Question: did i answer it all correctly? pls provide step by step explanation and computation for each transaction especially to wrong answers During the year 2020,

did i answer it all correctly? pls provide step by step explanation and computation for each transaction especially to wrong answers

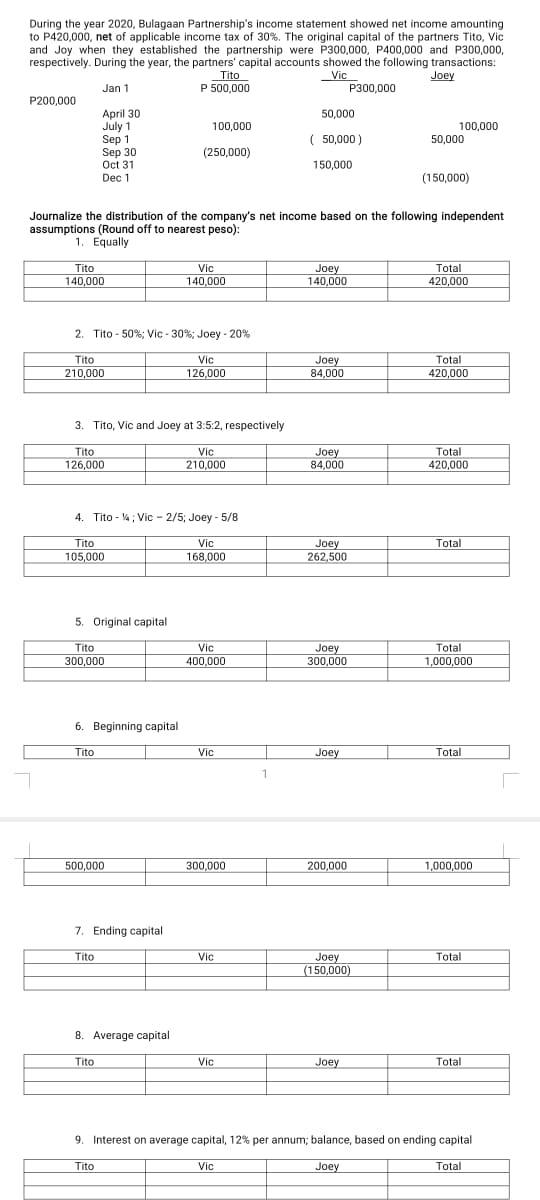

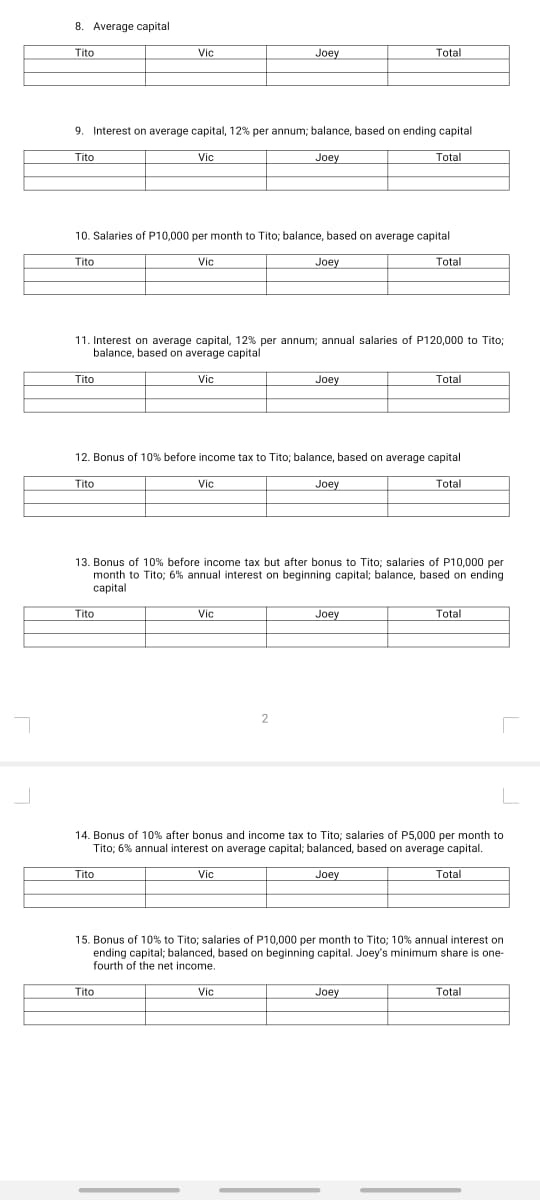

During the year 2020, Bulagaan Partnership's income statement showed net income amounting to P420,000, net of applicable income tax of 30%. The original capital of the partners Tito, Vic and Joy when they established the partnership were P300,000, P400,000 and P300,000, respectively. During the year, the partners' capital accounts showed the following transactions: Tito Vic Joey Jan 1 P 500,000 P300,000 P200,000 April 30 50,000 July 1 100,000 100,000 Sep 1 ( 50,000 ) 50,000 Sep 30 (250,000) Oct 31 150,000 Dec 1 (150,000) Journalize the distribution of the company's net income based on the following independent assumptions (Round off to nearest peso): 1. Equally Tito Vic Joey Total 140,000 140.000 140,000 420,000 2. Tito - 50%; Vic - 30%; Joey - 20% Tito Vic Joey Total 210,000 126,000 84,000 420,000 3. Tito, Vic and Joey at 3:5:2, respectively Tito Vic Joey Total 126,000 210,000 84.000 420,000 4. Tito - 1; Vic - 2/5; Joey - 5/8 Tito Vic Joey Total 105,000 168,000 262,500 5, Original capital Tito Vic Joey Total 300,000 400.000 300,000 1,000,000 6. Beginning capital Tito Vic Joey Total 500,000 300.000 200,000 1,000,000 7. Ending capital Tito Vic Joey Total (150,000) 8. Average capital Tito Vic Joey Total 9. Interest on average capital, 12% per annum; balance, based on ending capital Tito Vic Joey Total8. Average capital Tito Vic Joey Total 9. Interest on average capital, 12% per annum; balance, based on ending capital Tito Vic Joey Total 10. Salaries of P10,000 per month to Tito; balance, based on average capital Tito Vic Joey Total 11. Interest on average capital, 12% per annum; annual salaries of P120,000 to Tito; balance, based on average capital Tito Vic Joey Total 12. Bonus of 10% before income tax to Tito; balance, based on average capital Tito Vic Joey Total 13. Bonus of 10% before income tax but after bonus to Tito; salaries of P10,000 per month to Tito; 6% annual interest on beginning capital; balance, based on ending capital Tito Vic Joey Total 7 2 L 14. Bonus of 10% after bonus and income tax to Tito; salaries of P5,000 per month to Tito; 6% annual interest on average capital; balanced, based on average capital. Tito Vic Joey Total 15. Bonus of 10% to Tito; salaries of P10,000 per month to Tito; 10% annual interest on ending capital; balanced, based on beginning capital. Joey's minimum share is one- fourth of the net income. Tito Vic Joey Total