Question: DeVille Company began operations in 2 0 2 4 and reported a net operating loss of ( $ 7 ) million for

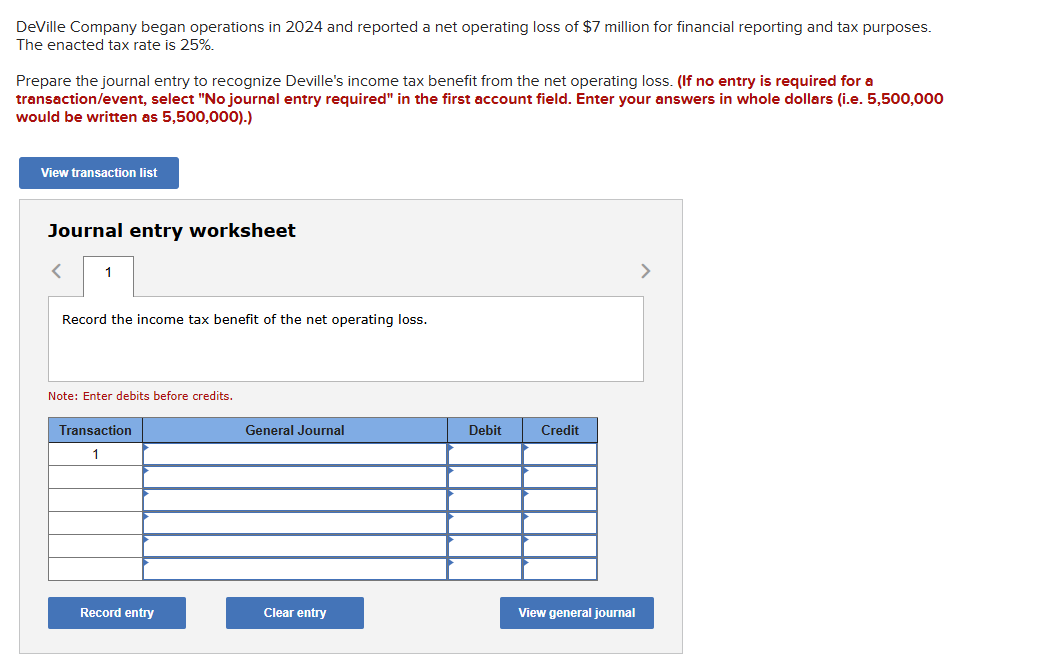

DeVille Company began operations in and reported a net operating loss of $ million for financial reporting and tax purposes. The enacted tax rate is

Prepare the journal entry to recognize Deville's income tax benefit from the net operating loss. If no entry is required for a transactionevent select No journal entry required" in the first account field. Enter your answers in whole dollars ie would be written as

Journal entry worksheet

Record the income tax benefit of the net operating loss.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock