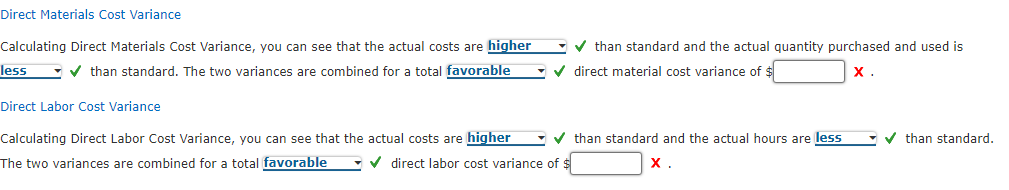

Question: Direct Materials Cost Variance Calculating Direct Materials Cost Variance, you can see that the actual costs are higher V 1! than standard and the actual

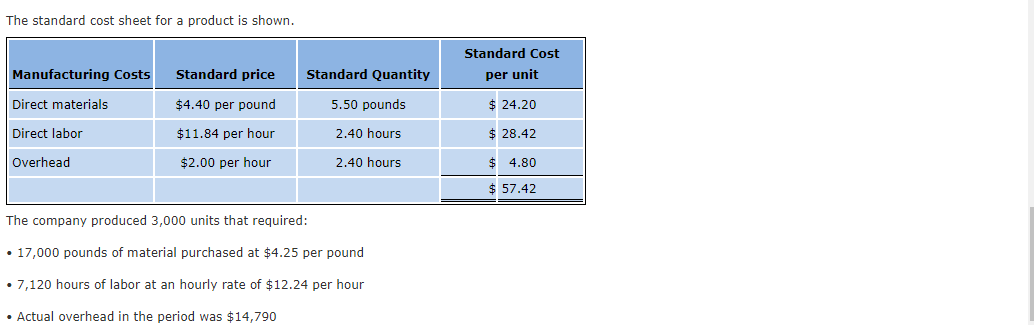

Direct Materials Cost Variance Calculating Direct Materials Cost Variance, you can see that the actual costs are higher V 1! than standard and the actual quantity purchased and used is less v if than standard. The two variances are combined for a total favorable V J direct material cost variance of $:] )1: . Direct Labor Cost Variance Calculating Direct Labor Cost Variance, you can see that the actual costs are higher V 1! than standard and the actual hours are less V 1! than standard. The two variances are combined for a total favorable ' 1" direct labor cost variance of ${:l X . The standard cost sheet for a product is shown. Standard Cost Manufacturing Costs Standard price Standard Quantity per unit Direct materials $4.40 per pound 5.50 pounds $ 24.20 Direct labor $11.84 per hour 2.40 hours $ 28.42 Overhead $2.00 per hour 2.40 hours $ 4.80 $ 57.42 The company produced 3,000 units that required: . 17,000 pounds of material purchased at $4.25 per pound . 7,120 hours of labor at an hourly rate of $12.24 per hour . Actual overhead in the period was $14,790

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts