Question: Direct materials Direct labor Variable manufacturing overhead or hours 5 pounds 2 hours 2 hours or Rate $11.75 per pound $17.00 per hour $ 3.00

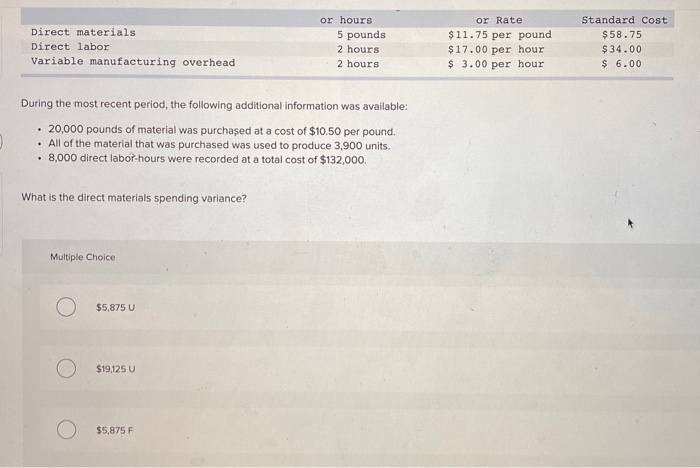

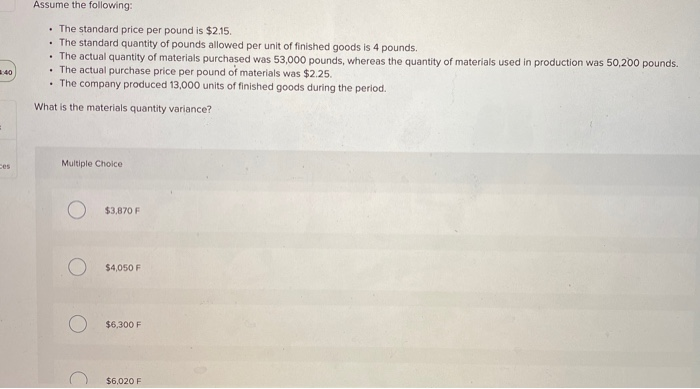

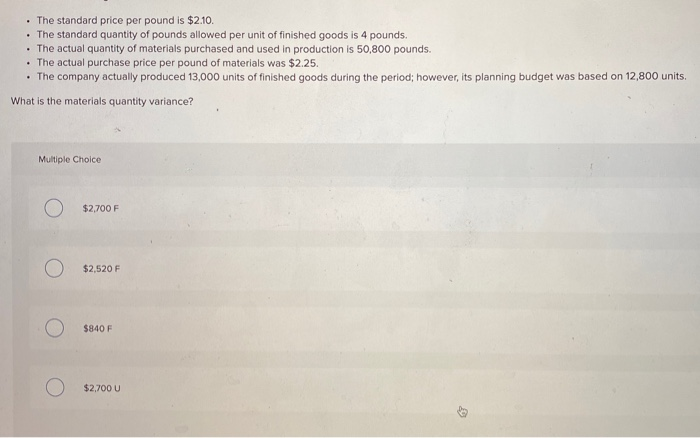

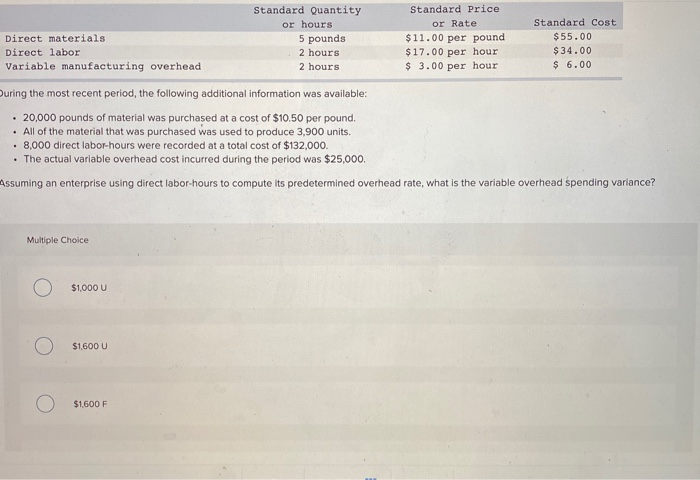

Direct materials Direct labor Variable manufacturing overhead or hours 5 pounds 2 hours 2 hours or Rate $11.75 per pound $17.00 per hour $ 3.00 per hour Standard Cost $58.75 $34.00 $ 6.00 During the most recent period, the following additional information was available: 20,000 pounds of material was purchased at a cost of $10.50 per pound, . All of the material that was purchased was used to produce 3,900 units. 8.000 direct labor-hours were recorded at a total cost of $132,000. What is the direct materials spending variance? Multiple Choice $5,875 U $19,125 U $5,875 F Assume the following: 40 The standard price per pound is $2.15. The standard quantity of pounds allowed per unit of finished goods is 4 pounds. The actual quantity of materials purchased was 53,000 pounds, whereas the quantity of materials used in production was 50,200 pounds. The actual purchase price per pound of materials was $2.25 The company produced 13,000 units of finished goods during the period. What is the materials quantity variance? Multiple Choice $3,870 F $4,050 F O $6,300F $6,020 F The standard price per pound is $2.10. The standard quantity of pounds allowed per unit of finished goods is 4 pounds. The actual quantity of materials purchased and used in production is 50,800 pounds. The actual purchase price per pound of materials was $2.25. The company actually produced 13,000 units of finished goods during the period; however, its planning budget was based on 12,800 units. What is the materials quantity variance? Multiple Choice $2,700 F $2,520 F $840 F O $2,700u Standard Quantity Standard Price or hours or Rate Standard Cost Direct materials 5 pounds $11.00 per pound $ 55.00 Direct labor 2 hours $17.00 per hour $34.00 Variable manufacturing overhead 2 hours $ 3.00 per hour $ 6.00 During the most recent period, the following additional information was available: 20,000 pounds of material was purchased at a cost of $10.50 per pound. . All of the material that was purchased was used to produce 3,900 units. 8,000 direct labor-hours were recorded at a total cost of $132,000. The actual variable overhead cost incurred during the period was $25,000. Assuming an enterprise using direct labor-hours to compute its predetermined overhead rate, what is the variable overhead spending variance? Multiple Choice $1,000 U $1,600 U $1,600 F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts