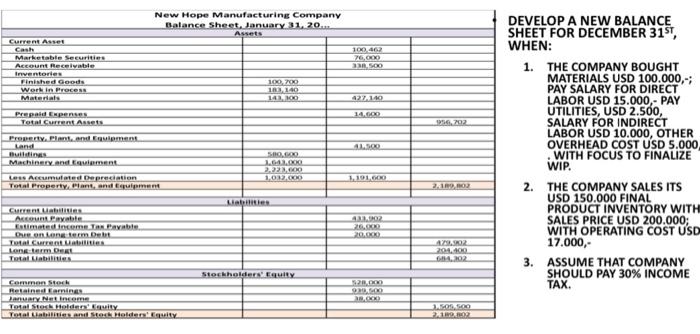

Question: DEVELOP A NEW BALANCE SHEET FOR DECEMBER 31ST,, WHEN: 1. THE COMPANY BOUGHT MATERIALS USD 100.000,; PAY SALARY FOR DIRECT LABOR USD 15.000,- PAY UTILITIES,

DEVELOP A NEW BALANCE SHEET FOR DECEMBER 31ST,, WHEN: 1. THE COMPANY BOUGHT MATERIALS USD 100.000,; PAY SALARY FOR DIRECT LABOR USD 15.000,- PAY UTILITIES, USD 2.500, SALARY FOR INDIRECT LABOR USD 10.000, OTHER OVERHEAD COST USD 5.000 WITH FOCUS TO FINALIZE 2. THE COMPANY SALES ITS USD 150.000 FINAL PRODUCT INVENTORY WITH SALES PRICE USD 200.000; WITH OPERATING COST USD 17.000,- 3. ASSUME THAT COMPANY SHOULD PAY 30% INCOME TAX. DEVELOP A NEW BALANCE SHEET FOR DECEMBER 31ST,, WHEN: 1. THE COMPANY BOUGHT MATERIALS USD 100.000,; PAY SALARY FOR DIRECT LABOR USD 15.000,- PAY UTILITIES, USD 2.500, SALARY FOR INDIRECT LABOR USD 10.000, OTHER OVERHEAD COST USD 5.000 WITH FOCUS TO FINALIZE 2. THE COMPANY SALES ITS USD 150.000 FINAL PRODUCT INVENTORY WITH SALES PRICE USD 200.000; WITH OPERATING COST USD 17.000,- 3. ASSUME THAT COMPANY SHOULD PAY 30% INCOME TAX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts