Question: Develop an Excel spreadsheet model for the following: Lease Corp. is considering a lease to XYZ Corp. for some new manufacturing equipment. The lease would

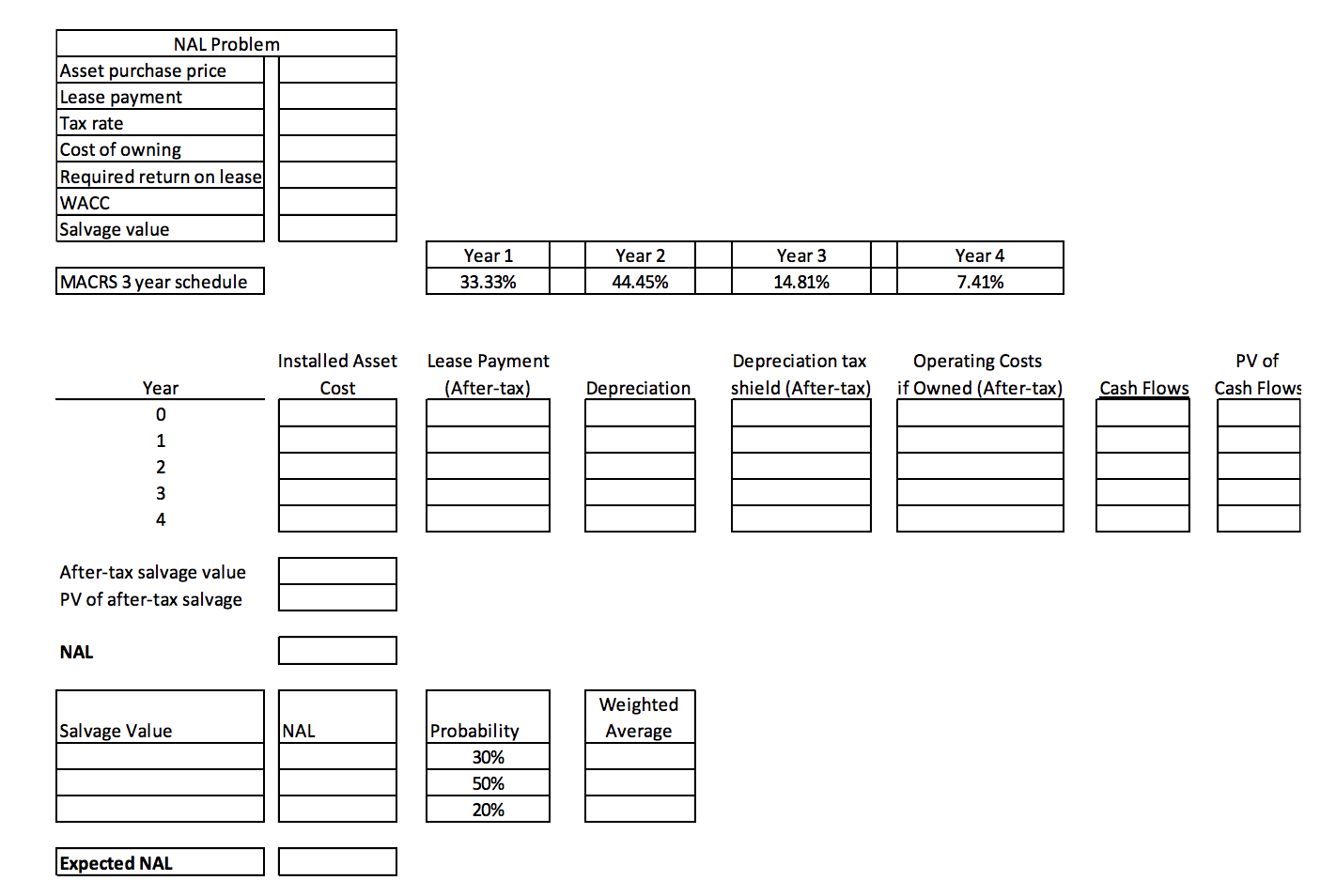

Develop an Excel spreadsheet model for the following: Lease Corp. is considering a lease to XYZ Corp. for some new manufacturing equipment. The lease would be a 4-year contract with a lease payment of $292,000 per year. In addition, payments for this particular lease are to be made at the end of the year and would include maintenance. If Lease Corp. agrees to lease the item to XYZ Corp, they will have to purchase the equipment outright for $790,000 and also will have to pay the local dealer $22,000 at the end of each year for maintenance service. The equipment falls into the MACRS 3-year class and has a resale value of $44,000. The lessor's tax rate is 25% and the lessee's tax rate is 34%. Lease Corp. requires a 12.25% after-tax return on equipment it leases, which is also its WACC (i.e., in this problem you only need to use one discount rate). NAL Problem Asset purchase price Lease payment Tax rate Cost of owning Required return on lease WACC Salvage value Year 1 33.33% Year 2 44.45% Year 3 14.81% Year 4 7.41% MACRS 3 year schedule Installed Asset Cost Lease Payment (After-tax) Depreciation tax shield (After-tax) Operating Costs if Owned (After-tax) PV of Cash Flows Depreciation Cash Flows After-tax salvage value PV of after-tax salvage NAL Weighted Average Salvage Value Probability 30% 50% 20% Expected NAL D Develop an Excel spreadsheet model for the following: Lease Corp. is considering a lease to XYZ Corp. for some new manufacturing equipment. The lease would be a 4-year contract with a lease payment of $292,000 per year. In addition, payments for this particular lease are to be made at the end of the year and would include maintenance. If Lease Corp. agrees to lease the item to XYZ Corp, they will have to purchase the equipment outright for $790,000 and also will have to pay the local dealer $22,000 at the end of each year for maintenance service. The equipment falls into the MACRS 3-year class and has a resale value of $44,000. The lessor's tax rate is 25% and the lessee's tax rate is 34%. Lease Corp. requires a 12.25% after-tax return on equipment it leases, which is also its WACC (i.e., in this problem you only need to use one discount rate). NAL Problem Asset purchase price Lease payment Tax rate Cost of owning Required return on lease WACC Salvage value Year 1 33.33% Year 2 44.45% Year 3 14.81% Year 4 7.41% MACRS 3 year schedule Installed Asset Cost Lease Payment (After-tax) Depreciation tax shield (After-tax) Operating Costs if Owned (After-tax) PV of Cash Flows Depreciation Cash Flows After-tax salvage value PV of after-tax salvage NAL Weighted Average Salvage Value Probability 30% 50% 20% Expected NAL D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts