Question: Disco Technology Inc. ( a . k . a . Disco Tech ) plans to launch a new line of consumer entertainment products, but is

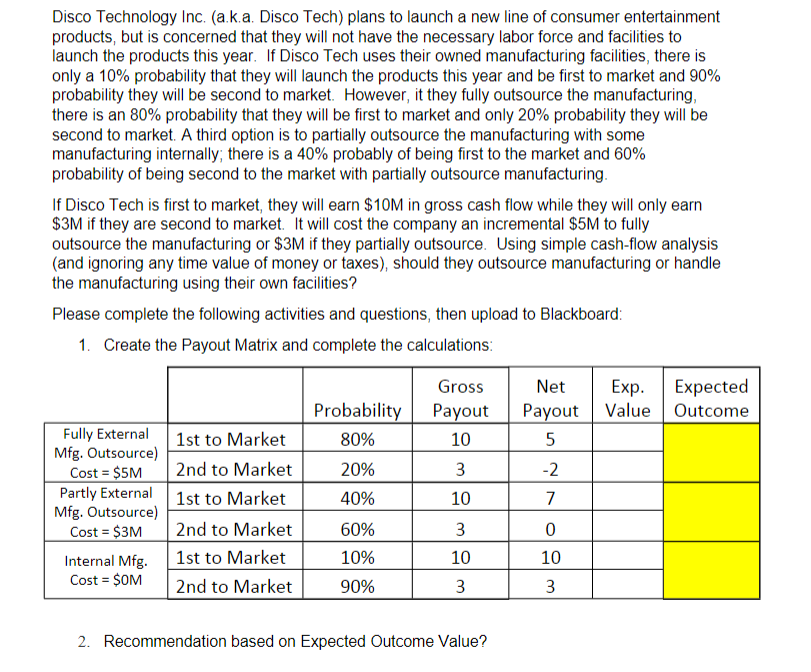

Disco Technology Inc. aka Disco Tech plans to launch a new line of consumer entertainment products, but is concerned that they will not have the necessary labor force and facilities to launch the products this year. If Disco Tech uses their owned manufacturing facilities, there is only a probability that they will launch the products this year and be first to market and probability they will be second to market. However, it they fully outsource the manufacturing, there is an probability that they will be first to market and only probability they will be second to market. A third option is to partially outsource the manufacturing with some manufacturing internally; there is a probably of being first to the market and probability of being second to the market with partially outsource manufacturing.

If Disco Tech is first to market, they will earn $ in gross cash flow while they will only earn $M if they are second to market. It will cost the company an incremental $ to fully outsource the manufacturing or $M if they partially outsource. Using simple cashflow analysis and ignoring any time value of money or taxes should they outsource manufacturing or handle the manufacturing using their own facilities?

Please complete the following activities and questions, then upload to Blackboard:

Create the Payout Matrix and complete the calculations:

tableProbability,tableGrossPayouttableNetPayouttableExpValuetableExpectedOutcometableFully ExternalMfg OutsourceCost $Mst to Market,nd to Market,tablePartly ExternalMfg OutsourceCost $Mst to Market,nd to Market,tableInternal MfgCost $Mst to Market,nd to Market,

Recommendation based on Expected Outcome Value?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock