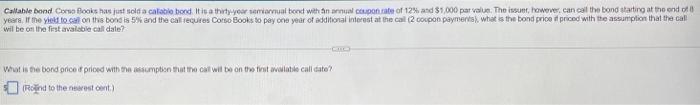

Question: please circle the final answer Callable bond Conso Books has just sold a calable bondIt is a thirty your smarta bond with an annual cupon

Callable bond Conso Books has just sold a calable bondIt is a thirty your smarta bond with an annual cupon rate of 12% and $1.000 par value. The issuer, however, can call the bond starting at the end of years. If the yield to call on the bond is 5% and the call requires Corso Books to pay one year of additional interest at the call 2 Coupon payments, what is the bond price of priced with the assumption that the call will be on the first valable call date? What is de bord orice prived with the sumption that the cat will be on the first wwwable call dato? rond to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts