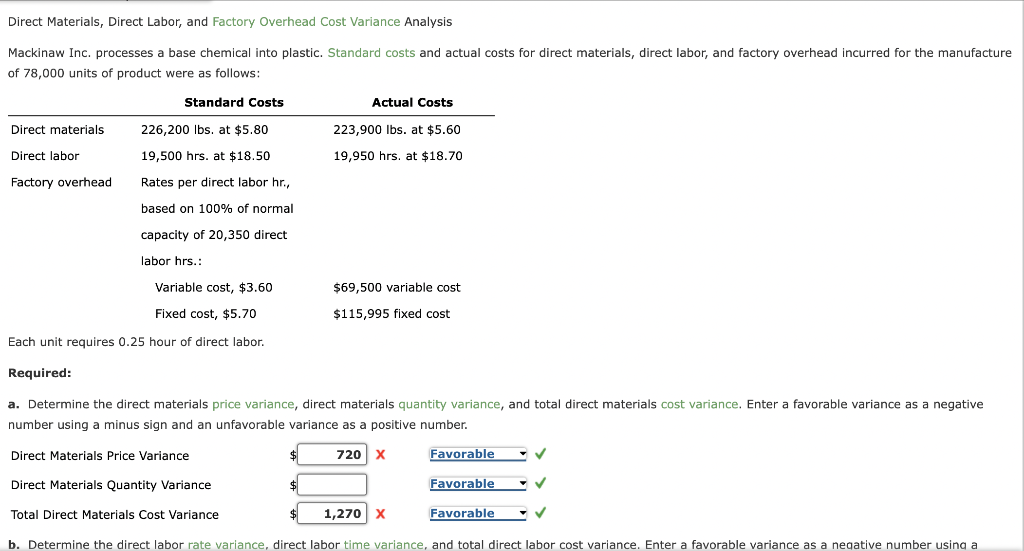

Question: Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct

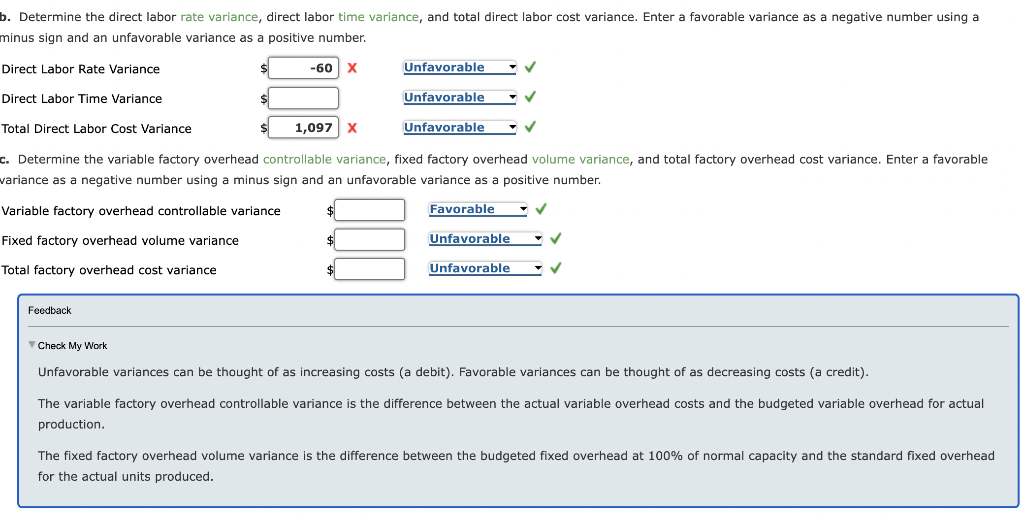

Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 78,000 units of product were as follows: Required: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Determine the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance. Enter a favorable riance as a negative number using a minus sign and an unfavorable variance as a positive number. Feedback Check My Work Unfavorable variances can be thought of as increasing costs (a debit). Favorable variances can be thought of as decreasing costs (a credit). The variable factory overhead controllable variance is the difference between the actual variable overhead costs and the budgeted variable overhead for actual production. The fixed factory overhead volume variance is the difference between the budgeted fixed overhead at 100% of normal capacity and the standard fixed overhead for the actual units produced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts