Question: Difficulties in adjusting average returns for risk present a host of issues, as the proper measure of risk may not be obvious, and risk

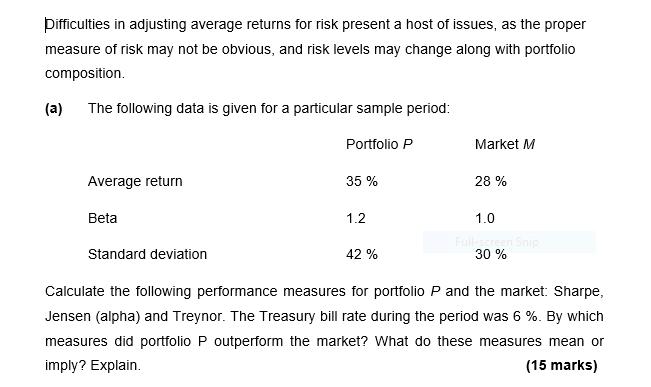

Difficulties in adjusting average returns for risk present a host of issues, as the proper measure of risk may not be obvious, and risk levels may change along with portfolio composition. The following data is given for a particular sample period: (a) Average return Beta Standard deviation Portfolio P 35 % 1.2 42 % Market M 28% 1.0 Full-screen Snip 30 % Calculate the following performance measures for portfolio P and the market: Sharpe, Jensen (alpha) and Treynor. The Treasury bill rate during the period was 6 %. By which measures did portfolio P outperform the market? What do these measures mean or imply? Explain. (15 marks)

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

The Sharpe ratio Jensens alpha and Treynor ratio are all measures of riskadjusted performance that can be used to compare the performance of a portfol... View full answer

Get step-by-step solutions from verified subject matter experts