Question: Development Expenditures (Period 0) - The following are the expected expenses and capital expenditures: Manufacturing expenses for ten test machines - $3,700,000 (tax deductible) Engineering

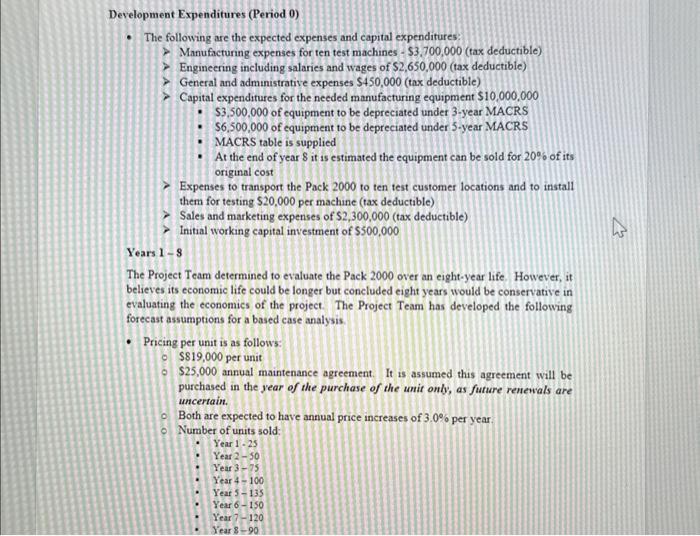

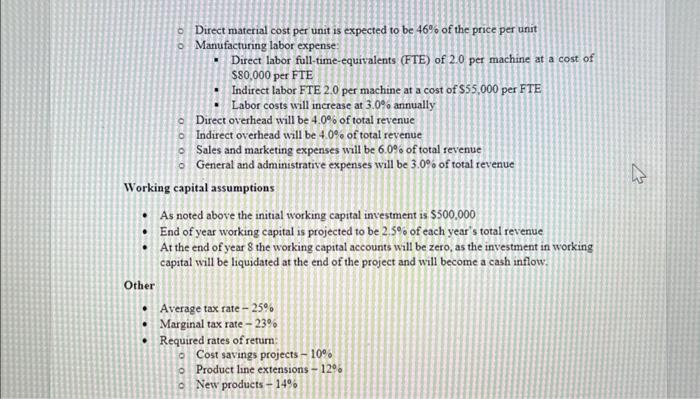

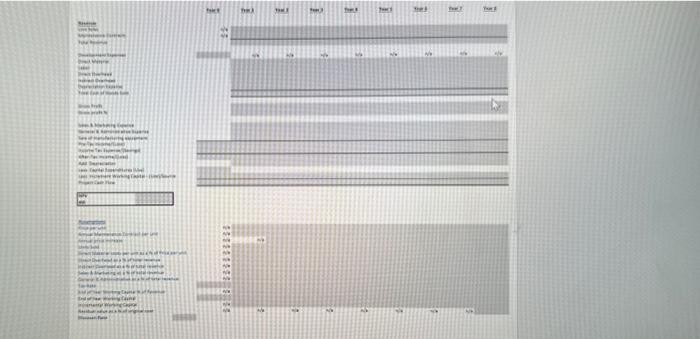

Development Expenditures (Period 0) - The following are the expected expenses and capital expenditures: Manufacturing expenses for ten test machines - $3,700,000 (tax deductible) Engineering including salaries and wages of $2,650,000 (tax deductible) General and administrative expenses $450,000 (tax deductible) Capital expenditures for the needed manufacturing equipment $10,000,000 - \$3,500,000 of equipment to be depreciated under 3-year MACRS - 56,500,000 of equipment to be depreciated under 5-year MACRS - MACRS table is supplied - At the end of year 8 it is estimated the equipment can be sold for 20% of its original cost Expenses to transport the Pack 2000 to ten test customer locations and to install them for testing $20,000 per machine (tax deductible) Sales and marketing expenses of $2,300,000 (tax deductible) Initial working capital investment of $500,000 Years 18 The Project Team determined to evaluate the Pack 2000 over an eight-year life. However, it believes its economic life could be longer but concluded eight years would be conservative in evaluating the economics of the project. The Project Team has developed the following forecast assumptions for a based case analysis - Pricing per unit is as follows: 9 $819,000 per unit Q $25,000 annual maintenance agreement. It is assumed this agreement will be purchased in the year of the purchase of the unit onb, as future renewals are uncertain. Both are expected to have annual price increases of 3.0% per year. Number of units sold: - Year 125 - Year 250 - Year 3-75 - Year 4100 - Year 5135 - Year 6150 - Year 7120 Direct material cost per unit is expected to be 46% of the price per unit Manufacturing labor expense: - Direct labor full-time-equivalents (FTE) of 2.0 per machine at a cost of $80,000 per FIE - Indirect labor FTE 2.0 per machine at a cost of $55,000 per FTE - Labor costs will increase at 3.0% annually Direct overhead will be 4.0% of total revenue Indirect overhead will be 4.0% of total revenue Sales and marketing expenses will be 6.0% of total revenue General and administrative expenses will be 3.0% of total revenue Working capital assumptions - As noted above the initial working capital investment is $500,000 - End of year working capital is projected to be 2.5% of each year's total revenue - At the end of year 8 the working capital accounts will be zero, as the investment in working capital will be liquidated at the end of the project and will become a cash inflow. Other - Average tax rate 25% - Marginal tax rate 23% - Required rates of return: Q Cost savings projects 10% o Product line extensions 12% o New products 14%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts