Question: Discussion Plan for Proctor & Gamble Scope Canada: Read Case thoroughly (12 pages with data) Summarize the case in five (5) sentences Make TYPED notes

Discussion Plan for Proctor & Gamble Scope Canada:

- Read Case thoroughly (12 pages with data)

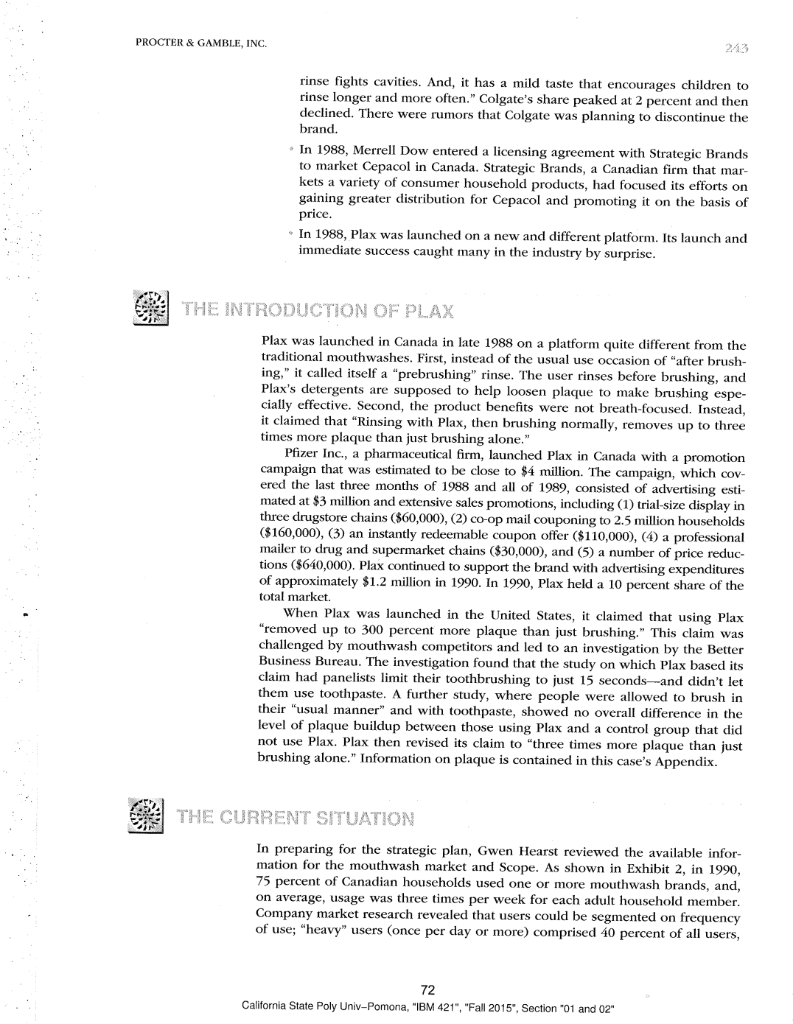

- Summarize the case in five (5) sentences

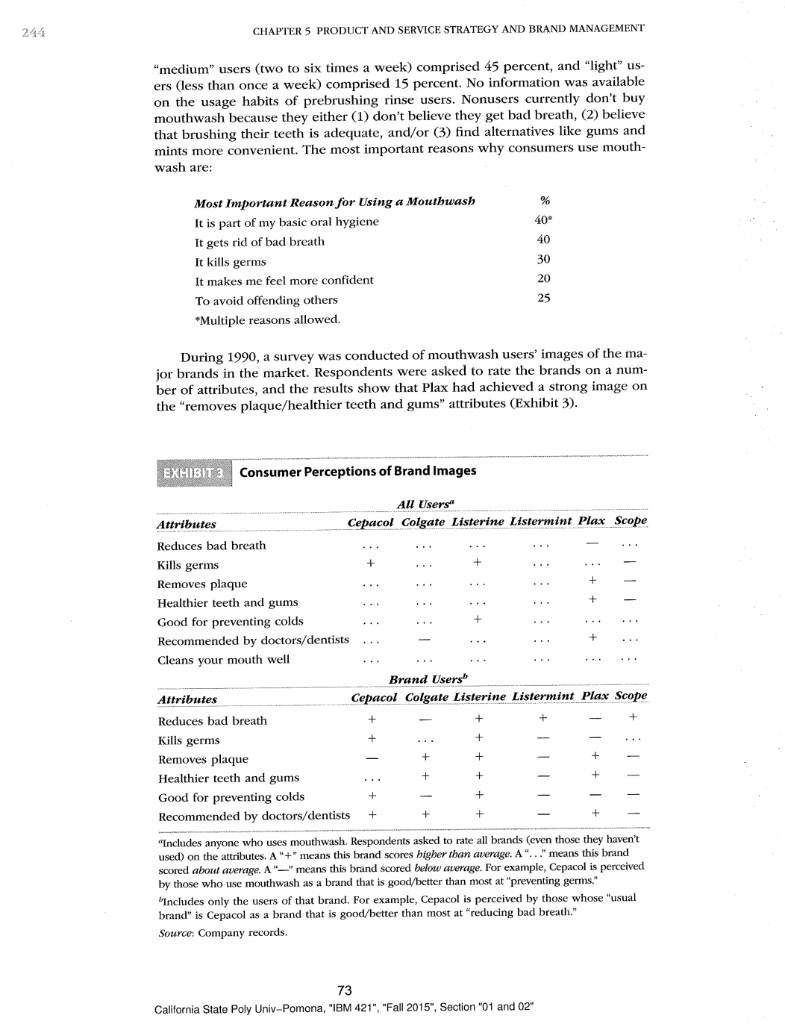

- Make TYPED notes on changes in Canadian mouthwash market over past three years

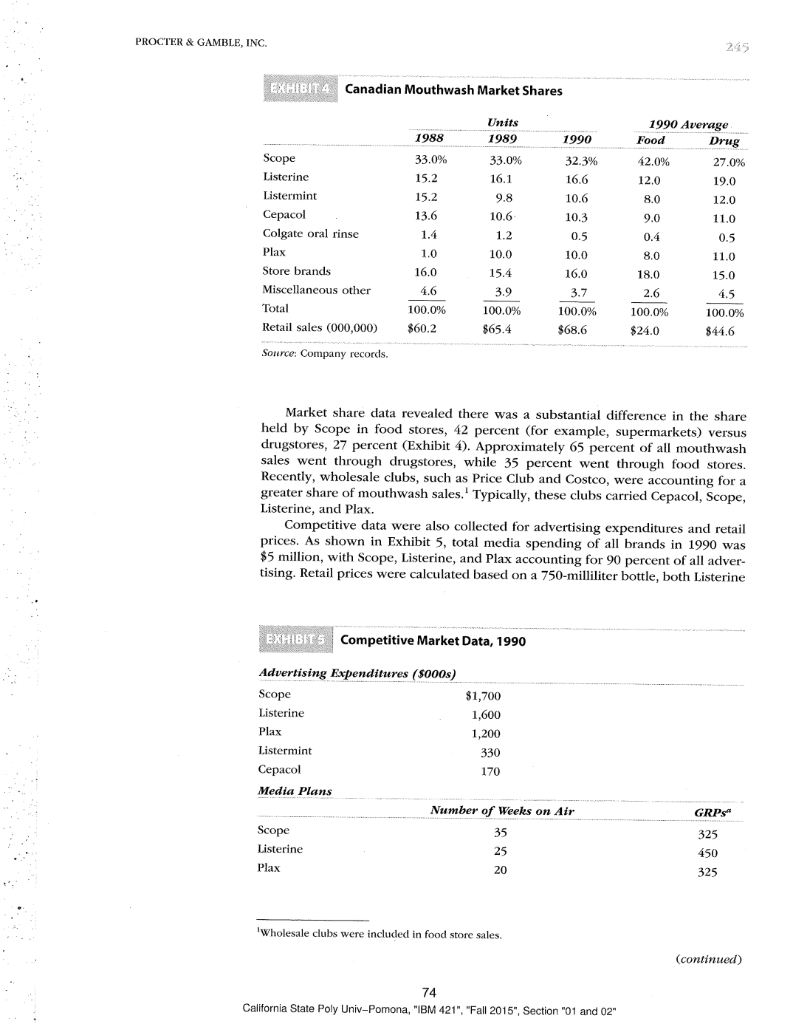

- Make TYPED notes on Scope and competitors pricing and market shares

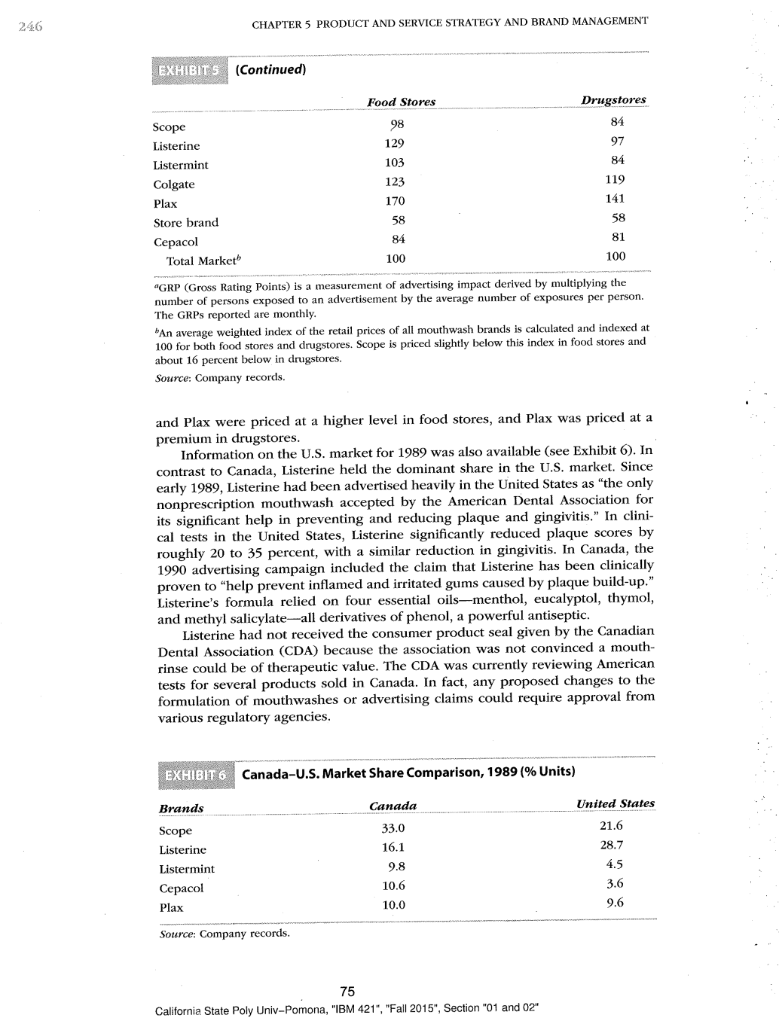

- TYPED evaluation of Scopes performance during last 3 years

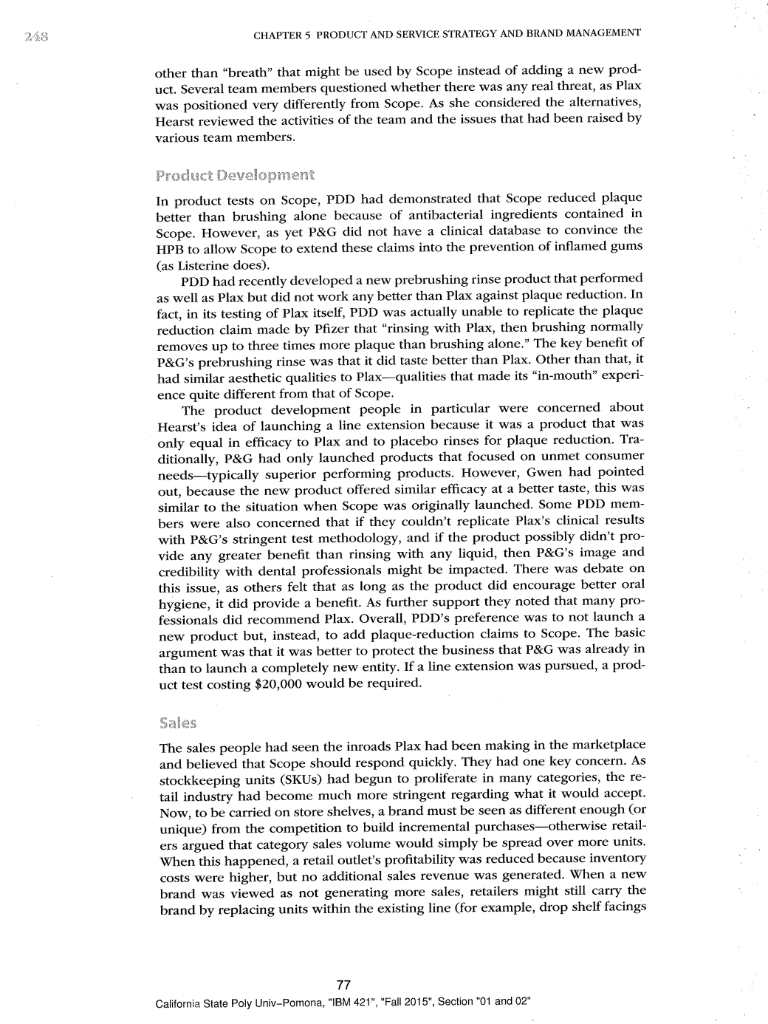

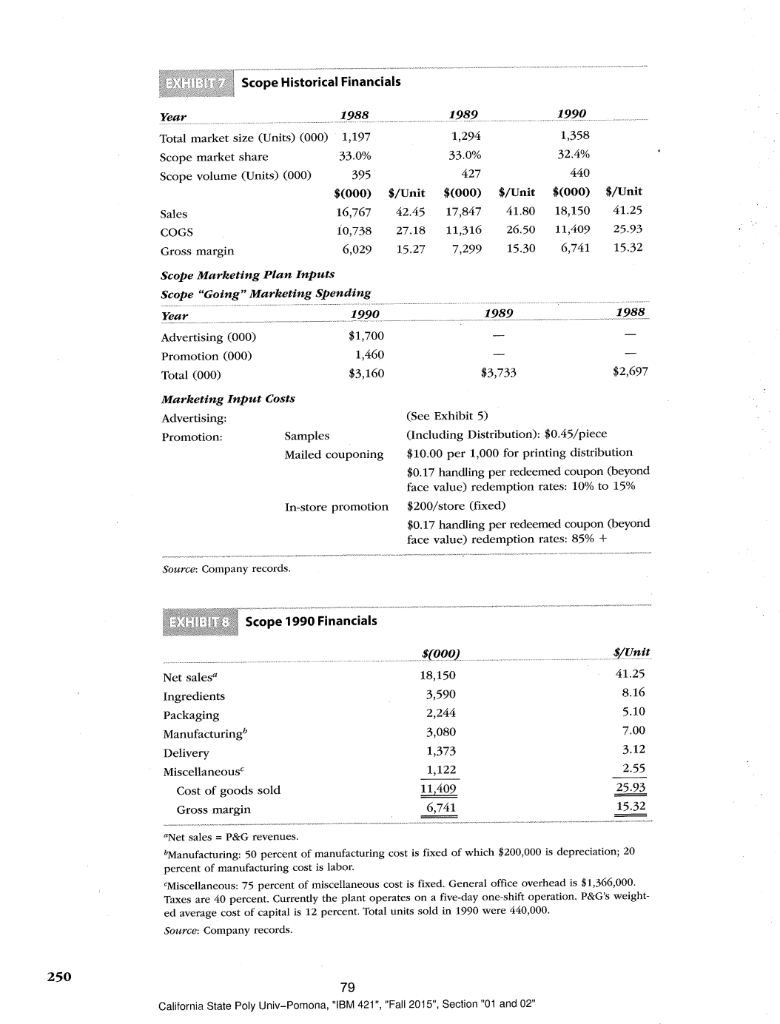

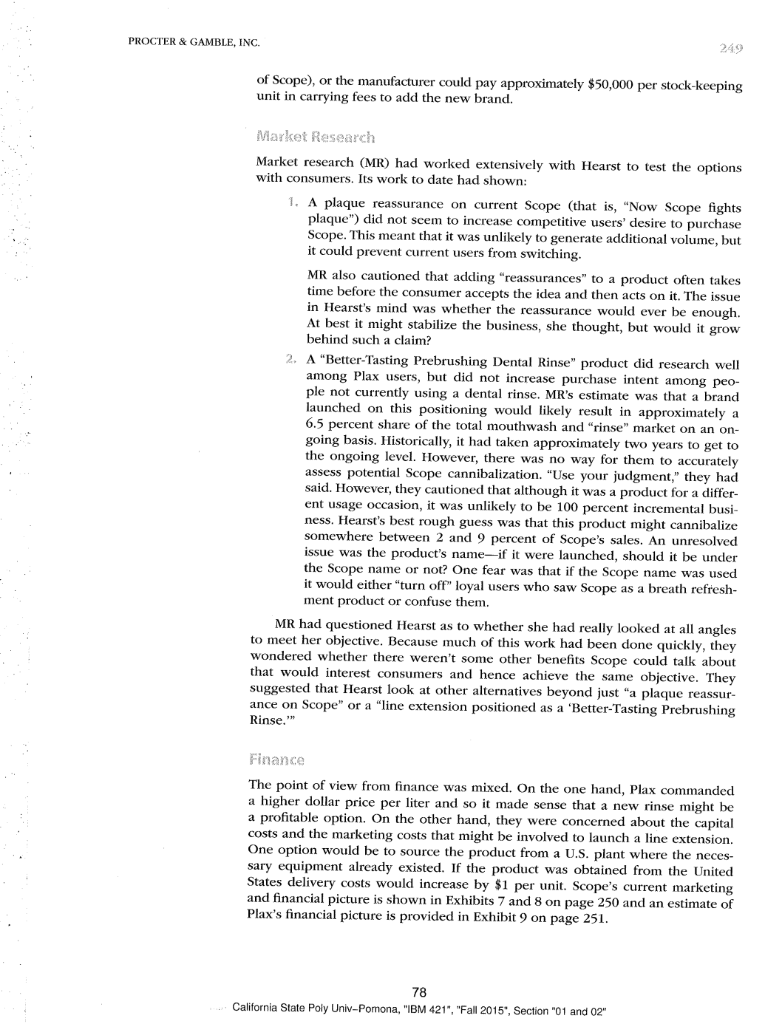

- What are Scopes alternatives, given the competitive situation?

- Pro and cons of each option

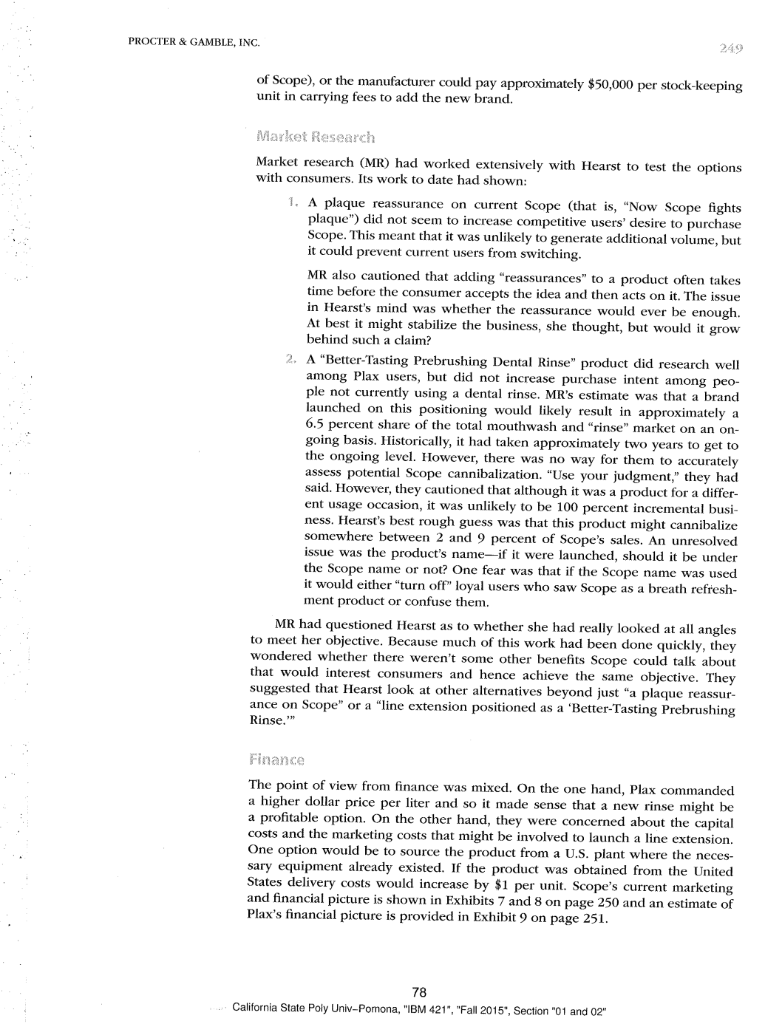

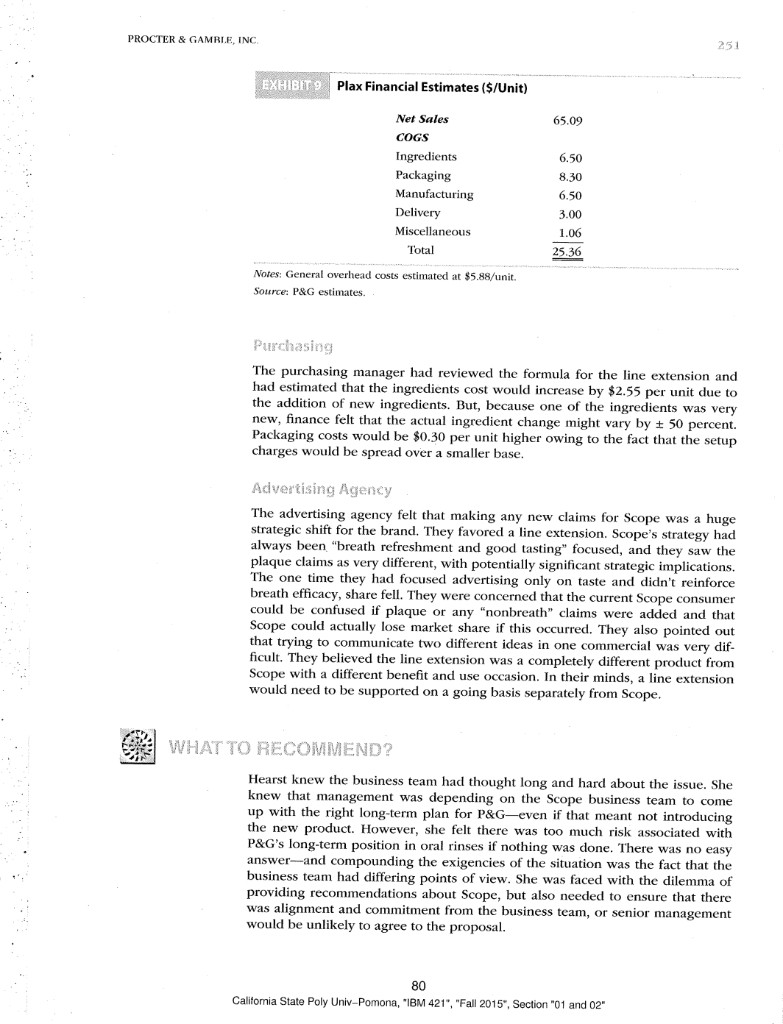

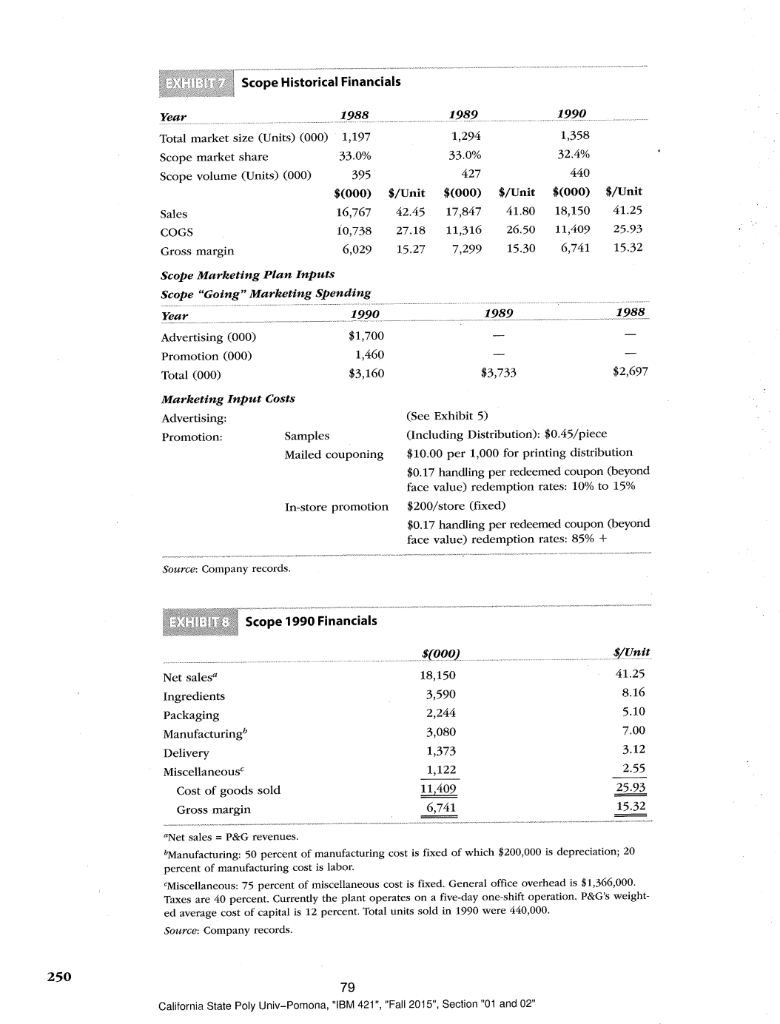

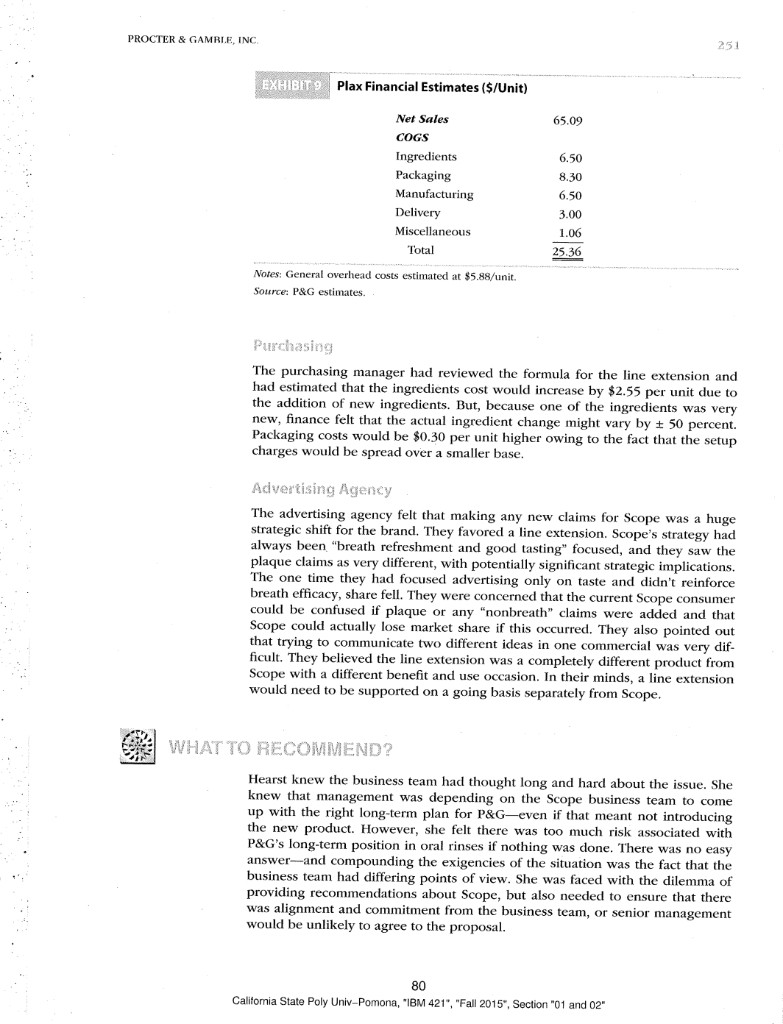

- Business case for each option

- Calculate P/L and Breakeven analysis for Scope (MANDATORY)

- Calculate the value of market share in sales/profits to the brand

- Estimate value and impact on profits and shelf price relative to competition given 5% price increase.

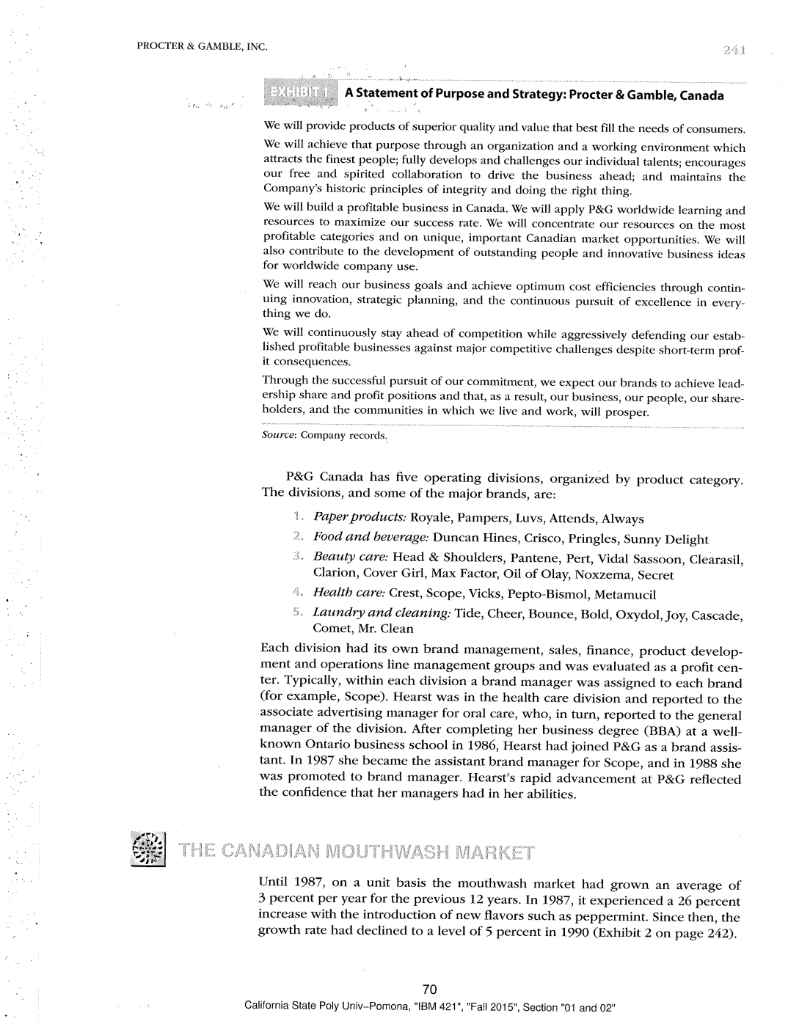

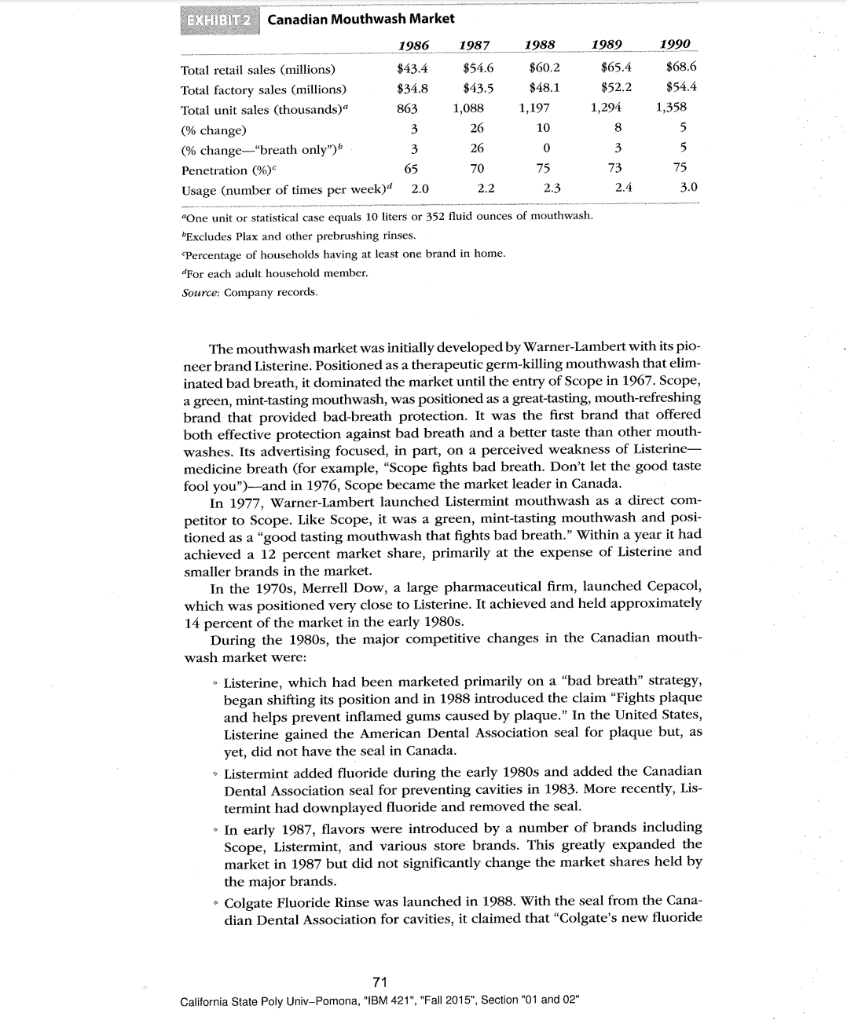

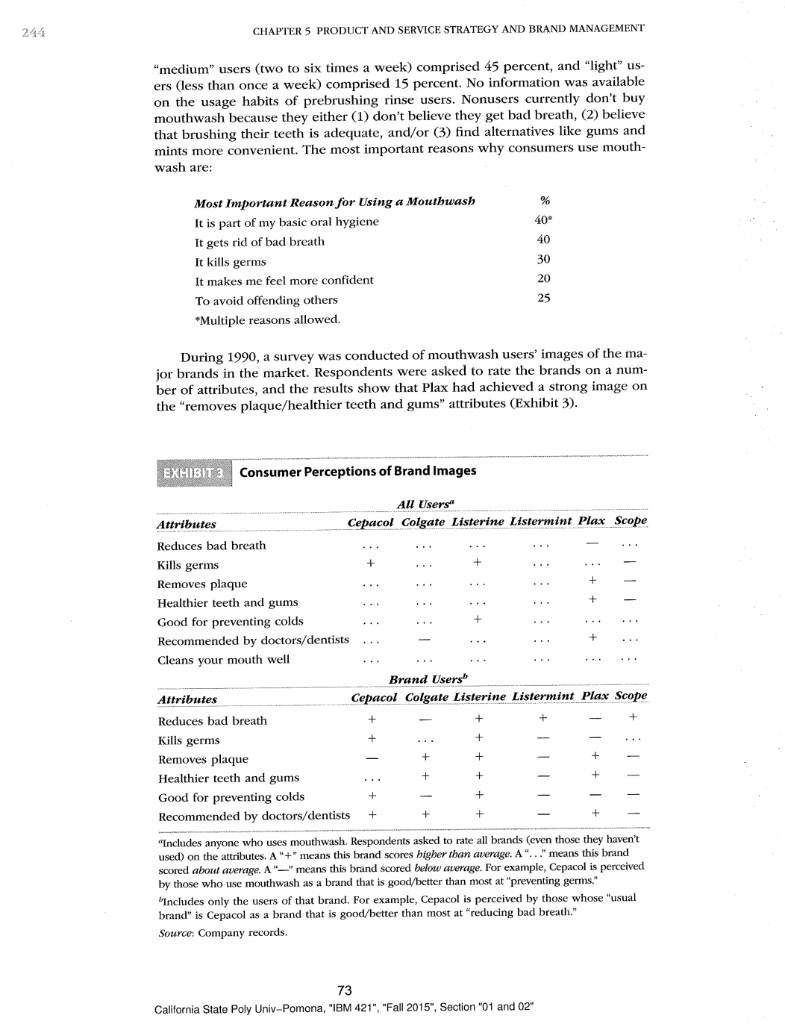

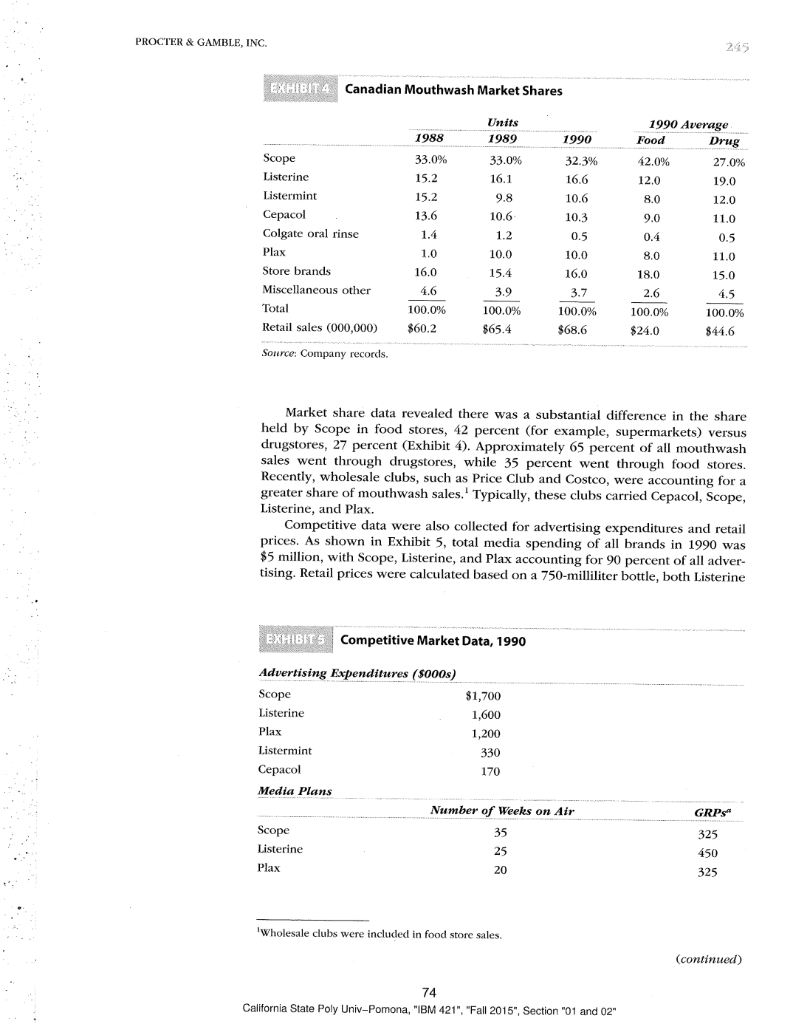

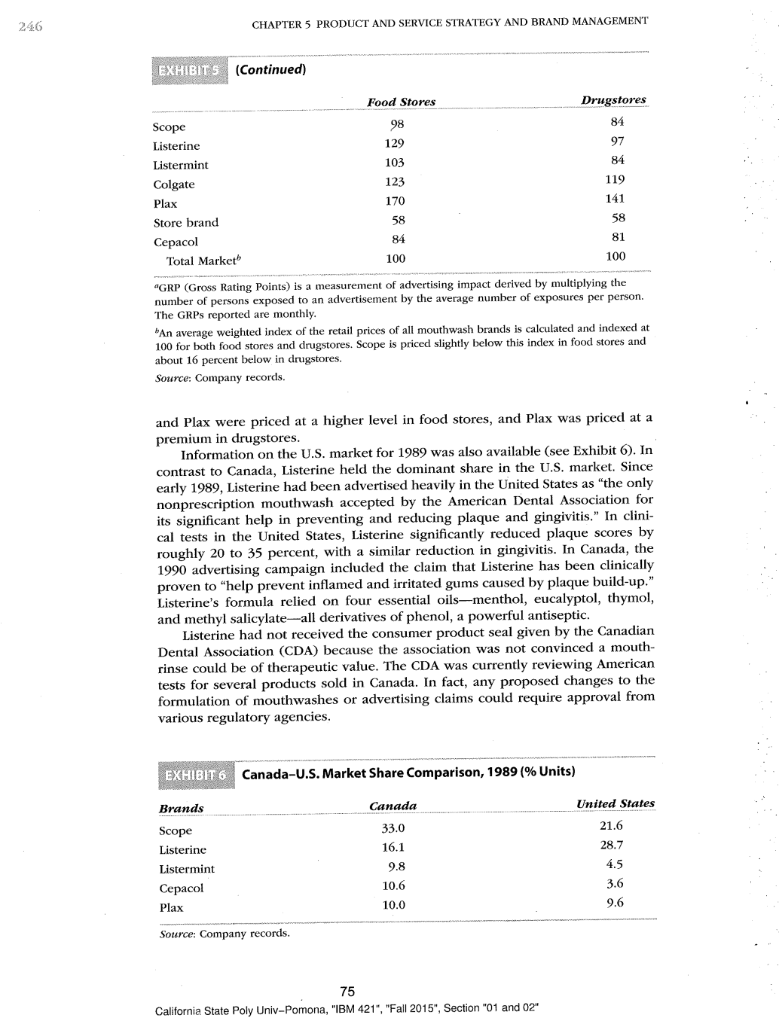

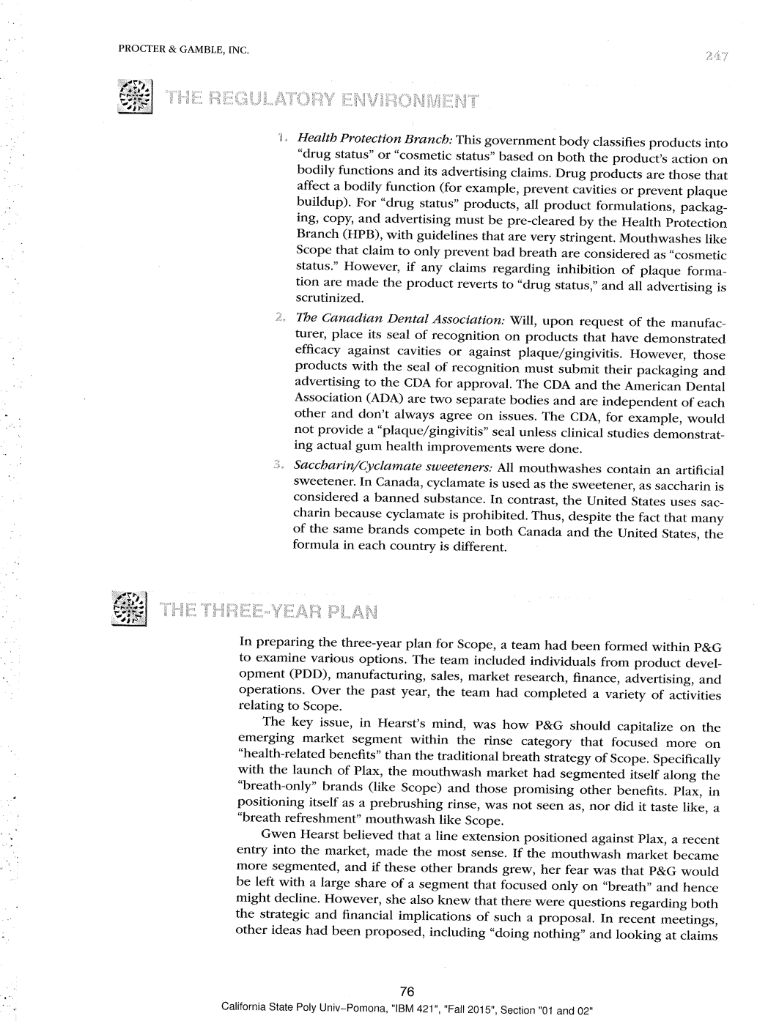

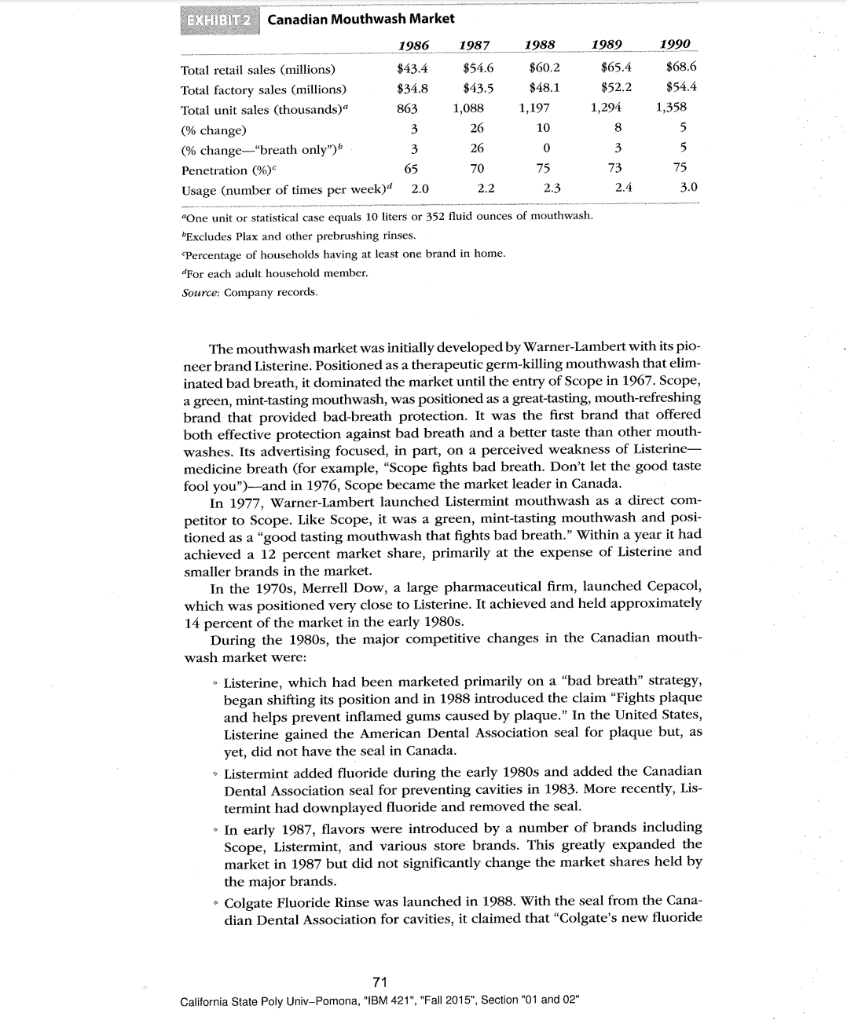

IBM 4801 PROF. JOHAS. WALI AUE Case Procter & Gamble, Inc. Scope As Gwen Hearst looked at the year-end report, she was pleased to see that Scope held a 32 percent share of the Canadian mouthwash market for 1990. She had been concerned about the inroads that Plax, a prebrushing rinse, had made in the market. Since its introduction in 1988, Plax had gained a 10 percent share of the product category and posed a threat to Scope. As brand manager, Hearst planned, developed, and directed the total marketing effort for S Gamble's (P&G) brand in the mouthwash market. She was responsible for maxi- mizing the market share, volume, and profitability of the brand. Until the entry of Plax, brands in the mouthwash market were positioned around two major benefits: fresh breath and killing germs. Plax was positioned around a new benefit as a "plaque fighter"-and indications were that other brands, such as Listerine, were going to promote this benefit. The challenge for Hearst was to develop a strategy that would ensure the continued profitability of Scope in the face of these competitive threats. Her specific task was to prepare a marketing plan for P&G's mouthwash business for the next three years. It was early February 1991, and she would be presenting the plan to senior management in March. COMPANY BACKGROUND Based on a philosophy of providing products of superior quality and value that best fill the needs of consumers, Procter & Gamble is one of the most successful consumer goods companies in the world. The company markets its brands in more than 140 countries and had net earnings of $1.6 billion in 1990. The Canadian sub- sidiary contributed $1.4 billion in sales and $100 million in net earnings in 1990. It was recognized as a leader in the Canadian packaged goods industry, and its consumer brands led in most of the categories in which the company competed. Between 1987 and 1990, worldwide sales of P&G had increased by $8 bil- lion and net earnings by $1.3 billion. P&G executives attributed the company's success to a variety of factors, including the ability to develop truly innovative products to meet consumers' needs. Exhibit 1 contains the statement of purpose and strategy of the Canadian subsidiary. This case was prepared by Professors Gordon H. G. McDougall and Franklin Ramsoomair, of the Wilfrid Laurier University, as a basis for class discussion and is not designed to illustrate effective or ineffective handling of an administrative situation. Used with permission. 240 69 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02 PROCTER & GAMBLE, INC. 241 - EXHIBIT 1 A Statement of Purpose and Strategy: Procter & Gamble, Canada We will provide products of superior quality and value that best fill the needs of consumers. We will achieve that purpose through an organization and a working environment which attracts the finest people, fully develops and challenges our individual talents: encourages our free and spirited collaboration to drive the business ahead; and maintains the Company's historic principles of integrity and doing the right thing We will build a profitable business in Canada. We will apply P&G worldwide learning and resources to maximize our success rate. We will concentrate our resources on the most profitable categories and on unique, important Canadian market opportunities. We will also contribute to the development of outstanding people and innovative business ideas for worldwide company use. We will reach our business goals and achieve optimum cost efficiencies through contin- uing innovation, strategic planning, and the continuous pursuit of excellence in every thing we do. We will continuously stay ahead of competition while aggressively defending our estab lished profitable businesses against major competitive challenges despite short-term prof- it consequences. Through the successful pursuit of our commitment, we expect our brands to achieve lead- ership share and profit positions and that, as a result, our business, our people, our share- holders, and the communities in which we live and work, will prosper. Source: Company records. P&G Canada has five operating divisions, organized by product category. The divisions, and some of the major brands, are: 1. Paper products: Royale, Pampers, Luvs, Attends, Always 2. Food and beverage: Duncan Hines, Crisco, Pringles, Sunny Delight 3. Beauty care: Head & Shoulders, Pantene, Pert, Vidal Sassoon, Clearasil, Clarion, Cover Girl, Max Factor, Oil of Olay, Noxzema, Secret 4. Health care: Crest, Scope, Vicks, Pepto-Bismol, Metamucil 5. Laundry and cleaning: Tide, Cheer, Bounce, Bold, Oxydol, Joy, Cascade, Comet, Mr. Clean Each division had its own brand management, sales, finance, product develop ment and operations line management groups and was evaluated as a profit cen- ter. Typically, within each division a brand manager was assigned to each brand (for example, Scope). Hearst was in the health care division and reported to the associate advertising manager for oral care, who, in turn, reported to the general manager of the division. After completing her business degree (BBA) at a well- known Ontario business school in 1986, Hearst had joined P&G as a brand assis- tant. In 1987 she became the assistant brand manager for Scope, and in 1988 she was promoted to brand manager. Hearst's rapid advancement at P&G reflected the confidence that her managers had in her abilities. CANADIAN MOUTHWASH MARKET Until 1987, on a unit basis the mouthwash market had grown an average of 3 percent per year for the previous 12 years. In 1987, it experienced a 26 percent increase with the introduction of new flavors such as peppermint. Since then, the growth rate had declined to a level of 5 percent in 1990 (Exhibit 2 on page 212). 70 California State Poly Univ-Pomona, "IBM 421', "Fall 2015", Section "01 and 02" EXHIBIT 2 Canadian Mouthwash Market 1986 1987 Total retail sales (millions) $43.4 $54.6 Total factory sales (millions) $34.8 $43.5 Total unit sales (thousands) 863 1,088 % change) - 3 26 (% change-"breath only") 3 2 6 Penetration (%) - 65 70 Usage (number of times per week) 2.0 2.2 1988 $60.2 $48.1 1,197 10 0 75 2.3 1989 $65.4 $52.2 1,294 8 3 73 2.4 1990 $68.6 $54.4 1,358 5 5 75 3.0 "One unit or statistical case equals 10 liters or 352 fluid Ounces of mouthwash. "Excludes Plax and other prebrushing rinses. Percentage of households having at least one brand in home. For each adult household member. Source: Company records. The mouthwash market was initially developed by Warner-Lambert with its pio- neer brand Listerine. Positioned as a therapeutic germ-killing mouthwash that elim- inated bad breath, it dominated the market until the entry of Scope in 1967. Scope, a green, mint-tasting mouthwash, was positioned as a great-tasting, mouth-refreshing brand that provided bad-breath protection. It was the first brand that offered both effective protection against bad breath and a better taste than other mouth- washes. Its advertising focused, in part, on a perceived weakness of Listerine- medicine breath (for example, "Scope fights bad breath. Don't let the good taste fool you") and in 1976, Scope became the market leader in Canada. In 1977, Warner-Lambert launched Listermint mouthwash as a direct com- petitor to Scope. Like Scope, it was a green, mint-tasting mouthwash and posi- tioned as a "good tasting mouthwash that fights bad breath." Within a year it had achieved a 12 percent market share, primarily at the expense of Listerine and smaller brands in the market. In the 1970s, Merrell Dow, a large pharmaceutical firm, launched Cepacol, which was positioned very close to Listerine. It achieved and held approximately 14 percent of the market in the early 1980s. During the 1980s, the major competitive changes in the Canadian mouth- wash market were: Listerine, which had been marketed primarily on a "bad breath" strategy, began shifting its position and in 1988 introduced the claim "Fights plaque and helps prevent inflamed gums caused by plaque." In the United States, Listerine gained the American Dental Association seal for plaque but, as yet, did not have the seal in Canada. Listermint added fluoride during the early 1980s and added the Canadian Dental Association seal for preventing cavities in 1983. More recently, Lis- termint had downplayed fluoride and removed the seal. In early 1987, flavors were introduced by a number of brands including Scope, Listermint, and various store brands. This greatly expanded the market in 1987 but did not significantly change the market shares held by the major brands. . Colgate Fluoride Rinse was launched in 1988. With the seal from the Cana- dian Dental Association for cavities, it claimed that "Colgate's new fluoride 71 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02" PROCTER & GAMBLE, INC. rinse fights cavities. And, it has a mild taste that encourages children to rinse longer and more often." Colgate's share peaked at 2 percent and then declined. There were rumors that Colgate was planning to discontinue the brand. In 1988, Merrell Dow entered a licensing agreement with Strategic Brands to market Cepacol in Canada. Strategic Brands, a Canadian firm that mar- kets a variety of consumer household products, had focused its efforts on gaining greater distribution for Cepacol and promoting it on the basis of price. In 1988, Plax was launched on a new and different platform. Its launch and immediate success caught many in the industry by surprise. THE INTRODUCTION OF PLAX Plax was launched in Canada in late 1988 on a platform quite different from the traditional mouthwashes. First, instead of the usual use occasion of "after brush- ing." it called itself a "prebrushing" rinse. The user rinses before brushing, and Plax's detergents are supposed to help loosen plaque to make brushing espe- cially effective. Second, the product benefits were not breath-focused. Instead, it claimed that "Rinsing with Plax, then brushing normally, removes up to three times more plaque than just brushing alone." Pfizer Inc., a pharmaceutical firm, launched Plax in Canada with a promotion campaign that was estimated to be close to $4 million. The campaign, which cov- ered the last three months of 1988 and all of 1989, consisted of advertising esti- mated at $3 million and extensive sales promotions, including (1) trial-size display in three drugstore chains ($60,000), (2) co-op mail couponing to 2.5 million households ($160,000), (3) an instantly redeemable coupon offer ($110,000), (4) a professional mailer to drug and supermarket chains ($30,000), and (5) a number of price reduc- 640,000). Plax continued to support the brand with advertising expenditures of approximately $1.2 million in 1990. In 1990, Plax held a 10 percent share of the total market. When Plax was launched in the United States, it claimed that using Plax "removed up to 300 percent more plaque than just brushing." This claim was challenged by mouthwash competitors and led to an investigation by the Better Business Bureau. The investigation found that the study on which Plax based its claim had panelists limit their toothbrushing to just 15 seconds and didn't let them use toothpaste. A further study, where people were allowed to brush in their "usual manner" and with toothpaste, showed no overall difference in the level of plaque buildup between those using Plax and a control group that did not use Plax. Plax then revised its claim to "three times more plaque than just brushing alone. Information on plaque is contained in this case's Appendix. THE CURRENT SITUATION In preparing for the strategic plan, Gwen Hearst reviewed the available infor- mation for the mouthwash market and Scope. As shown in Exhibit 2, in 1990, 75 percent of Canadian households used one or more mouthwash brands, and, on average, usage was three times per week for each adult household member. Company market research revealed that users could be segmented on frequency of use; "heavy" users (once per day or more) comprised 40 percent of all users, 72 California State Poly Univ-Pomona, "IBM 421", "Fall 2015', Section 01 and 02 244 CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND MANAGEMENT "medium" users (two to six times a week) comprised 45 percent, and "light" us- ers (less than once a week) comprised 15 percent. No information was available on the usage habits of prebrushing rinse users. Nonusers currently don't buy mouthwash because they either (1) don't believe they get bad breath, (2) believe that brushing their teeth is adequate, and/or (3) find alternatives like gums and mints more convenient. The most important reasons why consumers use mouth- wash are: Most Important Reason for Using a Mouthwash It is part of my basic oral hygiene It gets rid of bad breath It kills germs It makes me feel more confident To avoid offending others *Multiple reasons allowed. During 1990, a survey was conducted of mouthwash users' images of the ma- jor brands in the market. Respondents were asked to rate the brands on a num- ber of attributes, and the results show that Plax had achieved a strong image on the "removes plaque/healthier teeth and gums" attributes (Exhibit 3). EXHIBIT 3 Consumer Perceptions of Brand Images + + + All Users Attributes Cepacol Colgate Listerine Listermint Plax Scope Reduces bad breath Kills germs Removes plaque Healthier teeth and gums Good for preventing colds Recommended by doctors/dentists Cleans your mouth well Brand Users Attributes Cepacol Colgate Listerine Listermint Plax Scope Reduces bad breath Kills germs Removes plaque Healthier teeth and gums Good for preventing colds Recommended by doctors/dentists + + + T 1 + : + 1| + + + 1111 + + + "Includes anyone who uses mouthwash. Respondents asked to rate all brands (even those they haven't used on the attributes. A"+" means this brand scores higher than average. A"..." means this brand scored about average. A means this brand scored below average. For example, Cepacol is perceived by those who use mouthwash as a brand that is good/better than most at "preventing germs." Includes only the users of that brand. For example, Cepacol is perceived by those whose "usual brand" is Cepucol as a brand that is good/better than most at reducing bad breath." Source: Company records. 73 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02 PROCTER & GAMBLE, INC. 245 EXHIBIT 4 Canadian Mouthwash Market Shares Units 1989 1990 Drug 33.0% 32.3% 9.0 Scope Listerine Listermint Cepacol Colgate oral rinse Plax Store brands Miscellaneous other Total Retail sales (000,000) 1988 33.0% 15.2 15.2 13.6 1.4 1.0 16.0 4.6 100.0% $60.2 16.1 9.8 10.6 1.2 10.0 15.4 3.9 100.0% $65.4 16.6 10.6 10.3 0.5 10.0 16.0 3.7 100.0% $68.6 1990 Average Food 42.0% 27.0% 12.0 19.0 8.0 12.0 11.0 0.5 8.0 11.0 18.0 15.0 2.6 4.5 100.0% 100.0% $24.0 $44.6 Source: Company records. Market share data revealed there was a substantial difference in the share held by Scope in food stores, 42 percent (for example, supermarkets) versus drugstores, 27 percent (Exhibit 4). Approximately 65 percent of all mouthwash sales went through drugstores, while 35 percent went through food stores. Recently, wholesale clubs, such as Price Club and Costco, were accounting for a greater share of mouthwash sales. Typically, these clubs carried Cepacol, Scope, Listerine, and Plax. Competitive data were also collected for advertising expenditures and retail prices. As shown in Exhibit 5, total media spending of all brands in 1990 was $5 million, with Scope, Listerine, and Plax accounting for 90 percent of all adver- tising. Retail prices were calculated based on a 750-milliliter bottle, both Listerine EXHIBIT 5 Competitive Market Data, 1990 Advertising Expenditures (5000s) Scope Listerine Plax Listermint $1,700 1,600 1,200 330 170 Media Plans Number of Weeks on Air GRP Scope Listerine Plax 325 450 325 'Wholesale clubs were included in food store sales. (continued) 74 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02" 246 CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND MANAGEMENT EXHIBITS (Continued) Food Stores Drugstores 84 129 Scope Listerine Listermint Colgate Plax Store brand Cepacol Total Market 100 100 "GRP (Gross Rating Points) is a measurement of advertising impact derived by multiplying the number of persons exposed to an advertisement by the average number of exposures per person. The GRPs reported are monthly An average weighted index of the retail prices of all mouthwash brands is calculated and indexed at 100 for both food stores and drugstores. Scope is priced slightly below this index in food stores and about 16 percent below in drugstores Source: Company records. and Plax were priced at a higher level in food stores, and Plax was priced at a premium in drugstores. Information on the U.S. market for 1989 was also available (see Exhibit 6). In contrast to Canada, Listerine held the dominant share in the U.S. market. Since early 1989, Listerine had been advertised heavily in the United States as "the only nonprescription mouthwash accepted by the American Dental Association for its significant help in preventing and reducing plaque and gingivitis." In clini cal tests in the United States, Listerine significantly reduced plaque scores by roughly 20 to 35 percent, with a similar reduction in gingivitis. In Canada, the 1990 advertising campaign included the claim that Listerine has been clinically proven to "help prevent inflamed and irritated gums caused by plaque build-up." Listerine's formula relied on four essential oils-menthol, eucalyptol, thymol, and methyl salicylate-all derivatives of phenol, a powerful antiseptic. Listerine had not received the consumer product seal given by the Canadian Dental Association (CDA) because the association was not convinced a mouth- rinse could be of therapeutic value. The CDA was currently reviewing American tests for several products sold in Canada. In fact, any proposed changes to the formulation of mouthwashes or advertising claims could require approval from various regulatory agencies. EXHIBIT 6 Canada-U.S. Market Share Comparison, 1989 % Units) Brands Canada United States 21.6 28.7 Scope Listerine Listermint Cepacol Plax 33.0 16.1 9.8 10.6 10.0 4.5 Source: Company records. 75 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section 101 and 02" PROCTER & GAMBLE, INC. REGULATORY ENVIRONMENT 1. Health Protection Branch: This government body classifies products into "drug status" or "cosmetic status" based on both the product's action on bodily functions and its advertising claims. Drug products are those that affect a bodily function (for example, prevent cavities or prevent plaque buildup). For "drug status" products, all product formulations, packag- ing, copy, and advertising must be pre-cleared by the Health Protection Branch (HPB), with guidelines that are very stringent. Mouthwashes like Scope that claim to only prevent bad breath are considered as "cosmetic status." However, if any claims regarding inhibition of plaque forma- tion are made the product reverts to "drug status," and all advertising is scrutinized. 2. The Canadian Dental Association: Will, upon request of the manufac- turer, place its seal of recognition on products that have demonstrated efficacy against cavities or against plaque/gingivitis. However, those products with the seal of recognition must submit their packaging and advertising to the CDA for approval. The CDA and the American Dental Association (ADA) are two separate bodies and are independent of each other and don't always agree on issues. The CDA, for example, would not provide a "plaque/gingivitis" seal unless clinical studies demonstrat- ing actual gum health improvements were done. Saccharin/Cyclamate sweeteners: All mouthwashes contain an artificial sweetener. In Canada, cyclamate is used as the sweetener, as saccharin is considered a banned substance. In contrast, the United States uses sac- charin because cyclamate is prohibited. Thus, despite the fact that many of the same brands compete in both Canada and the United States, the formula in each country is different. THE THREE-YEAR PLAN In preparing the three-year plan for Scope, a team had been formed within P&G to examine various options. The team included individuals from product devel- opment (PDD), manufacturing, sales, market research, finance, advertising, and operations. Over the past year, the team had completed a variety of activities relating to Scope. The key issue, in Hearst's mind, was how P&G should capitalize on the emerging market segment within the rinse category that focused more on "health-related benefits" than the traditional breath strategy of Scope. Specifically with the launch of Plax, the mouthwash market had segmented itself along the "breath-only" brands like Scope) and those promising other benefits. Plax, in positioning itself as a prebrushing rinse, was not seen as, nor did it taste like, a "breath refreshment" mouthwash like Scope. Gwen Hearst believed that a line extension positioned against Plax, a recent entry into the market, made the most sense. If the mouthwash market became nore segmented, and if these other brands grew, her fear was that P&G would be left with a large share of a segment that focused only on "breath and hence might decline. However, she also knew that there were questions regarding both the strategic and financial implications of such a proposal. In recent meetings, other ideas had been proposed, including "doing nothing" and looking at claims 76 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02" 218 CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND MANAGEMENT other than "breath" that might be used by Scope instead of adding a new prod- uct. Several team members questioned whether there was any real threat, as Plax was positioned very differently from Scope. As she considered the alternatives, Hearst reviewed the activities of the team and the issues that had been raised by various team members. Product Development In product tests on Scope, PDD had demonstrated that Scope reduced plaque better than brushing alone because of antibacterial ingredients contained in Scope. However, as yet P&G did not have a clinical database to convince the HPB to allow Scope to extend these claims into the prevention of inflamed gums (as Listerine does). PDD had recently developed a new prebrushing rinse product that performed as well as Plax but did not work any better than Plax against plaque reduction. In fact, in its testing of Plax itself, PDD was actually unable to replicate the plaque reduction claim made by Pfizer that "rinsing with Plax, then brushing normally removes up to three times more plaque than brushing alone." The key benefit of P&G's prebrushing rinse was that it did taste better than Plax. Other than that, it had similar aesthetic qualities to Plax-qualities that made its "in-mouth" experi- ence quite different from that of Scope. The product development people in particular were concerned about Hearst's idea of launching a line extension because it was a product that was only equal in efficacy to Plax and to placebo rinses for plaque reduction. Tra- ditionally, P&G had only launched products that focused on unmet consumer needs typically superior performing products. However, Gwen had pointed out, because the new product offered similar efficacy at a better taste, this was similar to the situation when Scope was originally launched. Some PDD mem- bers were also concerned that if they couldn't replicate Plax's clinical results with P&G's stringent test methodology, and if the product possibly didn't pro- vide any greater benefit than rinsing with any liquid, then P&G's image and credibility with dental professionals might be impacted. There was debate on this issue, as others felt that as long as the product did encourage better oral hygiene, it did provide a benefit. As further support they noted that many pro- fessionals did recommend Plax. Overall, PDD's preference was to not launch a new product but, instead, to add plaque-reduction claims to Scope. The basic argument was that it was better to protect the business that P&G was already in than to launch a completely new entity. If a line extension was pursued, a prod- uct test costing $20,000 would be required. Sales The sales people had seen the inroads Plax had been making in the marketplace and believed that Scope should respond quickly. They had one key concern. As stockkeeping units (SKU) had begun to proliferate in many categories, the re- tail industry had become much more stringent regarding what it would accept. Now, to be carried on store shelves, a brand must be seen as different enough (or unique) from the competition to build incremental purchases otherwise retail ers argued that category sales volume would simply be spread over more units. When this happened, a retail outlet's profitability was reduced because inventory costs were higher, but no additional sales revenue was generated. When a new brand was viewed as not generating more sales, retailers might still carry the brand by replacing units within the existing line (for example, drop shelf facings California State Poly Univ-Pomona, "IBM 421", "Fall 2015', Section "01 and 02 PROCTER & GAMBLE, INC. 249 of Scope), or the manufacturer could pay approximately $50,000 per stock-keeping unit in carrying fees to add the new brand. Market Research Market research (MR) had worked extensively with Hearst to test the options with consumers. Its work to date had shown: 1. A plaque reassurance on current Scope (that is, "Now Scope fights plaque") did not seem to increase competitive users' desire to purchase Scope. This meant that it was unlikely to generate additional volume, but it could prevent current users from switching. MR also cautioned that adding "reassurances" to a product often takes time before the consumer accepts the idea and then acts on it. The issue in Hearst's mind was whether the reassurance would ever be enough. At best it might stabilize the business, she thought, but would it grow behind such a claim? 2. A "Better-Tasting Prebrushing Dental Rinse" product did research well among Plax users, but did not increase purchase intent among peo- ple not currently using a dental rinse. MR's estimate was that a brand launched on this positioning would likely result in approximately a 6.5 percent share of the total mouthwash and "rinse" market on an on- going basis. Historically, it had taken approximately two years to get to the ongoing level. However, there was no way for them to accurately assess potential Scope cannibalization. "Use your judgment," they had said. However, they cautioned that although it was a product for a differ- ent usage occasion, it was unlikely to be 100 percent incremental busi- ness. Hearst's best rough guess was that this product might cannibalize somewhere between 2 and 9 percent of Scope's sales. An unresolved issue was the product's name-if it were launched, should it be under the Scope name or not? One fear was that if the Scope name was used it would either "turn off" loyal users who saw Scope as a breath refresh- ment product or confuse them. MR had questioned Hearst as to whether she had really looked at all angles to meet her objective. Because much of this work had been done quickly, they wondered whether there weren't some other benefits Scope could talk about that would interest consumers and hence achieve the same objective. They suggested that Hearst look at other alternatives beyond just "a plaque reassur- ance on Scope" or a "line extension positioned as a 'Better-Tasting Prebrushing Rinse." Finance The point of view from finance was mixed. On the one hand, Plax commanded a higher dollar price per liter and so it made sense that a new rinse might be a profitable option. On the other hand, they were concerned about the capital costs and the marketing costs that might be involved to launch a line extension. One option would be to source the product from a U.S. plant where the neces- sary equipment already existed. If the product was obtained from the United States delivery costs would increase by $1 per unit. Scope's current marketing and financial picture is shown in Exhibits 7 and 8 on page 250 and an estimate of Plax's financial picture is provided in Exhibit 9 on page 251. California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02" EXHIBIT 7 Scope Historical Financials Year 1988 1989 1990 Total market size (Units) (000) . 1,197 1,294 1,358 Scope market share 33.0% 33.0% 32.4% Scope volume (Units) (000) 395 427 440 $(000) $/Unit $(000) $/Unit $(000) $/Unit Sales 16,767 42.45 17,847 41.80 18,150 41.25 COGS 10,738 27.18 11,316 26.50 11,409 25.93 Gross margin 6,029 15.277,299 15.30 6,741 15.32 Scope Marketing Plan Inputs Scope "Going" Marketing Spending Year 1990 1989 1988 Advertising (000) $1,700 Promotion (000) 1,460 Total (000) $3,160 $3,733 $2,697 Marketing Input Costs Advertising: (See Exhibit 5) Promotion: Samples (Including Distribution): $0.45/piece Mailed couponing $10.00 per 1,000 for printing distribution $0.17 handling per redeemed coupon (beyond face value) redemption rates: 10% to 15% In-store promotion $200/store (fixed) $0.17 handling per redeemed coupon (beyond face value) redemption rates: 85% + Source: Company records. EXHIBIT 8 Scope 1990 Financials $(000) 18,150 3,590 2,244 3,080 1,373 1,122 11,409 6,741 $/Unit 41.25 8.16 5.10 7.00 Net sales" Ingredients Packaging Manufacturing Delivery Miscellaneous Cost of goods sold Gross margin 2.55 25.93 15.32 "Net sales = P&G revenues. Manufacturing: 50 percent of manufacturing cost is fixed of which $200,000 is depreciation: 20 percent of manufacturing cost is labor. 'Miscellaneous: 75 percent of miscellaneous cost is fixed. General office overhead is $1,366,000. Taxes are 10 percent. Currently the plant operates on a five-day one-shift operation, P&G's weight- ed average cost of capital is 12 percent. Total units sold in 1990 were 440,000. Source: Company records. 250 79 California State Poly Univ-Pomona, "IBM 421", "Fall 2015". Section "01 and 02" PROCTER & GAMBLE, INC EXHIBIT 9 Plax Financial Estimates ($/Unit) 65.09 Net Sales COGS Ingredients Packaging Manufacturing Delivery Miscellaneous Total 6.50 3.00 1.06 25.36 Notes: General overhead costs estimated at $5.88/unit. Source: P&G estimates. Purchasing The purchasing manager had reviewed the formula for the line extension and had estimated that the ingredients cost would increase by $2.55 per unit due to the addition of new ingredients. But, because one of the ingredients was very new, finance felt that the actual ingredient change might vary by + 50 percent. Packaging costs would be $0.30 per unit higher owing to the fact that the setup charges would be spread over a smaller base. Advertising Agency The advertising agency felt that making any new claims for Scope was a huge strategic shift for the brand. They favored a line extension. Scope's strategy had always been "breath refreshment and good tasting" focused, and they saw the plaque claims as very different, with potentially significant strategic implications. The one time they had focused advertising only on taste and didn't reinforce breath efficacy, share fell. They were concerned that the current Scope consumer could be confused if plaque or any "nonbreath" claims were added and that Scope could actually lose market share if this occurred. They also pointed out that trying to communicate two different ideas in one commercial was very dif- ficult. They believed the line extension was a completely different product from Scope with a different benefit and use occasion. In their minds, a line extension would need to be supported on a going basis separately from Scope. AT TO RECOMMEND? Hearst knew the business team had thought long and hard about the issue. She knew that management was depending on the Scope busine up with the right long-term plan for P&G-even if that meant not introducing the new product. However, she felt there was too much risk associated with P&G's long-term position in oral rinses if nothing was done. There was no easy answer-and compounding the exigencies of the situation was the fact that the business team had differing points of view. She was faced with the dilemma of providing recommendations about Scope, but also needed to ensure that there was alignment and commitment from the business team, or senior management would be unlikely to agree to the proposal. 80 Califomia State Poly Univ-Pomona, "IBM 421", "Fall 2015', Section "01 and 02 CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND MANAGEMENT APPENDIX Plaque Plaque is a soft, sticky film that coats teeth within hours of brushing and may eventually harden into tartar. To curb gum diseasewhich over 90 percent of Canadians suffer at some time plaque must be curbed. Research has shown that, without brushing, within 24 hours a film (plaque) starts to spread over teeth and gums and, over days, becomes a sticky, gelatinous mat, which the plaque bacteria spin from sugars and starches. As the plaque grows it becomes home to yet more bacteria-dozens of strains. A mature plaque is about 75 percent bac teria; the remainder consists of organic solids from saliva, water, and other cells shed from soft oral tissues. As plaque bacteria digest food, they also manufacture irritating malodorous by-products, all of which can harm a tooth's supporting tissues as they seep into the crevice below the gum line. Within 10 to 21 days, depending on the person, signs of gingivitis- the mildest gum disease-first appear, gums deepen in color, swell, and lose their normally tight, arching contour around teeth. Such gingivitis is entirely reversible. It can disappear within a week after regular brushing and flossing are resumed. But when plaque isn't kept under control, gingivitis can be the first step down toward periodontitis, the more advanced gum disease in which bone and other structures that support the teeth become damaged. Teeth can loosen and fall out-or require extraction. The traditional and still best approach to plaque control is careful and thor ough brushing and flossing to scrub teeth clean of plaque. Indeed, the antiplaque claims that toothpastes carry are usually based on the product's ability to clean teeth mechanically, with brushing. Toothpastes contain abrasives, detergent, and foaming agents, all of which help the brush do its work. 81 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02" IBM 4801 PROF. JOHAS. WALI AUE Case Procter & Gamble, Inc. Scope As Gwen Hearst looked at the year-end report, she was pleased to see that Scope held a 32 percent share of the Canadian mouthwash market for 1990. She had been concerned about the inroads that Plax, a prebrushing rinse, had made in the market. Since its introduction in 1988, Plax had gained a 10 percent share of the product category and posed a threat to Scope. As brand manager, Hearst planned, developed, and directed the total marketing effort for S Gamble's (P&G) brand in the mouthwash market. She was responsible for maxi- mizing the market share, volume, and profitability of the brand. Until the entry of Plax, brands in the mouthwash market were positioned around two major benefits: fresh breath and killing germs. Plax was positioned around a new benefit as a "plaque fighter"-and indications were that other brands, such as Listerine, were going to promote this benefit. The challenge for Hearst was to develop a strategy that would ensure the continued profitability of Scope in the face of these competitive threats. Her specific task was to prepare a marketing plan for P&G's mouthwash business for the next three years. It was early February 1991, and she would be presenting the plan to senior management in March. COMPANY BACKGROUND Based on a philosophy of providing products of superior quality and value that best fill the needs of consumers, Procter & Gamble is one of the most successful consumer goods companies in the world. The company markets its brands in more than 140 countries and had net earnings of $1.6 billion in 1990. The Canadian sub- sidiary contributed $1.4 billion in sales and $100 million in net earnings in 1990. It was recognized as a leader in the Canadian packaged goods industry, and its consumer brands led in most of the categories in which the company competed. Between 1987 and 1990, worldwide sales of P&G had increased by $8 bil- lion and net earnings by $1.3 billion. P&G executives attributed the company's success to a variety of factors, including the ability to develop truly innovative products to meet consumers' needs. Exhibit 1 contains the statement of purpose and strategy of the Canadian subsidiary. This case was prepared by Professors Gordon H. G. McDougall and Franklin Ramsoomair, of the Wilfrid Laurier University, as a basis for class discussion and is not designed to illustrate effective or ineffective handling of an administrative situation. Used with permission. 240 69 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02 PROCTER & GAMBLE, INC. 241 - EXHIBIT 1 A Statement of Purpose and Strategy: Procter & Gamble, Canada We will provide products of superior quality and value that best fill the needs of consumers. We will achieve that purpose through an organization and a working environment which attracts the finest people, fully develops and challenges our individual talents: encourages our free and spirited collaboration to drive the business ahead; and maintains the Company's historic principles of integrity and doing the right thing We will build a profitable business in Canada. We will apply P&G worldwide learning and resources to maximize our success rate. We will concentrate our resources on the most profitable categories and on unique, important Canadian market opportunities. We will also contribute to the development of outstanding people and innovative business ideas for worldwide company use. We will reach our business goals and achieve optimum cost efficiencies through contin- uing innovation, strategic planning, and the continuous pursuit of excellence in every thing we do. We will continuously stay ahead of competition while aggressively defending our estab lished profitable businesses against major competitive challenges despite short-term prof- it consequences. Through the successful pursuit of our commitment, we expect our brands to achieve lead- ership share and profit positions and that, as a result, our business, our people, our share- holders, and the communities in which we live and work, will prosper. Source: Company records. P&G Canada has five operating divisions, organized by product category. The divisions, and some of the major brands, are: 1. Paper products: Royale, Pampers, Luvs, Attends, Always 2. Food and beverage: Duncan Hines, Crisco, Pringles, Sunny Delight 3. Beauty care: Head & Shoulders, Pantene, Pert, Vidal Sassoon, Clearasil, Clarion, Cover Girl, Max Factor, Oil of Olay, Noxzema, Secret 4. Health care: Crest, Scope, Vicks, Pepto-Bismol, Metamucil 5. Laundry and cleaning: Tide, Cheer, Bounce, Bold, Oxydol, Joy, Cascade, Comet, Mr. Clean Each division had its own brand management, sales, finance, product develop ment and operations line management groups and was evaluated as a profit cen- ter. Typically, within each division a brand manager was assigned to each brand (for example, Scope). Hearst was in the health care division and reported to the associate advertising manager for oral care, who, in turn, reported to the general manager of the division. After completing her business degree (BBA) at a well- known Ontario business school in 1986, Hearst had joined P&G as a brand assis- tant. In 1987 she became the assistant brand manager for Scope, and in 1988 she was promoted to brand manager. Hearst's rapid advancement at P&G reflected the confidence that her managers had in her abilities. CANADIAN MOUTHWASH MARKET Until 1987, on a unit basis the mouthwash market had grown an average of 3 percent per year for the previous 12 years. In 1987, it experienced a 26 percent increase with the introduction of new flavors such as peppermint. Since then, the growth rate had declined to a level of 5 percent in 1990 (Exhibit 2 on page 212). 70 California State Poly Univ-Pomona, "IBM 421', "Fall 2015", Section "01 and 02" EXHIBIT 2 Canadian Mouthwash Market 1986 1987 Total retail sales (millions) $43.4 $54.6 Total factory sales (millions) $34.8 $43.5 Total unit sales (thousands) 863 1,088 % change) - 3 26 (% change-"breath only") 3 2 6 Penetration (%) - 65 70 Usage (number of times per week) 2.0 2.2 1988 $60.2 $48.1 1,197 10 0 75 2.3 1989 $65.4 $52.2 1,294 8 3 73 2.4 1990 $68.6 $54.4 1,358 5 5 75 3.0 "One unit or statistical case equals 10 liters or 352 fluid Ounces of mouthwash. "Excludes Plax and other prebrushing rinses. Percentage of households having at least one brand in home. For each adult household member. Source: Company records. The mouthwash market was initially developed by Warner-Lambert with its pio- neer brand Listerine. Positioned as a therapeutic germ-killing mouthwash that elim- inated bad breath, it dominated the market until the entry of Scope in 1967. Scope, a green, mint-tasting mouthwash, was positioned as a great-tasting, mouth-refreshing brand that provided bad-breath protection. It was the first brand that offered both effective protection against bad breath and a better taste than other mouth- washes. Its advertising focused, in part, on a perceived weakness of Listerine- medicine breath (for example, "Scope fights bad breath. Don't let the good taste fool you") and in 1976, Scope became the market leader in Canada. In 1977, Warner-Lambert launched Listermint mouthwash as a direct com- petitor to Scope. Like Scope, it was a green, mint-tasting mouthwash and posi- tioned as a "good tasting mouthwash that fights bad breath." Within a year it had achieved a 12 percent market share, primarily at the expense of Listerine and smaller brands in the market. In the 1970s, Merrell Dow, a large pharmaceutical firm, launched Cepacol, which was positioned very close to Listerine. It achieved and held approximately 14 percent of the market in the early 1980s. During the 1980s, the major competitive changes in the Canadian mouth- wash market were: Listerine, which had been marketed primarily on a "bad breath" strategy, began shifting its position and in 1988 introduced the claim "Fights plaque and helps prevent inflamed gums caused by plaque." In the United States, Listerine gained the American Dental Association seal for plaque but, as yet, did not have the seal in Canada. Listermint added fluoride during the early 1980s and added the Canadian Dental Association seal for preventing cavities in 1983. More recently, Lis- termint had downplayed fluoride and removed the seal. In early 1987, flavors were introduced by a number of brands including Scope, Listermint, and various store brands. This greatly expanded the market in 1987 but did not significantly change the market shares held by the major brands. . Colgate Fluoride Rinse was launched in 1988. With the seal from the Cana- dian Dental Association for cavities, it claimed that "Colgate's new fluoride 71 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02" PROCTER & GAMBLE, INC. rinse fights cavities. And, it has a mild taste that encourages children to rinse longer and more often." Colgate's share peaked at 2 percent and then declined. There were rumors that Colgate was planning to discontinue the brand. In 1988, Merrell Dow entered a licensing agreement with Strategic Brands to market Cepacol in Canada. Strategic Brands, a Canadian firm that mar- kets a variety of consumer household products, had focused its efforts on gaining greater distribution for Cepacol and promoting it on the basis of price. In 1988, Plax was launched on a new and different platform. Its launch and immediate success caught many in the industry by surprise. THE INTRODUCTION OF PLAX Plax was launched in Canada in late 1988 on a platform quite different from the traditional mouthwashes. First, instead of the usual use occasion of "after brush- ing." it called itself a "prebrushing" rinse. The user rinses before brushing, and Plax's detergents are supposed to help loosen plaque to make brushing espe- cially effective. Second, the product benefits were not breath-focused. Instead, it claimed that "Rinsing with Plax, then brushing normally, removes up to three times more plaque than just brushing alone." Pfizer Inc., a pharmaceutical firm, launched Plax in Canada with a promotion campaign that was estimated to be close to $4 million. The campaign, which cov- ered the last three months of 1988 and all of 1989, consisted of advertising esti- mated at $3 million and extensive sales promotions, including (1) trial-size display in three drugstore chains ($60,000), (2) co-op mail couponing to 2.5 million households ($160,000), (3) an instantly redeemable coupon offer ($110,000), (4) a professional mailer to drug and supermarket chains ($30,000), and (5) a number of price reduc- 640,000). Plax continued to support the brand with advertising expenditures of approximately $1.2 million in 1990. In 1990, Plax held a 10 percent share of the total market. When Plax was launched in the United States, it claimed that using Plax "removed up to 300 percent more plaque than just brushing." This claim was challenged by mouthwash competitors and led to an investigation by the Better Business Bureau. The investigation found that the study on which Plax based its claim had panelists limit their toothbrushing to just 15 seconds and didn't let them use toothpaste. A further study, where people were allowed to brush in their "usual manner" and with toothpaste, showed no overall difference in the level of plaque buildup between those using Plax and a control group that did not use Plax. Plax then revised its claim to "three times more plaque than just brushing alone. Information on plaque is contained in this case's Appendix. THE CURRENT SITUATION In preparing for the strategic plan, Gwen Hearst reviewed the available infor- mation for the mouthwash market and Scope. As shown in Exhibit 2, in 1990, 75 percent of Canadian households used one or more mouthwash brands, and, on average, usage was three times per week for each adult household member. Company market research revealed that users could be segmented on frequency of use; "heavy" users (once per day or more) comprised 40 percent of all users, 72 California State Poly Univ-Pomona, "IBM 421", "Fall 2015', Section 01 and 02 244 CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND MANAGEMENT "medium" users (two to six times a week) comprised 45 percent, and "light" us- ers (less than once a week) comprised 15 percent. No information was available on the usage habits of prebrushing rinse users. Nonusers currently don't buy mouthwash because they either (1) don't believe they get bad breath, (2) believe that brushing their teeth is adequate, and/or (3) find alternatives like gums and mints more convenient. The most important reasons why consumers use mouth- wash are: Most Important Reason for Using a Mouthwash It is part of my basic oral hygiene It gets rid of bad breath It kills germs It makes me feel more confident To avoid offending others *Multiple reasons allowed. During 1990, a survey was conducted of mouthwash users' images of the ma- jor brands in the market. Respondents were asked to rate the brands on a num- ber of attributes, and the results show that Plax had achieved a strong image on the "removes plaque/healthier teeth and gums" attributes (Exhibit 3). EXHIBIT 3 Consumer Perceptions of Brand Images + + + All Users Attributes Cepacol Colgate Listerine Listermint Plax Scope Reduces bad breath Kills germs Removes plaque Healthier teeth and gums Good for preventing colds Recommended by doctors/dentists Cleans your mouth well Brand Users Attributes Cepacol Colgate Listerine Listermint Plax Scope Reduces bad breath Kills germs Removes plaque Healthier teeth and gums Good for preventing colds Recommended by doctors/dentists + + + T 1 + : + 1| + + + 1111 + + + "Includes anyone who uses mouthwash. Respondents asked to rate all brands (even those they haven't used on the attributes. A"+" means this brand scores higher than average. A"..." means this brand scored about average. A means this brand scored below average. For example, Cepacol is perceived by those who use mouthwash as a brand that is good/better than most at "preventing germs." Includes only the users of that brand. For example, Cepacol is perceived by those whose "usual brand" is Cepucol as a brand that is good/better than most at reducing bad breath." Source: Company records. 73 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02 PROCTER & GAMBLE, INC. 245 EXHIBIT 4 Canadian Mouthwash Market Shares Units 1989 1990 Drug 33.0% 32.3% 9.0 Scope Listerine Listermint Cepacol Colgate oral rinse Plax Store brands Miscellaneous other Total Retail sales (000,000) 1988 33.0% 15.2 15.2 13.6 1.4 1.0 16.0 4.6 100.0% $60.2 16.1 9.8 10.6 1.2 10.0 15.4 3.9 100.0% $65.4 16.6 10.6 10.3 0.5 10.0 16.0 3.7 100.0% $68.6 1990 Average Food 42.0% 27.0% 12.0 19.0 8.0 12.0 11.0 0.5 8.0 11.0 18.0 15.0 2.6 4.5 100.0% 100.0% $24.0 $44.6 Source: Company records. Market share data revealed there was a substantial difference in the share held by Scope in food stores, 42 percent (for example, supermarkets) versus drugstores, 27 percent (Exhibit 4). Approximately 65 percent of all mouthwash sales went through drugstores, while 35 percent went through food stores. Recently, wholesale clubs, such as Price Club and Costco, were accounting for a greater share of mouthwash sales. Typically, these clubs carried Cepacol, Scope, Listerine, and Plax. Competitive data were also collected for advertising expenditures and retail prices. As shown in Exhibit 5, total media spending of all brands in 1990 was $5 million, with Scope, Listerine, and Plax accounting for 90 percent of all adver- tising. Retail prices were calculated based on a 750-milliliter bottle, both Listerine EXHIBIT 5 Competitive Market Data, 1990 Advertising Expenditures (5000s) Scope Listerine Plax Listermint $1,700 1,600 1,200 330 170 Media Plans Number of Weeks on Air GRP Scope Listerine Plax 325 450 325 'Wholesale clubs were included in food store sales. (continued) 74 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02" 246 CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND MANAGEMENT EXHIBITS (Continued) Food Stores Drugstores 84 129 Scope Listerine Listermint Colgate Plax Store brand Cepacol Total Market 100 100 "GRP (Gross Rating Points) is a measurement of advertising impact derived by multiplying the number of persons exposed to an advertisement by the average number of exposures per person. The GRPs reported are monthly An average weighted index of the retail prices of all mouthwash brands is calculated and indexed at 100 for both food stores and drugstores. Scope is priced slightly below this index in food stores and about 16 percent below in drugstores Source: Company records. and Plax were priced at a higher level in food stores, and Plax was priced at a premium in drugstores. Information on the U.S. market for 1989 was also available (see Exhibit 6). In contrast to Canada, Listerine held the dominant share in the U.S. market. Since early 1989, Listerine had been advertised heavily in the United States as "the only nonprescription mouthwash accepted by the American Dental Association for its significant help in preventing and reducing plaque and gingivitis." In clini cal tests in the United States, Listerine significantly reduced plaque scores by roughly 20 to 35 percent, with a similar reduction in gingivitis. In Canada, the 1990 advertising campaign included the claim that Listerine has been clinically proven to "help prevent inflamed and irritated gums caused by plaque build-up." Listerine's formula relied on four essential oils-menthol, eucalyptol, thymol, and methyl salicylate-all derivatives of phenol, a powerful antiseptic. Listerine had not received the consumer product seal given by the Canadian Dental Association (CDA) because the association was not convinced a mouth- rinse could be of therapeutic value. The CDA was currently reviewing American tests for several products sold in Canada. In fact, any proposed changes to the formulation of mouthwashes or advertising claims could require approval from various regulatory agencies. EXHIBIT 6 Canada-U.S. Market Share Comparison, 1989 % Units) Brands Canada United States 21.6 28.7 Scope Listerine Listermint Cepacol Plax 33.0 16.1 9.8 10.6 10.0 4.5 Source: Company records. 75 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section 101 and 02" PROCTER & GAMBLE, INC. REGULATORY ENVIRONMENT 1. Health Protection Branch: This government body classifies products into "drug status" or "cosmetic status" based on both the product's action on bodily functions and its advertising claims. Drug products are those that affect a bodily function (for example, prevent cavities or prevent plaque buildup). For "drug status" products, all product formulations, packag- ing, copy, and advertising must be pre-cleared by the Health Protection Branch (HPB), with guidelines that are very stringent. Mouthwashes like Scope that claim to only prevent bad breath are considered as "cosmetic status." However, if any claims regarding inhibition of plaque forma- tion are made the product reverts to "drug status," and all advertising is scrutinized. 2. The Canadian Dental Association: Will, upon request of the manufac- turer, place its seal of recognition on products that have demonstrated efficacy against cavities or against plaque/gingivitis. However, those products with the seal of recognition must submit their packaging and advertising to the CDA for approval. The CDA and the American Dental Association (ADA) are two separate bodies and are independent of each other and don't always agree on issues. The CDA, for example, would not provide a "plaque/gingivitis" seal unless clinical studies demonstrat- ing actual gum health improvements were done. Saccharin/Cyclamate sweeteners: All mouthwashes contain an artificial sweetener. In Canada, cyclamate is used as the sweetener, as saccharin is considered a banned substance. In contrast, the United States uses sac- charin because cyclamate is prohibited. Thus, despite the fact that many of the same brands compete in both Canada and the United States, the formula in each country is different. THE THREE-YEAR PLAN In preparing the three-year plan for Scope, a team had been formed within P&G to examine various options. The team included individuals from product devel- opment (PDD), manufacturing, sales, market research, finance, advertising, and operations. Over the past year, the team had completed a variety of activities relating to Scope. The key issue, in Hearst's mind, was how P&G should capitalize on the emerging market segment within the rinse category that focused more on "health-related benefits" than the traditional breath strategy of Scope. Specifically with the launch of Plax, the mouthwash market had segmented itself along the "breath-only" brands like Scope) and those promising other benefits. Plax, in positioning itself as a prebrushing rinse, was not seen as, nor did it taste like, a "breath refreshment" mouthwash like Scope. Gwen Hearst believed that a line extension positioned against Plax, a recent entry into the market, made the most sense. If the mouthwash market became nore segmented, and if these other brands grew, her fear was that P&G would be left with a large share of a segment that focused only on "breath and hence might decline. However, she also knew that there were questions regarding both the strategic and financial implications of such a proposal. In recent meetings, other ideas had been proposed, including "doing nothing" and looking at claims 76 California State Poly Univ-Pomona, "IBM 421", "Fall 2015", Section "01 and 02" 218 CHAPTER 5 PRODUCT AND SERVICE STRATEGY AND BRAND MANAGEMENT other than "breath" that might be used by Scope instead of adding a new prod- uct. Several team members questioned whether there was any real threat, as Plax was positioned very differently from Scope. As she considered the alternatives, Hearst reviewed the activities of the team and the issues that had been raised by various team members. Product Development In product tests on Scope, PDD had demonstrated that Scope reduced plaque better than brushing alone because of antibacterial ingredients contained in Scope. However, as yet P&G did not have a clinical database to convince the HPB to allow Scope to extend these claims into the prevention of inflamed gums (as Listerine does). PDD had recently developed a new prebrushing rinse product that performed as well as Plax but did not work any better than Plax against plaque reduction. In fact, in its testing of Plax itself, PDD was actually unable to replicate the plaque reduction claim made by Pfizer that "rinsing with Plax, then brushing normally removes up to three times more plaque than brushing alone." The key benefit of P&G's prebrushing rinse was that it did taste better than Plax. Other than that, it had similar aesthetic qualities to Plax-qualities that made its "in-mouth" experi- ence quite different from that of Scope. The product development people in particular were concerned about Hearst's idea of launching a line extension because it was a product that was only equal in efficacy to Plax and to placebo rinses for plaque reduction. Tra- ditionally, P&G had only launched products that focused on unmet consumer needs typically superior performing products. However, Gwen had pointed out, because the new product offered similar efficacy at a better taste, this was similar to the situation when Scope was originally launched. Some PDD mem- bers were also concerned that if they couldn't replicate Plax's clinical results with P&G's stringent test methodology, and if the product possibly didn't pro- vide any greater benefit than rinsing with any liquid, then P&G's image and credibility with dental professionals might be impacted. There was debate on this issue, as others felt that as long as the product did encourage better oral hygiene, it did provide a benefit. As further support they noted that many pro- fessionals did recommend Plax. Overall, PDD's preference was to not launch a new product but, instead, to add plaque-reduction claims to Scope. The basic argument was that it was better to protect the business that P&G was already in than to launch a completely new entity. If a line extension was pursued, a prod- uct test costing $20,000 would be required. Sales The sales people had seen the inroads Plax had been making in the marketplace and believed that Scope should respond quickly. They had one key concern. As stockkeeping units (SKU) had begun to proliferate in many categories, the re- tail industry had become much more stringent regarding what it would accept. Now, to be carried on store shelves, a brand must be seen as different enough (or unique) from the competition to build incremental purchases otherwise retail ers argued that category sales volume would simply be spread over more units. When this happened, a retail outlet's profitability was reduced because inventory costs were higher, but no additional sales revenue was generated. When a new brand was viewed as not generating more sales, retailers might still carry the brand by replacing units within the existing line (for example, drop shelf facings California State Poly Univ-Pomona, "IBM 421", "Fall 2015', Section "01 and 02 PROCTER & GAMBLE, INC. 249 of Scope), or the manufacturer could pay approximately $50,000 per stock-keeping unit in carrying fees to add the new brand. Market Research Market research (MR) had worked extensively with Hearst to test the options with consumers. Its work to date had shown: 1. A plaque reassurance on current Scope (that is, "Now Scope fights plaque") did not seem to increase competitive users' desire to purchase Scope. This meant that it was unlikely to generate additional volume, but it could prevent current users from switching. MR also cautioned that adding "reassurances" to a product often takes time before the consumer accepts the idea and then acts on it. The issue in Hearst's mind was whether the reassurance would ever be enough. At best it might stabilize the business, she thought, but would it grow behind such a claim? 2. A "Better-Tasting Prebrushing Dental Rinse" product did research well among Plax users, but did not increase purchase intent among peo- ple not currently using a dental rinse. MR's estimate was that a brand launched on this positioning would likely result in approximately a 6.5 percent share of the total mouthwash and "rinse" market on an on- going basis. Historically, it had taken approximately two years to get to the ongoing level. However, there was no way for them to accurately assess potential Scope cannibalization. "Use your judgment," they had said. However, they cautioned that although it was a product for a differ- ent usage occasion, it was unlikely to be 100 percent incremental busi- ness. Hearst's best rough guess was that this product might cannibalize somewhere between 2 and 9 percent of Scope's sales. An unresolved issue was the product's name-if it were launched, should it be under the Scope name or not? One fear was that if the Scope name was used it would either "turn off" loyal users who saw Scope as a bre