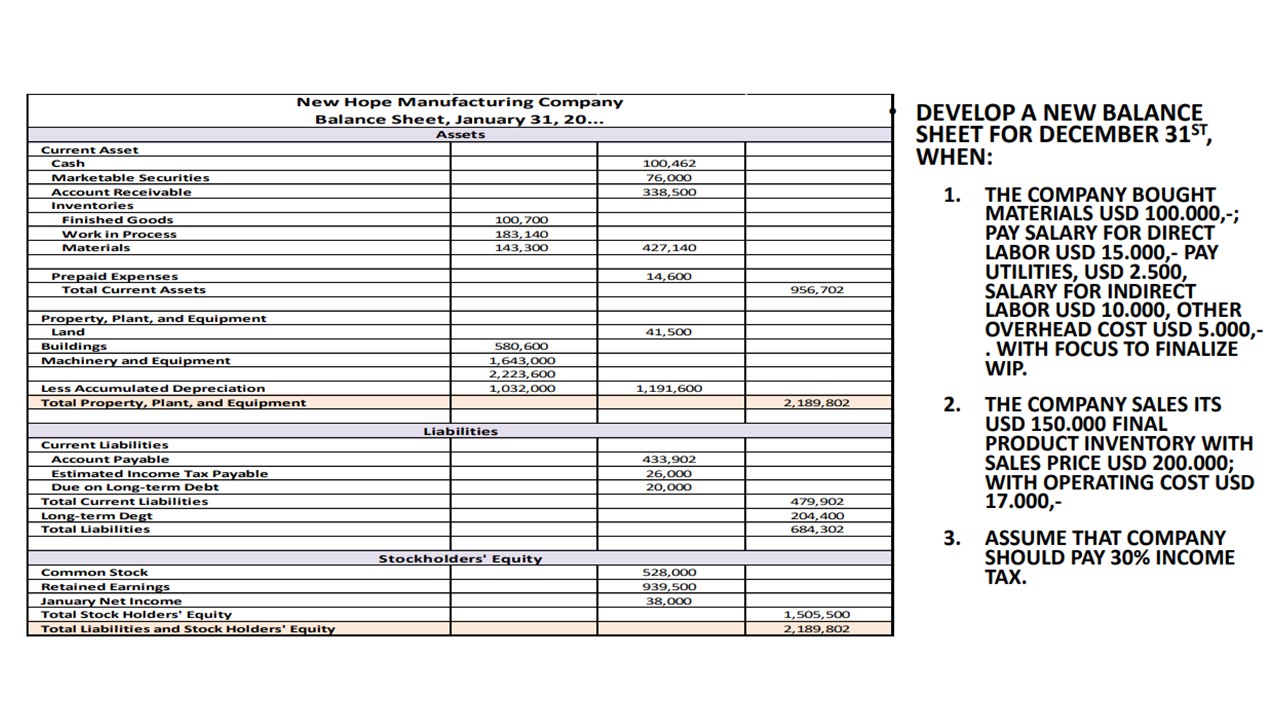

Question: DEVELOP A NEW BALANCE SHEET FOR DECEMBER 31 ST,, WHEN: 1. THE COMPANY BOUGHT MATERIALS USD 100.000,-; PAY SALARY FOR DIRECT LABOR USD 15.000,- PAY

DEVELOP A NEW BALANCE SHEET FOR DECEMBER 31 ST,, WHEN: 1. THE COMPANY BOUGHT MATERIALS USD 100.000,-; PAY SALARY FOR DIRECT LABOR USD 15.000,- PAY UTILITIES, USD 2.500, SALARY FOR INDIRECT OVERHEAD COST USD 5.000,- WITH FOCUS TO FINALIZE WIP. 2. THE COMPANY SALES ITS USD 150.000 FINAL PRODUCT INVENTORY WITH SALES PRICE USD 200.000; 17.000,- 3. ASSUME THAT COMPANY SHOULD PAY 30\% INCOME TAX. DEVELOP A NEW BALANCE SHEET FOR DECEMBER 31 ST,, WHEN: 1. THE COMPANY BOUGHT MATERIALS USD 100.000,-; PAY SALARY FOR DIRECT LABOR USD 15.000,- PAY UTILITIES, USD 2.500, SALARY FOR INDIRECT OVERHEAD COST USD 5.000,- WITH FOCUS TO FINALIZE WIP. 2. THE COMPANY SALES ITS USD 150.000 FINAL PRODUCT INVENTORY WITH SALES PRICE USD 200.000; 17.000,- 3. ASSUME THAT COMPANY SHOULD PAY 30\% INCOME TAX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts