Question: did i answer it all correctly? pls provide step by step explanation and computation for each transaction especially to wrong answers A. During the year

did i answer it all correctly? pls provide step by step explanation and computation for each transaction especially to wrong answers

A.

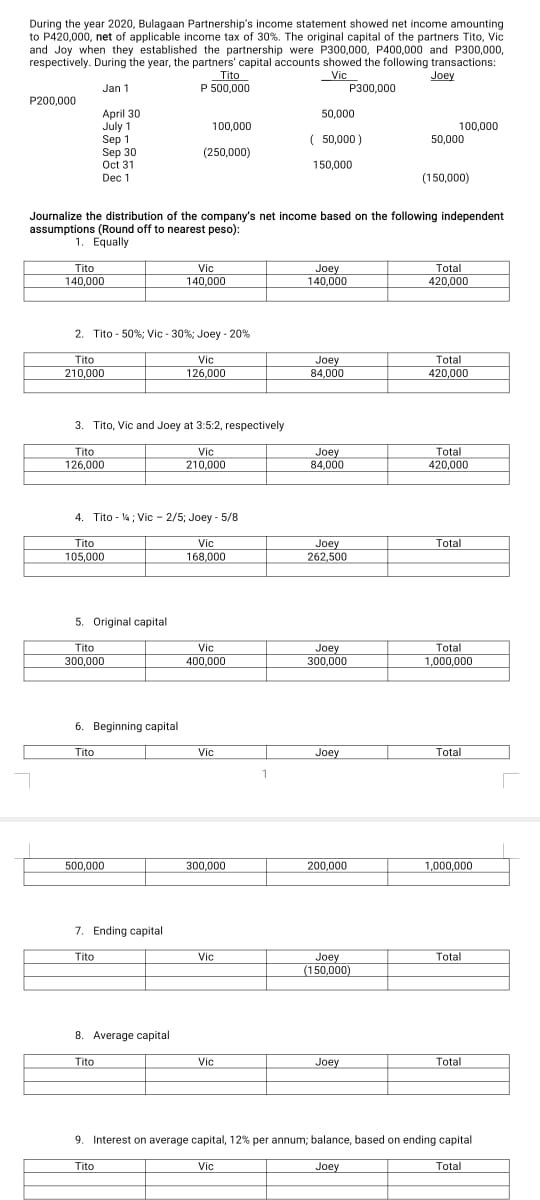

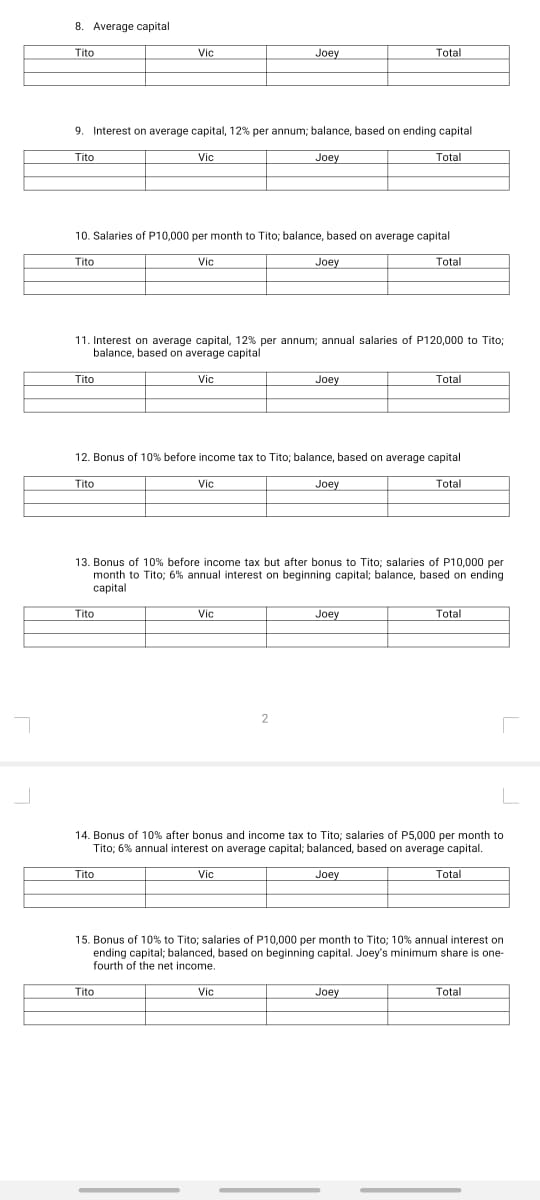

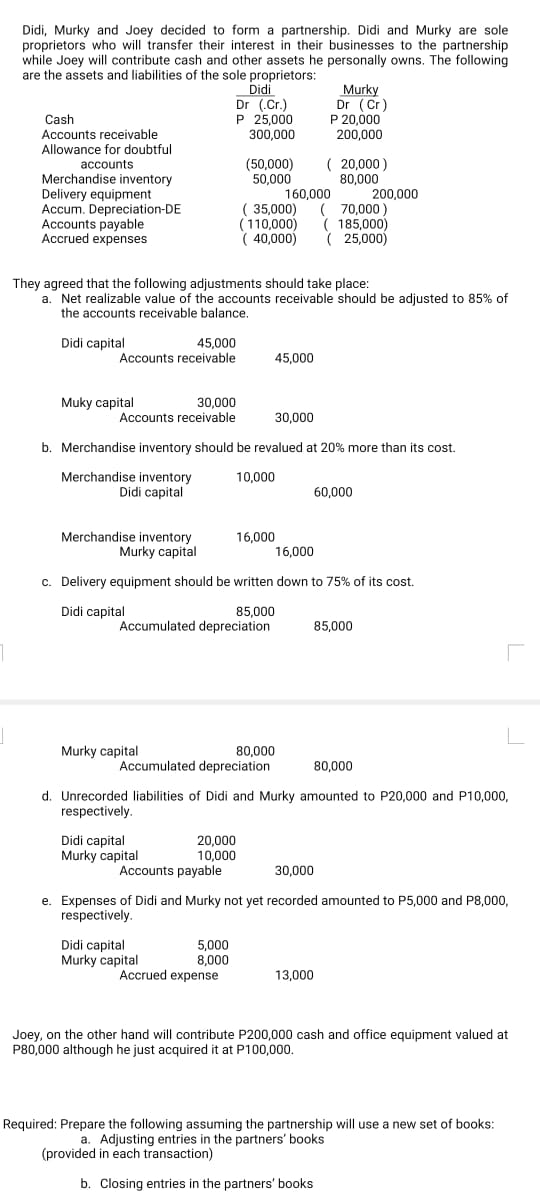

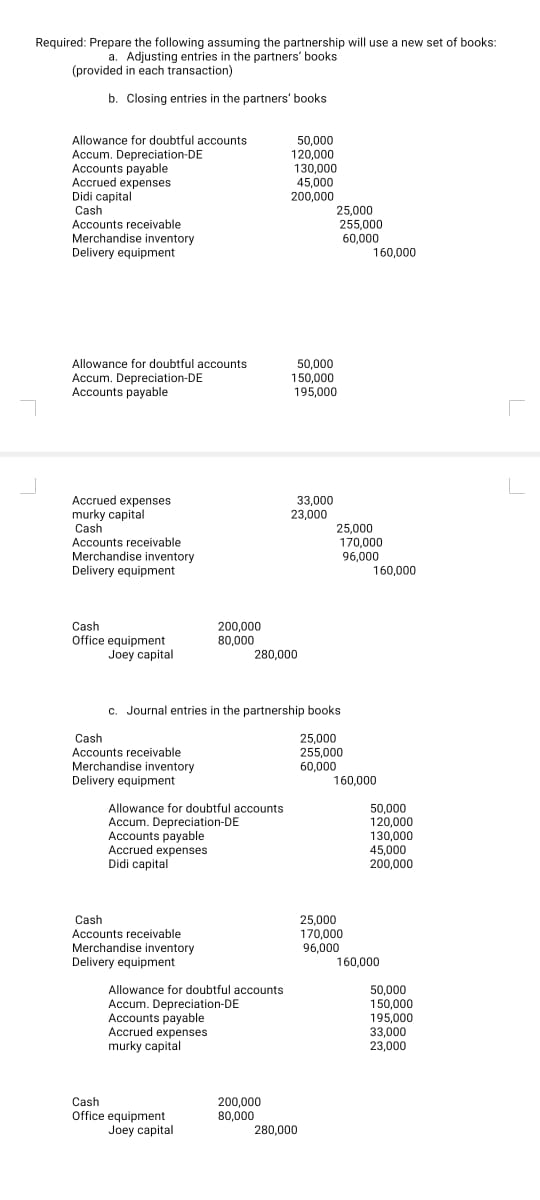

During the year 2020, Bulagaan Partnership's income statement showed net income amounting to P420,000, net of applicable income tax of 30%. The original capital of the partners Tito, Vic and Joy when they established the partnership were P300,000, P400,000 and P300,000, respectively. During the year, the partners' capital accounts showed the following transactions: Tito Vic Joey Jan 1 P 500,000 P300,000 P200,000 April 30 50,000 July 1 100,000 100,000 Sep 1 ( 50,000 ) 50,000 Sep 30 (250,000) Oct 31 150,000 Dec 1 (150,000) Journalize the distribution of the company's net income based on the following independent assumptions (Round off to nearest peso): 1. Equally Tito Vic Joey Total 140,000 140.000 140,000 420,000 2. Tito - 50%; Vic - 30%; Joey - 20% Tito Vic Joey Total 210,000 126,000 84,000 420,000 3. Tito, Vic and Joey at 3:5:2, respectively Tito Vic Joey Total 126,000 210,000 84.000 420,000 4. Tito - 1; Vic - 2/5; Joey - 5/8 Tito Vic Joey Total 105,000 168,000 262,500 5, Original capital Tito Vic Joey Total 300,000 400.000 300,000 1,000,000 6. Beginning capital Tito Vic Joey Total 500,000 300.000 200,000 1,000,000 7. Ending capital Tito Vic Joey Total (150,000) 8. Average capital Tito Vic Joey Total 9. Interest on average capital, 12% per annum; balance, based on ending capital Tito Vic Joey Total8. Average capital Tito Vic Joey Total 9. Interest on average capital, 12% per annum; balance, based on ending capital Tito Vic Joey Total 10. Salaries of P10,000 per month to Tito; balance, based on average capital Tito Vic Joey Total 11. Interest on average capital, 12% per annum; annual salaries of P120,000 to Tito; balance, based on average capital Tito Vic Joey Total 12. Bonus of 10% before income tax to Tito; balance, based on average capital Tito Vic Joey Total 13. Bonus of 10% before income tax but after bonus to Tito; salaries of P10,000 per month to Tito; 6% annual interest on beginning capital; balance, based on ending capital Tito Vic Joey Total 7 2 L 14. Bonus of 10% after bonus and income tax to Tito; salaries of P5,000 per month to Tito; 6% annual interest on average capital; balanced, based on average capital. Tito Vic Joey Total 15. Bonus of 10% to Tito; salaries of P10,000 per month to Tito; 10% annual interest on ending capital; balanced, based on beginning capital. Joey's minimum share is one- fourth of the net income. Tito Vic Joey TotalDidi, Murky and Joey decided to form a partnership. Didi and Murky are sole proprietors who will transfer their interest in their businesses to the partnership while Joey will contribute cash and other assets he personally owns. The following are the assets and liabilities of the sole proprietors: Didi Murky Dr (.Cr.) Dr ( Cr ) Cash P 25,000 P 20,000 Accounts receivable 300,000 200,000 Allowance for doubtful accounts (50,000) ( 20,000 ) Merchandise inventory 50,000 80,000 Delivery equipment 160,000 200,000 Accum. Depreciation-DE ( 35,000) 70,000 Accounts payable ( 110,000) 185,000) Accrued expenses ( 40,000) ( 25,000) They agreed that the following adjustments should take place: a. Net realizable value of the accounts receivable should be adjusted to 85% of the accounts receivable balance. Didi capital 45,000 Accounts receivable 45,000 Muky capital 30,000 Accounts receivable 30,000 b. Merchandise inventory should be revalued at 20% more than its cost. Merchandise inventory 10,000 Didi capital 60,000 Merchandise inventory 16,000 Murky capital 16,000 c. Delivery equipment should be written down to 75% of its cost. Didi capital 85,000 Accumulated depreciation 85,000 L Murky capital 80,000 Accumulated depreciation 80,000 d. Unrecorded liabilities of Didi and Murky amounted to P20,000 and P10,000, respectively. Didi capital 20,000 Murky capital 10,000 Accounts payable 30,000 e. Expenses of Didi and Murky not yet recorded amounted to P5,000 and P8,000, respectively. Didi capital 5,000 Murky capital 8,000 Accrued expense 13,000 Joey, on the other hand will contribute P200,000 cash and office equipment valued at P80,000 although he just acquired it at P100,000. Required: Prepare the following assuming the partnership will use a new set of books: a. Adjusting entries in the partners' books (provided in each transaction) b. Closing entries in the partners' booksRequired: Prepare the following assuming the partnership will use a new set of books: a. Adjusting entries in the partners' books (provided in each transaction) b. Closing entries in the partners' books Allowance for doubtful accounts 50,000 Accum. Depreciation-DE 120,000 Accounts payable 130,000 Accrued expenses 45,000 Didi capital 200,000 Cash 25,000 Accounts receivable 255,000 Merchandise inventory 60,000 Delivery equipment 160,000 Allowance for doubtful accounts 50,000 Accum. Depreciation-DE 150,000 Accounts payable 195,000 L Accrued expenses 33,000 murky capital 23,000 Cash 25,000 Accounts receivable 170,000 Merchandise inventory 96,000 Delivery equipment 160,000 Cash 200,000 Office equipment 80,000 Joey capital 280,000 c. Journal entries in the partnership books Cash 25,000 Accounts receivable 255,000 Merchandise inventory 60,000 Delivery equipment 160,000 Allowance for doubtful accounts 50,000 Accum. Depreciation-DE 120,000 Accounts payable 130,000 Accrued expenses 45,000 Didi capital 200,000 Cash 25,000 Accounts receivable 170,000 Merchandise inventory 96,000 Delivery equipment 160,000 Allowance for doubtful accounts 50,000 Accum. Depreciation-DE 150,000 Accounts payable 195,000 Accrued expenses 33,000 murky capital 23,000 Cash 200,000 Office equipment 80,000 Joey capital 280,000