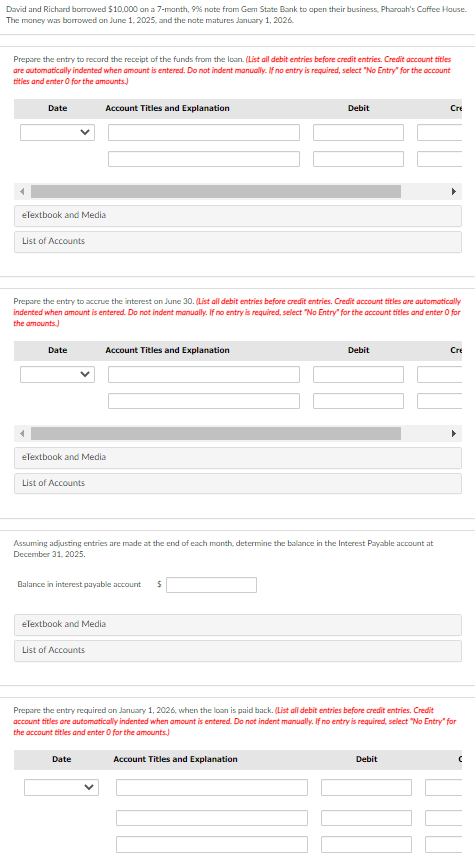

Question: Devid and Richard borrowed $10,000 on a 7-manth, 9%6 note fram Gem State Bank to apen their business, Pharoah's Caffee Hlouse. The maney wis borrowed

Devid and Richard borrowed $10,000 on a 7-manth, 9%6 note fram Gem State Bank to apen their business, Pharoah's Caffee Hlouse. The maney wis borrowed on June 1, 2025, and the nate matures dantary 1, 2026. Prepare the entry to record the receipt of the funds from the losn. (List all debit entries before credit entries. Credit account titles are cutomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. eTextbook and Media Prepare the entry to accrue the interest on June 30. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Assuming adjusting entries are mode at the end of each month, determine the balance in the Interest Payable account at December 31, 2025. Balance in interest payable accourt $ Prepare the entry required an January 1, 2026, when the loan is paid back. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts