Question: Develop (in Excel) an enterprise budget for a proposed 2021 No-Till wheat enterprise based on the following assumptions: For this exercise I want you to

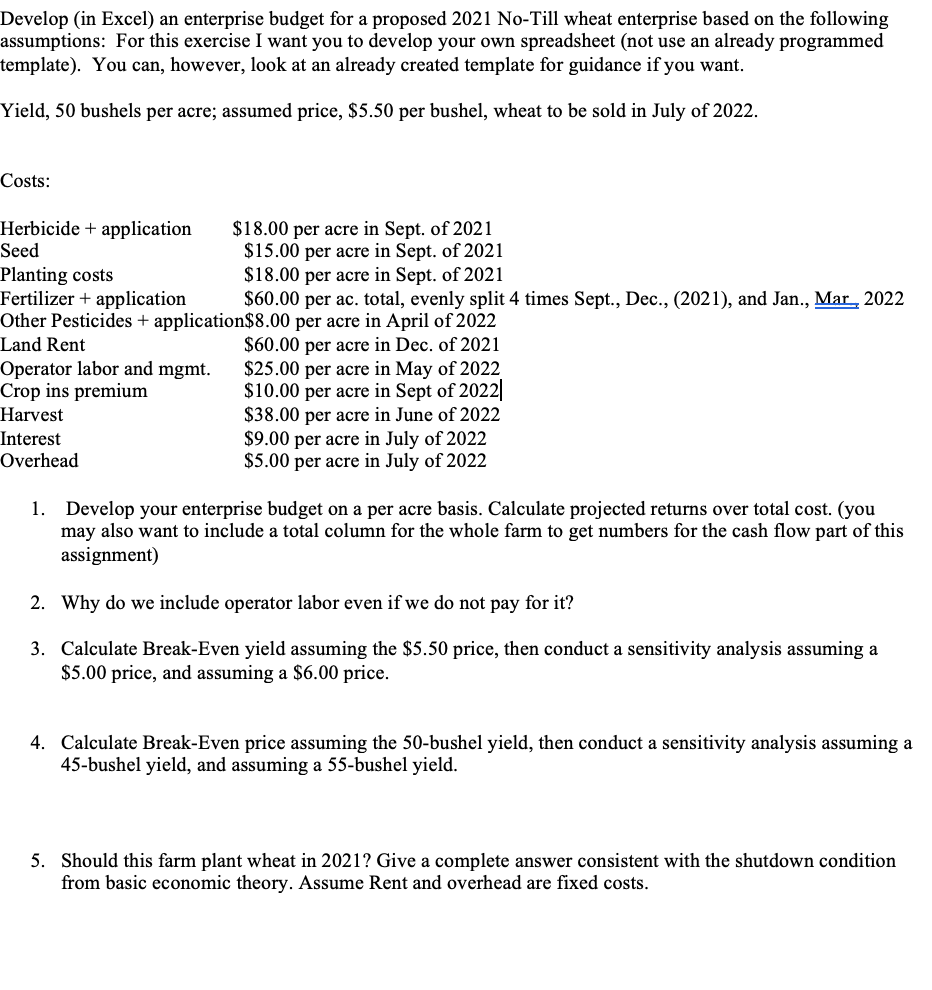

Develop (in Excel) an enterprise budget for a proposed 2021 No-Till wheat enterprise based on the following assumptions: For this exercise I want you to develop your own spreadsheet (not use an already programmed template). You can, however, look at an already created template for guidance if you want. Yield, 50 bushels per acre; assumed price, $5.50 per bushel, wheat to be sold in July of 2022. Costs: Herbicide + application $18.00 per acre in Sept. of 2021 Seed $15.00 per acre in Sept. of 2021 Planting costs $18.00 per acre in Sept. of 2021 Fertilizer + application $60.00 per ac. total, evenly split 4 times Sept., Dec., (2021), and Jan., Mar 2022 Other Pesticides + application$8.00 per acre in April of 2022 Land Rent $60.00 per acre in Dec. of 2021 Operator labor and mgmt. $25.00 per acre in May of 2022 Crop ins premium $10.00 per acre in Sept of 2022|| Harvest $38.00 per acre in June of 2022 Interest $9.00 per acre in July of 2022 Overhead $5.00 per acre in July of 2022 1. Develop your enterprise budget on a per acre basis. Calculate projected returns over total cost. (you may also want to include a total column for the whole farm to get numbers for the cash flow part of this assignment) 2. Why do we include operator labor even if we do not pay for it? 3. Calculate Break-Even yield assuming the $5.50 price, then conduct a sensitivity analysis assuming a $5.00 price, and assuming a $6.00 price. 4. Calculate Break-Even price assuming the 50-bushel yield, then conduct a sensitivity analysis assuming a 45-bushel yield, and assuming a 55-bushel yield. 5. Should this farm plant wheat in 2021? Give a complete answer consistent with the shutdown condition from basic economic theory. Assume Rent and overhead are fixed costs. Develop (in Excel) an enterprise budget for a proposed 2021 No-Till wheat enterprise based on the following assumptions: For this exercise I want you to develop your own spreadsheet (not use an already programmed template). You can, however, look at an already created template for guidance if you want. Yield, 50 bushels per acre; assumed price, $5.50 per bushel, wheat to be sold in July of 2022. Costs: Herbicide + application $18.00 per acre in Sept. of 2021 Seed $15.00 per acre in Sept. of 2021 Planting costs $18.00 per acre in Sept. of 2021 Fertilizer + application $60.00 per ac. total, evenly split 4 times Sept., Dec., (2021), and Jan., Mar 2022 Other Pesticides + application$8.00 per acre in April of 2022 Land Rent $60.00 per acre in Dec. of 2021 Operator labor and mgmt. $25.00 per acre in May of 2022 Crop ins premium $10.00 per acre in Sept of 2022|| Harvest $38.00 per acre in June of 2022 Interest $9.00 per acre in July of 2022 Overhead $5.00 per acre in July of 2022 1. Develop your enterprise budget on a per acre basis. Calculate projected returns over total cost. (you may also want to include a total column for the whole farm to get numbers for the cash flow part of this assignment) 2. Why do we include operator labor even if we do not pay for it? 3. Calculate Break-Even yield assuming the $5.50 price, then conduct a sensitivity analysis assuming a $5.00 price, and assuming a $6.00 price. 4. Calculate Break-Even price assuming the 50-bushel yield, then conduct a sensitivity analysis assuming a 45-bushel yield, and assuming a 55-bushel yield. 5. Should this farm plant wheat in 2021? Give a complete answer consistent with the shutdown condition from basic economic theory. Assume Rent and overhead are fixed costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts