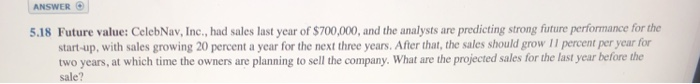

Question: Did I approach this problem correctly? Please show work, thanks! ANSWER 5.18 Future value: CelebNav, Inc., had sales last year of $700,000, and the analysts

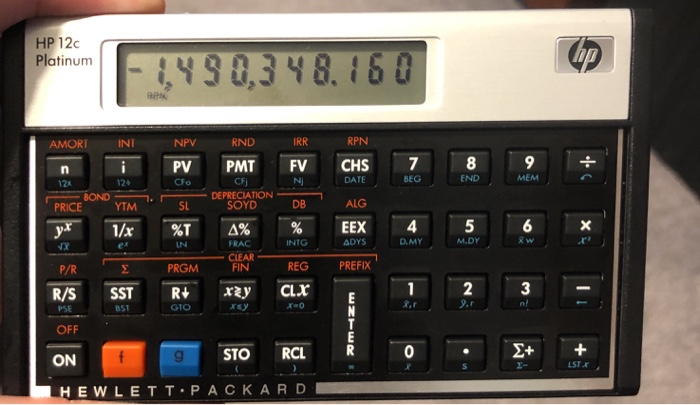

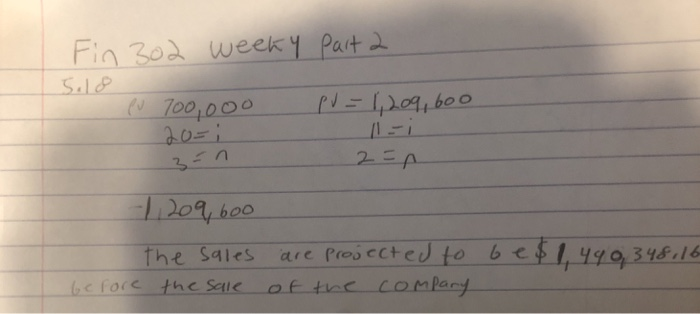

ANSWER 5.18 Future value: CelebNav, Inc., had sales last year of $700,000, and the analysts are predicting strong future performance for the start-up, with sales growing 20 percent a year for the next three years. After that, the sales should grow 11 percent per year for two years, at which time the owners are planning to sell the company. What are the projected sales for the last year before the sale? HP 12c Platinum 90,348. 1S0 AMORT INT NPV RND IRR RPN i-PV PMT FV CHS 7 8 9 BEG END MEM CFj DEPRECIATION SOYD 12 124 DATE PRICE BOND YTM.- SL ALG EEX 4 5 6 x FRAC INTG DMY M.DY CLEAR FIN REG PREFIX P/R PRGM xzy rey cLtE 2 BST GTO OFF ON 9 STO RCL R ST LHEWLETT PACKARD Fin zod weeky Part 2. A the Sales are fected to b1316.14 8.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts