Question: Different figures, read through carefully. Cornerstone Exercise 5-26 (Algorithmic) Write-att of Uncollectible Accounts The Rock has credit sales of $510,000 during 2019 and estimates at

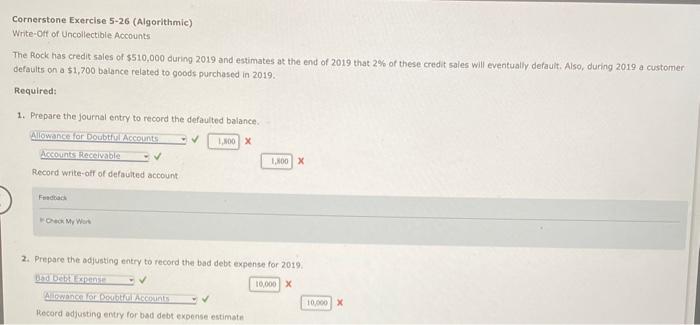

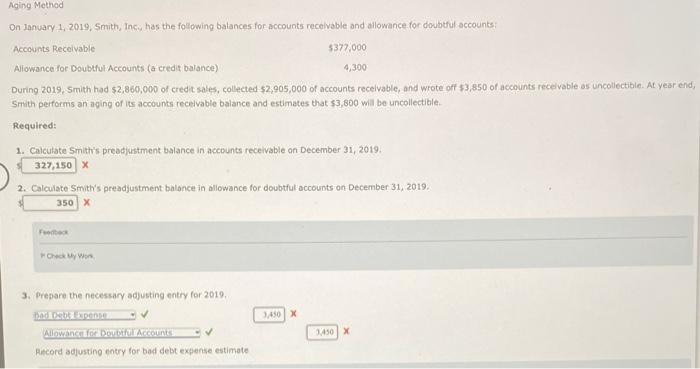

Cornerstone Exercise 5-26 (Algorithmic) Write-att of Uncollectible Accounts The Rock has credit sales of $510,000 during 2019 and estimates at the end of 2019 that 2% of these credit soles will eventually default. Also, during 2019 a customer. defaults on a $1,700 balance related to goods purchased in 2019 . Required: 1. Prepare the journal entry to record the defaulted balance. Fistciact Finen My Wis 2. Prepare the adjusting entry to record the bad debt expense for 2019. On January 1, 2019, Smith, Incy has the folowing balances for accounts recelvable and allowance for doubtful accounts: Accounts Receivable Aliowance for Doubtrul Accounts (a credit balance) 5377,0004,300 During 2019, Smith had $2,860,000 of credit sales, collected $2,905,000 of accounts recelvable, and wrote off $3,850 of accounts receivable as uncollectible. At year end, Smith performs an aging of its accounts recelvable balance and estimates that $3,800 will be uncollectible. Required: 1. Calculate Smith's preadjustment balance in accounts receivable on December 31,2019. x 2. Calculate Smith's preadjustment balance in allowance for doubtful accounts on December 31, 2019. x Fondek wi won 3. Prepare the necessary adjusting entry for 2019 . Alcord adjusting entry for bad debt explense estimate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts