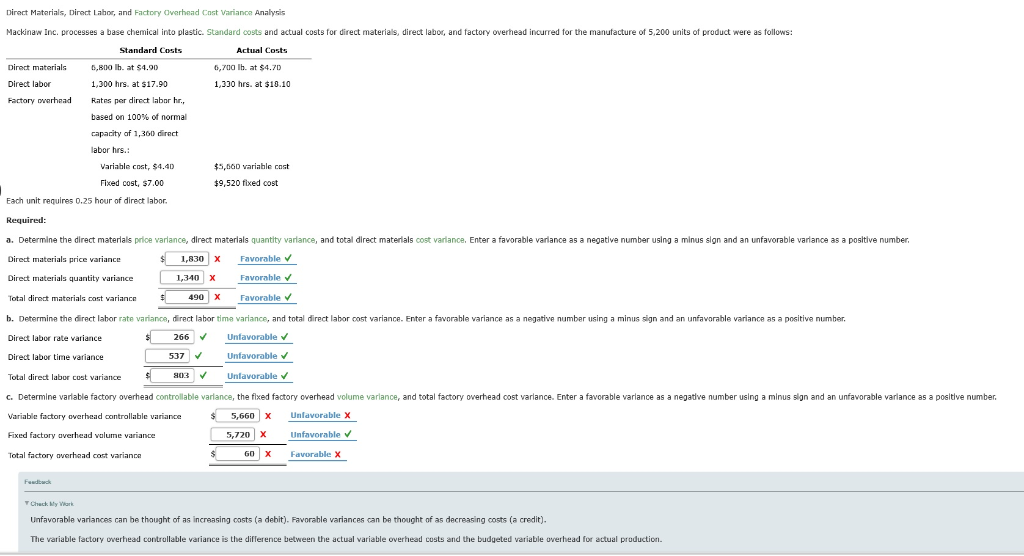

Question: Direct Materials, Diract Lahor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct

Direct Materials, Diract Lahor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 5,200 units of product were as follows: Standard Costs Actual Costs 6,700 I Direct materials 6.800 lb. t $4.90 at $4.7D 1.300 hrs. at s17.90 Direct labor 1,330 hrs. at $18.10 Factory overhead Rates per direct labor hr., based on 100% of normal capacity of 1,360 direct labor hrs Variable cost, $4.40 ts so0 variable cost $9.520 fixed cost Fixed cost, s7,00 Each unit requires 0.25 hour of direct labor Required: a. Determine the direct materlals price varlance, direct materlals quantity varlance, and total direct materlals cost varlance. Enter a favorable variance as a negative number using a minus sign and an unfavorable varlance as a positive number 1,830 X Favorable V Direct materials price variance Direct materials quantity variance Favorable 1,340 X 490 x Total direct matorials cost variance Favorable b. Determine the direct labor rate variance, direct labor time variance, and total direct labor cost variance. Enter a favorable variance s a negative number using a minus sign and an unfavorable variance as a positive number Unfavorable Direct labor rate variance: 266 Unfavorable 537 Direct labor time variance Total direct labor cost variance s03 Unlavorable c. Determine varlable factory overhead controllable varlance, the fixed factory overhead volume varlance, and total factory overhead cost varlance. Enter a favorable varlance as a negative number using a minus sign and unfavorable varlance s a positive number 5,660 x Unlavorable X Variable factory overhead contrallable variance 5.720 X Fixed factory averhead valume variance Unfavorable 60 X Favorable X Total factory aerhaad cost variance Fedbwck TChack y Weark thought of as decreasing costs (a credit). Unfavorable variances can be thought of as increasing costs debit). Favorable variances can The variable factory overhead controllable variance is the difference between the actual variable overhead costs and the budgeted variable overhead for actual production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts