Question: Disco Technology Inc. ( a . k . a . Disco Tech ) plans to launch a new line of consumer entertainment products, but is

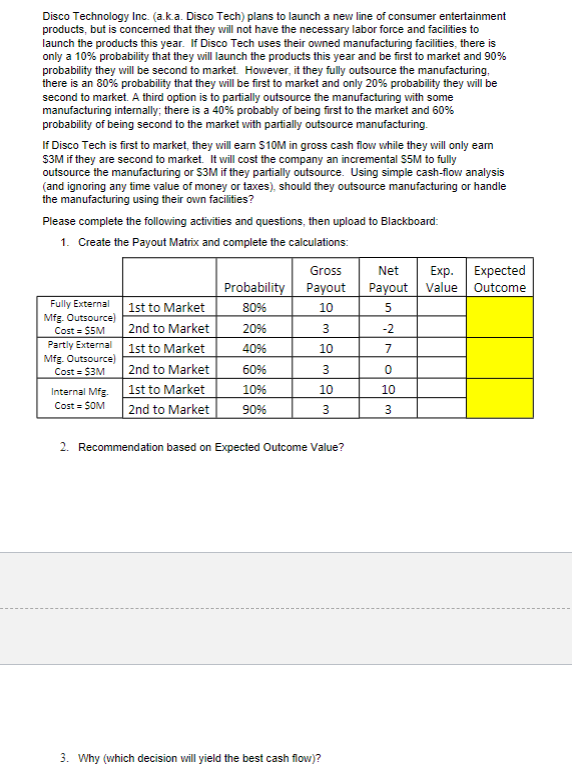

Disco Technology Inc. aka Disco Tech plans to launch a new line of consumer entertainment

products, but is concerned that they will not have the necessary labor force and facilities to

launch the products this year. If Disco Tech uses their owned manufacturing facilities, there is

only a probability that they will launch the products this year and be first to market and

probability they will be second to market. However, it they fully outsource the manufacturing,

there is an probability that they will be first to market and only probability they will be

second to market. A third option is to partially outsource the manufacturing with some

manufacturing internally; there is a probably of being first to the market and

probability of being second to the market with partially outsource manufacturing.

If Disco Tech is first to market, they will earn $ in gross cash flow while they will only earn

$M if they are second to market. It will cost the company an incremental $ to fully

outsource the manufacturing or $ if they partially outsource. Using simple cashflow analysis

and ignoring any time value of money or taxes should they outsource manufacturing or handle

the manufacturing using their own facilities?

Please complete the following activities and questions, then upload to Blackboard:

Create the Payout Matrix and complete the calculations:

Recommendation based on Expected Outcome Value?

Why which decision will yield the best cash flow

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock