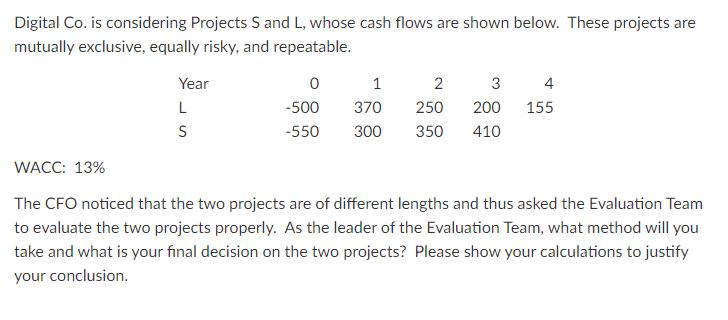

Question: Digital Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and repeatable. WACC: 13%

Digital Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and repeatable. WACC: 13% The CFO noticed that the two projects are of different lengths and thus asked the Evaluation Team to evaluate the two projects properly. As the leader of the Evaluation Team, what method will you take and what is your final decision on the two projects? Please show your calculations to justify your conclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts