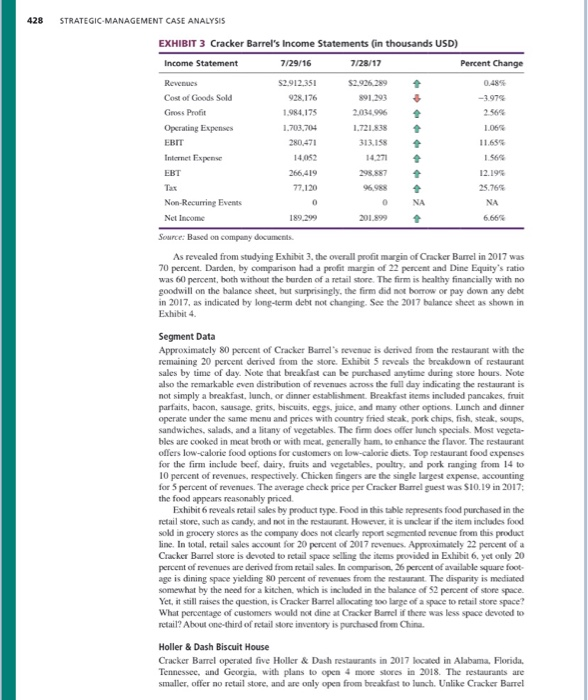

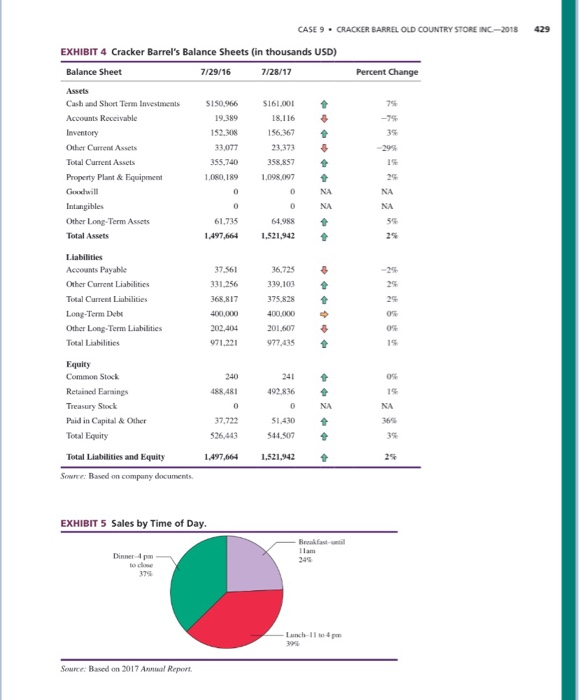

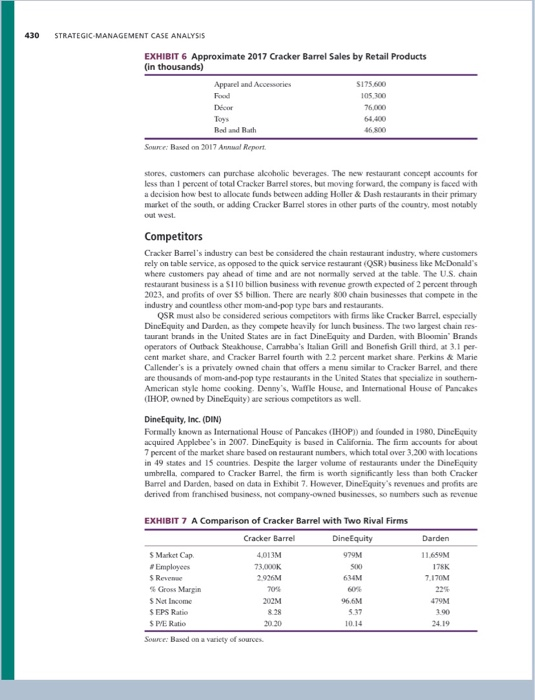

Cracker Barrel Old Country Store Inc.-2018 www.crackerbarrel.com (CBRL) Hended a Luce Tesse. Cracker Bandi c cha ined Cracker an d Southwest Lid Sutherlanded as the Fach Cracker Ramel features are perched with woodening dance place and deve ats tad to the local schoollege fo o t in the particular All Cracker Bundl e d and operated by the opposed to using a franchised lice del chai The firm has haved traditional deep the conten t cooking that tends to the high is calles fotogrando Mach oth food is made to order and serves breakfast, lunch and dinner Popular servi c e fried chicken chicken and dumplings Countrytriedk amers with rent vegetales.com bread and hiscuits and has fonds Neth uhe des plus des chas pecan pie and how Alcoholic beverages are not asker Bulbul e firm's relatively Holler & Dash Biscuit House restaurants Cracker Bandis i ning a merchandise store located in every re m archandise es t percent of company reves . The company's hapser van d e schockier chairs holiday and scalifts, toys apparels, CD. C a ndo other items as well as candies, preserve pics camises e cake mise and other food items. As of early 2018, the company pred 59 Cracker Bamel Old Country stores in 45 states In fiscal 2017, the firm had sales of mely S3 with a rin pofit margin of 70 percent. Cracker Barrel is listed in Forbes Mas Top 100 S eputable companies ranks were in the American Customer Satisfactiones the best full-services rant in the United States For the second year in a row.ad Nashville, Tennessee's Ascend Amphitheater from June 7 through June 9, 2018 Cracker Barrel and the Country Music Assoc (CMA) teamed up to hring hospitality, charm, and an ima he lineup of sponsor the annual CMA Fe's Country Roads Sage festival. Cracker and the lucky to Nashville to price the CMA Rust in VIP style Copyright by Fred Duvid Books LLC, written by Forest Did History Founded by Dan Evins in 1909. Cracker Barrel was only a s e mesturant in Lau Tennessee. Dus passed away in 2012. this comme nded by 1977 became a publicly traded company in 1951. By 200 3 ctions Du the 190 the company red legal problems for c h es and minorities and was subject to everce and gender discrimination is the cars since the y has provided scholarships and other com p o sando and gos 2013 the c ap a ce Bebededos including: cum delindung d a pat with S k 2016, the firm expanded s a e ller. Das Bici H . The continues to and movi e s in Las Vegas wall. Open 2017 425 426 STRATEGIC MANAGEMENT CASE ANALYSIS Vision/Mission Cracker Barrel's vision statement paraphrased) is to create an efficient organization by capital iring on the uniqueness of every employee. The company's mi m et paraphrasis to promote diversity, inclusiveness, and operament in the workplace, win in the marketplace and give back to contests w hy that the wedding is included in the company's statement because for a decade the firm had problems with diversity but has T ed fully partly due to the words incluse in the m e eting a tone throughout the firm to respect, promotencourage and reward diversity today Internal Issues Organizational Structure EXHIBIT 1 Cracker Barrel's Top Executives and Organizational Chart 1. Sandra Cachan President and CEO 2. Doug Courvilio Senior VP Sourcing and Supply Chain L a Dails, Senior VP, Retail 4. Nicholas Flanagan Seni VP Rest der Oper 5. Jill Golder. Seni VP and CHO 6. De Hoffman Seni VP. Marketing RW V P Coral Secretary Sew : Based on company documents Current Strategies According to CEO Cochran, the basis for Cracker Barrel's strategic plan is to "Enhance the Core, Expand the Footprint, and Extend the Brand The three phrases include such strate gies as product development market development market penetration, and more. In short the firm is expanding and outperforming the casual dining industry on sales and traffic, and outperforming the specialty retail industry in merchandise sales, according to the company's 2017 Anal Report. However the firmware clear what metrics the outperformance were derived from Cracker Barrel expanded its menu in fiscal 2017 to include a French dip, mushroom pot roast and peppermell steak. In addition, the firm expanded its holiday meal pickup where cu tomers can pick up family sized meals to take home and simply heat and serve. Also in 2017 the company opened a restaurant in Las Vegas and Oregon, and in 2018 ventured into California with store openings. Two new Holler Dach Biscuit House stores opened in 2017 as well as part of the firm's "Extend the Brand strategy All stores comprise approximately 25 percent dining space 22 percent retail space and 52 percent Kitchen Storage and training areas. All stores contain a large stone fireplace and are furnished with antique style and sta t es typically found in country stores decades a The restaurants offer a large front porch loaded with rocking Chairs where guests may sit when waiting for a while, or may purchase the chair Gestalten hose the retail store while waiting on a table, or to pick up a snack upon leaving before paying Cracker Barrel offers se managers house designed a nd the profits from their store to help motivate managers by sharing in the profits of the particular store they manage to the CASE 9. CRACKER BARREL OLD COUNTRY STORE INC.-2018 427 total corporate umbrella for stores. Achieving operational targets is another way for managers to receive bonuses. Based on the authors visiting numerous stores, the Cracker Barrel managers and employees both seem highly motivated, pleasant, efficient, and responsive Marketing and Store Placement Cracker Barrel advertises in many ways, but outdoor billboards account for a significant portion of the store's advertising dollars. The firm's 1,600 billboards average out to around 2.5 billboards per store, and many billboards advertise more than one store location. For ex- ample, a billboard may reveal to travelers the next two or three Cracker Barrels at exits along an interstate. The firm also advertises on TV, radio, and social media sites. Around 3 percent of revenues are devoted to advertising. Over 80 percent of Cracker Barrel stores are indeed located along interstate highways close to the exit ramp, with the remaining stores located generally near tourist destinations. The chain relies heavily on travelers as customers, and as a result of this, is likely dependent on a healthy economy where people can afford to travel. Further evidence for this thought is the firme ports revenues are higher in the second and fourth quarter, which corresponds to summer and Thanksgiving/Christmas seasons in the United States. Stores are 9,000 square feet and can scat around 180 guests. Properties In Lebanon, Tennessee, the company owns 90 acres of land with a headquarters building that has 245,000 square feet of office space. The company leases an additional 370,000 square feet of warehouse facilities. Around 65 percent of Cracker Barrel warehouse and headquarters proper ties are owned by the company, the balance is leased. Importantly, the company does not fran- chise any restaurants. Exhibit 2 reveals that 64 percent of Cracker Barrel stores are located in the South and only 8 percent stores in Arkansas and Louisiana were considered to be the South) of stores west of the Mississippi River. The firm is expanding west, but their roots and cooking style is rooted in the South Florida has 59 stores, leading all states and, not surprisingly, Florida is also a state that heavily depends on tourists. The firm's home state of Tennessee has 52 stores followed by Texas with 51 and Georgia with 48 stores. Finance In fiscal 2017, Cracker Barrel increased its dividend to $1.20 per share, making it the eighth time in the previous 6 years that the firm increased its dividend accounting for a 450 percent increase over this time period. Cracker Barrel's cost of goods sold is relatively low, even with the retail store segment. The retail segment accounted for $296 million in cost of goods sold in 2017 with the remaining $595 million allocated to the restaurant business. The resulting numbers indicate a 75 percent profit margin from the restaurant segment and a 49 percent profit margin from retail sales. EXHIBIT 2 Stores by Geographic Region Cracker Barrel Store Locations West of Minipi River North and Northeast Source: Based on company documents. 428 STRATEGIC MANAGEMENT CASE ANALYSIS EXHIBIT 3 Cracker Barrel's Income Statements in thousands USD) Income Statement 7/29/16 7/28/17 Percent Change + Revenues Cost of Goods Sold Gross Profit Operating Expenses EBIT Internet Expense 52.912,351 928.176 1.984.175 1.703.704 280,471 $2.926.289 891.293 2.024.996 1.721.838 313.158 14.271 298.887 -1976 2565 1.06% 11.63 1.565 12.19 25.76% 266.419 77.130 Non-Recurring Events Net Income 180109 2019 6.66 Source: Based on company documents As revealed from studying Exhibit 3. the overall profit margin of Cracker Barrel in 2017 was 70 percent. Darden, by comparison had a profit margin of 22 percent and Dine Equity's ratio was 60 percent, both without the burden of a retail store. The firm is healthy financially with no goodwill on the balance sheet, but surprisingly, the firm did not borrow or pay down any debt in 2017. as indicated by long-term debt not changing. See the 2017 balance sheet as shown in Exhibit 4 Segment Data Approximately 80 percent of Cracker Barrel's revenue is derived from the restaurant with the remaining 20 percent derived from the store. Exhibit 5 reveals the breakdown of restaurant sales by time of day. Note that breakfast can be purchased anytime during store hours. Note also the remarkable even distribution of revenues across the full day indicating the restaurant is not simply a breakfast, lunch, or dinner establishment. Breakfast items included pancakes, fruit parfaits, bacon, sausage, grits, biscuits, eggs, juice, and many other options. Lunch and dinner operate under the same menu and prices with country fried steak, pork chips, fish, steak, soups, sandwiches, salads, and a litany of vegetables. The firm does offer lunch specials. Most vegeta- bles are cooked in meat broth or with meat, generally ham. to enhance the flavor. The restaurant offers low-calorie food options for customers on low-calorie dicts. Top restaurant food expenses for the firm include beef, dairy fruits and vegetables poultry, and pork ranging from 14 to 10 percent of revenues, respectively. Chicken fingers are the single largest expense, accounting for 5 percent of revenues. The average check price per Cracker Barrel guest was SI0.19 in 2017; the food appears reasonably priced. Exhibit 6 reveals retail sales by product type. Food in this table represents food purchased in the retail store, such as candy, and not in the restaurant. However, it is unclear if the item includes food sold in grocery stores as the company does not clearly report segmented revenue from this product line. In total, retail sales account for 20 percent of 2017 revenues. Approximately 22 percent of a Cracker Barrel store is devoted to retail space selling the items provided in Exhibit 6. yet only 20 percent of revenues are derived from retail sales. In comparison. 26 percent of available square foot- age is dining space yielding 80 percent of revenues from the restaurant. The disparity is mediated somewhat by the need for a kitchen, which is included in the balance of 52 percent of store space. Yet, it still raises the question, is Cracker Barrel allocating to large of a space to retail store space? What percentage of customers would not dine at Cracker Barrel if there was less space devoted to retail? About one-third of retail store inventory is purchased from China Holler & Dash Biscuit House Cracker Barrel operated five Holler & Dash restaurants in 2017 located in Alabama, Florida. Tennessee, and Georgia. with plans to open 4 more stores in 2018. The restaurants are smaller, offer no retail store and are only open from breakfast to lunch. Unlike Cracker Barrel CASE 9. CRACKER BARREL OLD COUNTRY STORE INC-2018 429 EXHIBIT 4 Cracker Barrel's Balance Sheets (in thousands USD) Balance Sheet 7/29/16 7/28/17 Percent Change Assets Cash and Short Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Property Plant & Equipment Goodwill Intangibles Other Long-Term Assets Total Assets SI50.966 19.389 152.308 33,077 355,740 1. SIRO $161.001 18.116 156,367 21.173 358,857 1.OOR 097 61.735 64,988 1.521,942 Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities 331.256 368,817 400,000 202,404 971.221 36.725 339,103 375,828 400,000 201.607 977,435 240 488,481 492.836 Equity Common Stock Retained Earnings Treasury Stock Paid in Capital & Other Total Equity 365 37.722 536,443 51.430 544.507 Total Liabilities and Equity 1.497,664 1,521,942 + Source: Based on company documents. EXHIBIT 5 Sales by Time of Day. Raksti Ilam Dinner tock Launch Il top Source: Based on 2017 Anal Rent 430 STRATEGIC MANAGEMENT CASE ANALYSIS EXHIBIT 6 Approximate 2017 Cracker Barrel Sales by Retail Products (in thousands) es Appard and Acc Food $17500 105 200 Tos 54100 BR Rada 2017 Report stores, customers can purchase alcoholic beverapes. The new restaurant concept accounts for less than I percent of local Cracker Barrel stores, ut moving forward the company is faced with a decision how best to allocate funds between adding Holler & Dash restaurants in their primary market of the south, or adding Cracker Barrel stores in other parts of the country, most notably out Competitors Cracker Barrel's industry can best be considered the chain restaurant industry, where customers rely on table service, as opposed to the quick service restaurant (OSR) business like McDonald's where customers pay ahead of time and are not normally served at the table. The US chain restaurant business is a SI 10 billion business with revenue growth expected of 2 percent through 2023, and profits of over SS billion. There are nearly 800 chain businesses that compete in the industry and countless other mom-and-pop type burs and restaurants QSR must also be considered serious competitors with firms like Cracker Barrel, especially DincEquity and Darden, as they compete bavily for lunch business. The two largest chain res taurant brands in the United States are in fact Dine Equity and Darden, with Bloomin' Brands operators of Outback Steakhouse, Carabha's Italian Grill and Bonetih Grill third, at 3. per cent market share, and Cracker Barrel fourth with 22 percent market share Perkins Marie Callender's is a privately owned chain that offers a menu similar to Cracker Barrel, and there are thousands of mom-and-pop type restaurants in the United States that specialize in them American style home cooking. Denny's, Waffle House and International House of Pancakes (IHOP, owned by Dine Equity) are serious competitors as well Dine Equity, Inc. (DIN) Formally known as International House of Pancakes (IHOP) and founded in 1980. DineEquity acquired Applebee's in 2007. DineEquity is based in California. The firm o unts for about 7 percent of the market share based on restaurant numbers, which total over 3.200 with locations in 49 states and IS countries. Despite the larger volume of restaurants under the Dine buity umbrella compared to Cracker Barel, the firm is worth significantly less than oth Cracker Barel and Darden, based on data in Exhibit 7. However, DineEquity's revenues and profits are derived from franchised business of company owned businesses, se number such as revenue EXHIBIT 7 A Comparison of Cracker Barrel with Two Rival Firms Cracker Barrel DineEquity Darden 99 4 73.000K 2016 11 AM 17 IM 6UM SM Cap Employees Rece Go Me S Notice SEPS Ratio SPER 1014 CASE 9. CRACKER BARREL OLD COUNTRY STORE INC.-2018 431 and employees will naturally be lower as much of these numbers are counted by the franchisee. The firm divested all company owned Applebee's in 2015 to become a fully franchised opera tion, the exact opposite of Cracker Barrel's strategy of owning 100 percent of its stores. IHOP's menu is more similar to Cracker Barrel's than Applebee's, providing breakfast all day long as well as providing burgers and a few Souther-style foods. In contrast, Applebee's is not open for breakfast and serves American hur style food with a full bar in every location allowed by law. IHOP is performing better of the two businesses, opening around 50 stores between 2010 and 2015, while Applebee's closed 160 during that time period. Darden Restaurants, Inc. (DRI) Headquartered in Orlando, Florida, also home to Disney World, Darden Restaurants became a public company in 1996 and employs over 178,000 workers. Like Cracker Barrel. Darden wwwns all of its more than 1.700 restaurants except for 8. The firm has an international presence in Canada, South and Central America, Middle East and Malaysia, but over 98 percent of re- enue is derived from the United States. Popular brands with store numbers include: 840 Olive Gardens focusing on American Italian food, 490 Long Horn Steakhouses. 56 Capital Guilles 37 Bahama Breeze, 41 Seasons 52, 18 Eddie V's Prime Seafood, and 3 Wildfish Seafood Grille establishments. Darden divested its stake in Red Lobuter in 2014 to Golden Gate for S21 billion. Danden acquired Cheddar Scratch Kitchen for $780 million in cash in 2017. Perkins & Marie Callender's LLC Perkins, as it is often referred to by the name on the sign, is a direct competitor to Cracker Barrel offering a menu close to what Cracker Barrel offers. The firm was founded in 1958 in Memphis, Tennessee, and currently employs over 25.000 workers. The firm filed for bankruptcy in February 2017. Perkins operates restaurants and bakeries in the United States and Canada in cluding breakfast, lunch, dinner, and snacks. The Marie Callender's brand manufactures bakery desserts that can be purchased at most grocery stores across the United States Mom-and-Pop Diners There are countless diners across the South, and United States in general, that offer a menu based on southern country cooking. Many of these establishments also offer a buffet and deep-discounted lunches significantly cheaper than Cracker Barrel. Others may offer a principle product, such as barbecue pork in conjunction with a country-cooking ballet in an attempt to attract a wider range of customers External Issues Menu Types The restaurant business in the United States serves a wide array of foods with American food accounting for 55 percent of food served and breakfast foods accounting for 17 percent. Italian-American food accounts for 9 percent and the balance of 19 percent is derived from seafood, specialty burgers, Asian food, and other food types. It is important to remember, only chain restaurants are considered in this data, a slightly different rivals such as McDonald's and even mom-and-pops with a menu similar to Cracker Barrel are not included. Cracker Barrel is well positioned in this market though, taking direct advantage by serving over 70 percent of the most common food types among chain restaurants, including breakfast all day long. Healthier Eating While Cracker Barrel offers a few healthy food options, the company's core business is Vasily centered around food high in calories, fat, sugar and salt. Even the vegetables fit into this mold of generally being cooked in ham broth with extra salt added for flavor. However, customers in the United States and around the world are increasingly more conscious about the healthy qual- ity of food options. Applebee's even promotes an under 550 calorie menu. While Cracker Barrel should likely not venture away from its core customer x cut calories in its principle products, the firm should consider adding a few additional healthier options to the menu and marketing them as many diners are with a group and a health conscious diner could rule cul Cracker Barrel as an cuting option for the entire group. 432 STRATEGIC MANAGEMENT CASE ANALYSIS Growth Overseas Cracker Barrel has a unique menu that is tailored closely to a traditional Southern diet in the United States, but the growth overseas has lured many American restaurant firms to expand as growth opportunities have previously been capitalized on in the United States. Durden te cently expanded its LongHom and Olive Garden brands into Malaysia and you can find Chili's Applebee's, and many other similar establishments in the Middle East and other areas Traditional fast food restaurants, such as McDonald's, KFC and Burger King. are world wide For Cracker Barrel, there is still a large US market to tap into especially west of the Mississippi River, and the firm could also focus on growing its Holler & Dash chain in the South. Nevertheless, rival firms are continuing to push overseas as markets are saturated in the United States and as food consumption habits become more similar worldwide Merger & Acquistion (M&A) Like many industries, over the last several years of low-interest rates and increased competi tion, there have been ample M&As in the restaurant industry also. In addition to the acquisitions previously mentioned. Panera Bread was acquired by a private equity firm for $7.5 billion Bob Evans Farms, offering a menu of breakfast items and Southern country cooking, was acquired by Golden Gate Capital for $565 million; Restaurant Brands International, owner of Burger King, purchased Popeye's Louisiana Kitchen for $1.8 billion M&A is an excellent way to expand quickly into new markets and could possibly be an avenue for Cracker Barrel moving forward. However, the company has a clear strategy of company-owned stores with a culture of being devoted to its workers, sofinding a suitable firm to acquire may be difficult and stray Cracker Barrel away from its core business, Cracker Barrel's stock price and health of the company are robust now, so it is unlikely the firm would be acquired as there are cheaper and casier targets for rival firms or private equity firms to target. Food Prices While Cracker Barrel has an excellent profit margin, food prices still greatly impact the firm's profits. Moving through 2018 and beyond, production of heef, pork, and poultry in the United States are expected to increase, which should help to keep food prices relatively stable. The United States Department of Agriculture projects lower prices for farm commodities due to lower fuel and materials cost. Vegetables for human consumption and feed for animals should remain at a relatively steady price after falling for much of the last few years leading into 2018 Future In February 2018, Cracker Burrel released its Q2 2018 financial results that revealed the following 1. Revenue was $787.8 million, a 2 percent increase over the prior year's Q2. 2. Net Income was $9 million, a 72.9 percent increase over the prior year Q2 3. Comparable store restaurant les increased Il percent 4. Comparable store restaurant traffic decreased 0.9 percent. 5. The average menu price increased 23 percent Given the Q2 2018 financial results, Cracker Barrel said it expects full year 2018 revenues to reach 53.1 billion, reflecting the expected opening of eight or nine new Cracker Barrel stores and three new Holler & Dash Biscuit House restaurants. The company projects for 2018 that comparable store restaurant sales will grow by 2 percent while comparable store retail sales will be flat. Although the retail part of the restaurants are anticipated not to grow revenues, hay ing those unique stores with the restaurants provides a unique indirect benefit. Should Cracker Barrel accelerate expansion of its Holler & Dash restaurants? A clear strategic plan is needed to make these kinds of game-changing decisions Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock