Question: did i do this correctly or what do i need to change? Exercise 3-17 (Algo) Calculating ratios; Bargain Deal (LO3-8] 7 Bargain Deal, Inc., is

![change? Exercise 3-17 (Algo) Calculating ratios; Bargain Deal (LO3-8] 7 Bargain Deal,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f704a87e1ea_61666f704a8186ef.jpg)

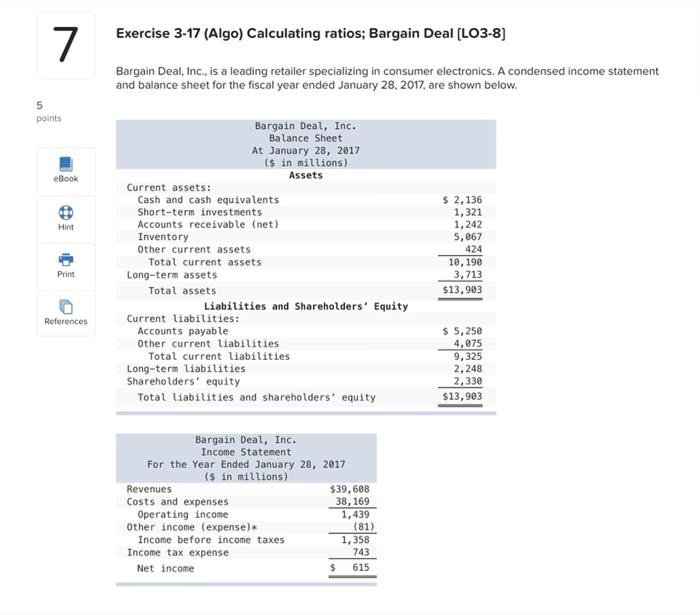

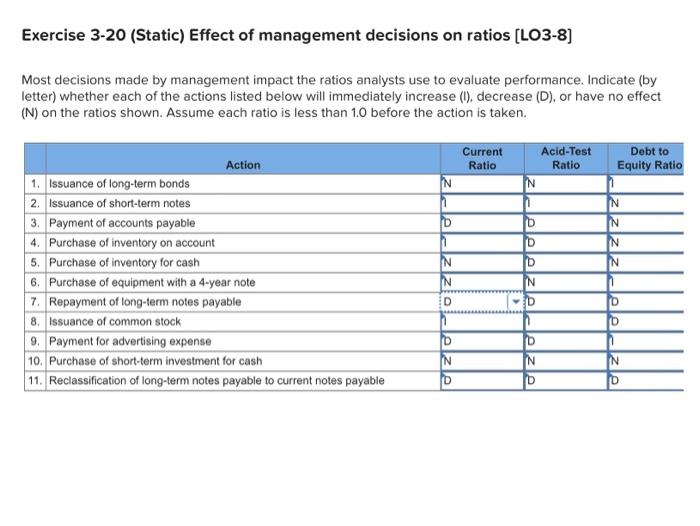

Exercise 3-17 (Algo) Calculating ratios; Bargain Deal (LO3-8] 7 Bargain Deal, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended January 28, 2017, are shown below. 5 points eBook Hint Bargain Deal, Inc. Balance Sheet At January 28, 2017 ($ in millions) Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable (net) Inventory Other current assets Total current assets Long-term assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Other current liabilities Total current liabilities Long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 2,136 1,321 1, 242 5,067 424 10,190 3,713 $13,903 Print References $ 5,250 4,075 9,325 2,248 2,330 $13,903 Bargain Deal, Inc. Income Statement For the Year Ended January 28, 2017 (s in millions) Revenues $39,688 Costs and expenses 38, 169 Operating income 1,439 Other income (expense)* (81) Income before income taxes 1,358 Income tax expense 743 Net income $ 615 References Includes $224 of interest expense. Required: 1-a. Calculate the current ratio for Bargain Deal for its fiscal year ended January 28, 2017 1-b. Calculate the acid-test ratio for Bargain Deal for its fiscal year ended January 28, 2017 1-c. Calculate the debt to equity ratio for Bargain Deal for its fiscal year ended January 28, 2017, 1-d. Calculate the times interest earned ratio for Bargain Deal for its fiscal year ended January 28, 2017 (For all requirements, round your answers to 2 decimal places.) 1-a. Current ratio 1-6. Acid-test ratio 1-c. Debt to equity ratio 1-d. Times interest earned ratio 1.09 0.50 4.97 7.06 times Mc Graw Exercise 3-20 (Static) Effect of management decisions on ratios (LO3-8] Most decisions made by management impact the ratios analysts use to evaluate performance. Indicate (by letter) whether each of the actions listed below will immediately increase (0), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is less than 1.0 before the action is taken. Current Ratio Acid-Test Ratio Action Debt to Equity Ratio IN N IN D D IN IN 1. Issuance of long-term bonds 2. Issuance of short-term notes 3. Payment of accounts payable 4. Purchase of inventory on account 5. Purchase of inventory for cash 6. Purchase of equipment with a 4-year note 7. Repayment of long-term notes payable 8. Issuance of common stock 9. Payment for advertising expense 10. Purchase of short-term investment for cash 11. Reclassification of long-term notes payable to current notes payable IN IN IN D D D D D IN IN IN D D Exercise 3-17 (Algo) Calculating ratios; Bargain Deal (LO3-8] 7 Bargain Deal, Inc., is a leading retailer specializing in consumer electronics. A condensed income statement and balance sheet for the fiscal year ended January 28, 2017, are shown below. 5 points eBook Hint Bargain Deal, Inc. Balance Sheet At January 28, 2017 ($ in millions) Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable (net) Inventory Other current assets Total current assets Long-term assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Other current liabilities Total current liabilities Long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 2,136 1,321 1, 242 5,067 424 10,190 3,713 $13,903 Print References $ 5,250 4,075 9,325 2,248 2,330 $13,903 Bargain Deal, Inc. Income Statement For the Year Ended January 28, 2017 (s in millions) Revenues $39,688 Costs and expenses 38, 169 Operating income 1,439 Other income (expense)* (81) Income before income taxes 1,358 Income tax expense 743 Net income $ 615 References Includes $224 of interest expense. Required: 1-a. Calculate the current ratio for Bargain Deal for its fiscal year ended January 28, 2017 1-b. Calculate the acid-test ratio for Bargain Deal for its fiscal year ended January 28, 2017 1-c. Calculate the debt to equity ratio for Bargain Deal for its fiscal year ended January 28, 2017, 1-d. Calculate the times interest earned ratio for Bargain Deal for its fiscal year ended January 28, 2017 (For all requirements, round your answers to 2 decimal places.) 1-a. Current ratio 1-6. Acid-test ratio 1-c. Debt to equity ratio 1-d. Times interest earned ratio 1.09 0.50 4.97 7.06 times Mc Graw Exercise 3-20 (Static) Effect of management decisions on ratios (LO3-8] Most decisions made by management impact the ratios analysts use to evaluate performance. Indicate (by letter) whether each of the actions listed below will immediately increase (0), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is less than 1.0 before the action is taken. Current Ratio Acid-Test Ratio Action Debt to Equity Ratio IN N IN D D IN IN 1. Issuance of long-term bonds 2. Issuance of short-term notes 3. Payment of accounts payable 4. Purchase of inventory on account 5. Purchase of inventory for cash 6. Purchase of equipment with a 4-year note 7. Repayment of long-term notes payable 8. Issuance of common stock 9. Payment for advertising expense 10. Purchase of short-term investment for cash 11. Reclassification of long-term notes payable to current notes payable IN IN IN D D D D D IN IN IN D D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts