Question: Tracy is preparing her budget for next year and needs your assistance. Now that she has a better idea of what to expect now

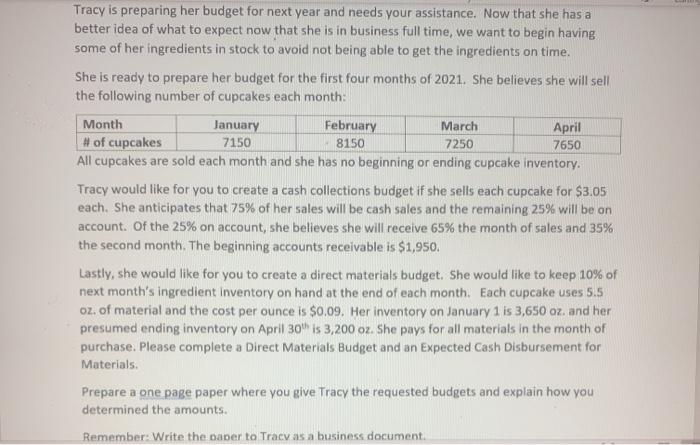

Tracy is preparing her budget for next year and needs your assistance. Now that she has a better idea of what to expect now that she is in business full time, we want to begin having some of her ingredients in stock to avoid not being able to get the ingredients on time. She is ready to prepare her budget for the first four months of 2021. She believes she will sell the following number of cupcakes each month: Month # of cupcakes All cupcakes are sold each month and she has no beginning or ending cupcake inventory. January February March April 7650 7150 - 8150 7250 Tracy would like for you to create a cash collections budget if she sells each cupcake for $3.05 each. She anticipates that 75% of her sales will be cash sales and the remaining 25% will be on account. Of the 25% on account, she believes she will receive 65% the month of sales and 35% the second month. The beginning accounts receivable is $1,950. Lastly, she would like for you to create a direct materials budget. She would like to keep 10% of next month's ingredient inventory on hand at the end of each month. Each cupcake uses 5.5 oz. of material and the cost per ounce is $0.09. Her inventory on January 1 is 3,650 oz. and her presumed ending inventory on April 30h is 3,200 oz. She pays for all materials in the month of purchase. Please complete a Direct Materials Budget and an Expected Cash Disbursement for Materials. Prepare a one page paper where you give Tracy the requested budgets and explain how you determined the amounts. Remember: Write the paper to Tracv as a business document.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Dear Tracy Based on the information you provided for the first 4 months of 2021 I have worked out and presented here both Cash Collections Budget and ... View full answer

Get step-by-step solutions from verified subject matter experts