Question: Discuss your data: a. Present a table with prices, maturity dates and coupon rates on six bonds in the main body of your report. b.

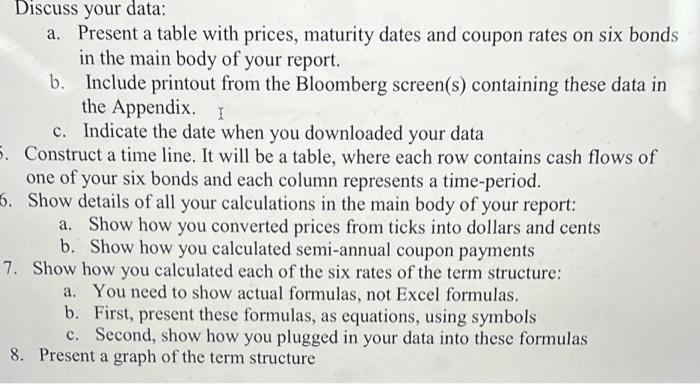

Discuss your data: a. Present a table with prices, maturity dates and coupon rates on six bonds in the main body of your report. b. Include printout from the Bloomberg screen(s) containing these data in the Appendix. I c. Indicate the date when you downloaded your data 5. Construct a time line. It will be a table, where each row contains cash flows of one of your six bonds and each column represents a time-period. 6. Show details of all your calculations in the main body of your report: a. Show how you converted prices from ticks into dollars and cents b. Show how you calculated semi-annual coupon payments 7. Show how you calculated each of the six rates of the term structure: a. You need to show actual formulas, not Excel formulas. b. First, present these formulas, as equations, using symbols c. Second, show how you plugged in your data into these formulas 8. Present a graph of the term structure Discuss your data: a. Present a table with prices, maturity dates and coupon rates on six bonds in the main body of your report. b. Include printout from the Bloomberg screen(s) containing these data in the Appendix. I c. Indicate the date when you downloaded your data 5. Construct a time line. It will be a table, where each row contains cash flows of one of your six bonds and each column represents a time-period. 6. Show details of all your calculations in the main body of your report: a. Show how you converted prices from ticks into dollars and cents b. Show how you calculated semi-annual coupon payments 7. Show how you calculated each of the six rates of the term structure: a. You need to show actual formulas, not Excel formulas. b. First, present these formulas, as equations, using symbols c. Second, show how you plugged in your data into these formulas 8. Present a graph of the term structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts