Question: Development Expenditures (Period 0) . The following are the expected expenses and capital expenditures: > Manufacturing expenses for ten test machines - $4,450,000 (tax deductible)

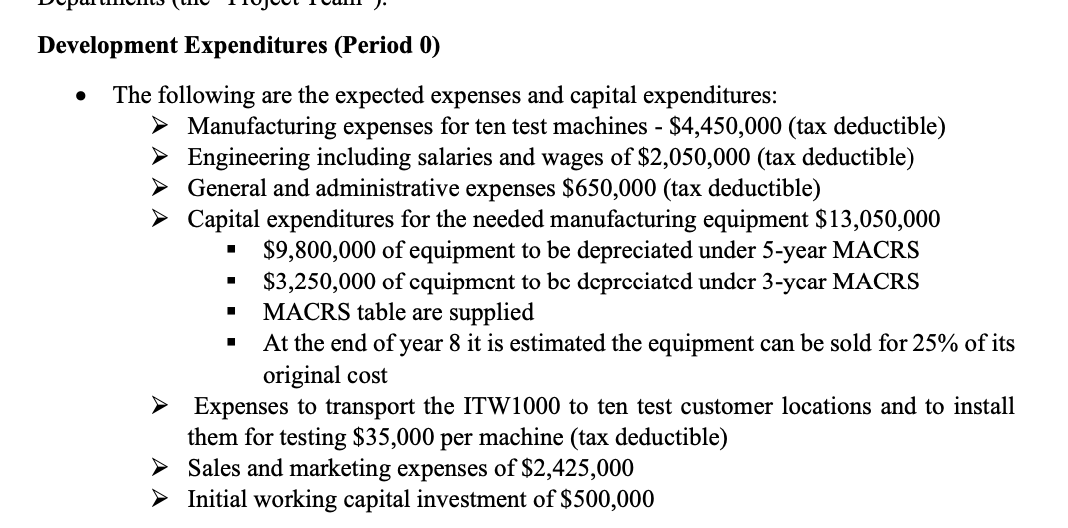

Development Expenditures (Period 0) . The following are the expected expenses and capital expenditures: > Manufacturing expenses for ten test machines - $4,450,000 (tax deductible) Engineering including salaries and wages of $2,050,000 (tax deductible) > General and administrative expenses $650,000 (tax deductible) Capital expenditures for the needed manufacturing equipment $13,050,000 $9,800,000 of equipment to be depreciated under 5-year MACRS $3,250,000 of cquipment to be depreciated under 3-year MACRS MACRS table are supplied At the end of year 8 it is estimated the equipment can be sold for 25% of its original cost Expenses to transport the ITW1000 to ten test customer locations and to install them for testing $35,000 per machine (tax deductible) Sales and marketing expenses of $2,425,000 Initial working capital investment of $500,000 Development Expenditures (Period 0) . The following are the expected expenses and capital expenditures: > Manufacturing expenses for ten test machines - $4,450,000 (tax deductible) Engineering including salaries and wages of $2,050,000 (tax deductible) > General and administrative expenses $650,000 (tax deductible) Capital expenditures for the needed manufacturing equipment $13,050,000 $9,800,000 of equipment to be depreciated under 5-year MACRS $3,250,000 of cquipment to be depreciated under 3-year MACRS MACRS table are supplied At the end of year 8 it is estimated the equipment can be sold for 25% of its original cost Expenses to transport the ITW1000 to ten test customer locations and to install them for testing $35,000 per machine (tax deductible) Sales and marketing expenses of $2,425,000 Initial working capital investment of $500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts