Question: Assume yourself as an entrepreneur of a small scale business ( a Keurig look-a-like but for alcohol instead of coffee ) Financial Plan The financial

Assume yourself as an entrepreneur of a small scale business ( a Keurig look-a-like but for alcohol instead of coffee )

Financial Plan

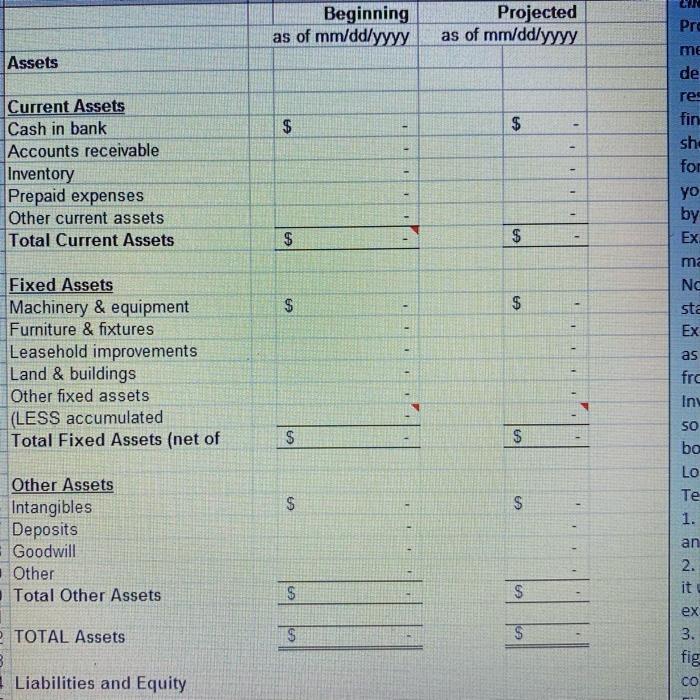

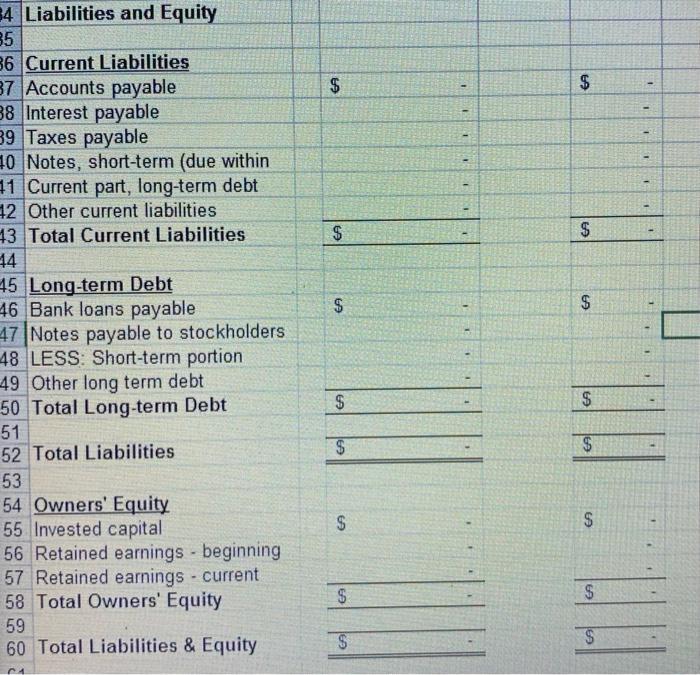

The financial plan consists of a 12‐month profit and loss projection, a cash‐flow projection, a projected balance sheet, and a break‐even calculation. Together they constitute a reasonable estimate of your company’s financial future.

Assets Current Assets Cash in bank Accounts receivable Inventory Prepaid expenses Other current assets Total Current Assets Fixed Assets Machinery & equipment Furniture & fixtures Leasehold improvements Land & buildings Other fixed assets (LESS accumulated Total Fixed Assets (net of Other Assets Intangibles Deposits Goodwill Other Total Other Assets 2 TOTAL Assets 3 Liabilities and Equity Beginning as of mm/dd/yyyy $ 69 $ 69 SA LA $ S " Projected as of mm/dd/yyyy LA $ $ $ CA $ $ 60 S S 1 I 1 1 I F E I * I Pre me de res fin sh for yo by Ex ma No sta Ex as frc Inv 50 bo Lo Te 1. an 2. +3 it ex 3. fig CO

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts