Question: Difference in Financing (Same Operating Leverage - Different Financial Leverage) Management of Lead Zepplins Blimp Co. has decided to invest in a new project. They

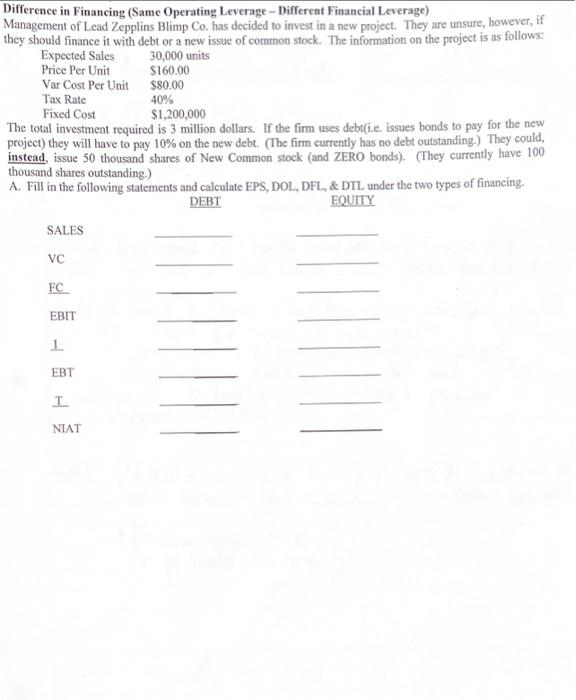

Difference in Financing (Same Operating Leverage - Different Financial Leverage)

Management of Lead Zepplins Blimp Co. has decided to invest in a new project. They are unsure, however, if they should finance it with debt or a new issue of common stock. The information on the project is as follows:

Expected Sales

30,000 units

Price Per Unit

$160.00

Var Cost Per Unit

$80.00

Tax Rate

40%

Fixed Cost

$1,200,000

The total investment required is 3 million dollars. If the firm uses debti.e. issues bonds to pay for the new project) they will have to pay 10% on the new debt. (The firm currently has no debt outstanding.) They could, instead, issue 50 thousand shares of New Common stock (and ZERO bonds). (They currently have 100 thousand shares outstanding.)

A. Fill in the following statements and calculate EPS, DOL, DFL, & DTL under the two types of financing.

Please show all steps to get the answer, thank you!

Difference in Financing (Same Operating Leverage - Different Financial Leverage) Management of Lead Zepplins Blimp Co. has decided to invest in a new project. They are unsure, however, if they should finance it with debt or a new issue of common stock. The information on the project is as follows: The total investment required is 3 million dollars. If the firm uses debt(i.e. issues bonds to pay for the new project) they will have to pay 10% on the new debt. (The firm currently has no debt outstanding.) They could, instead, issue 50 thousand shares of New Common stock (and ZERO bonds). (They currently have 100 thousand shares outstanding.) A. Fill in the following statements and calculate EPS, DOL, DFL, \& DTL under the two types of financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts